-

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

A statewide stay at home order imposed in late March didn't stop Dayton Realtors from hitting their highest monthly sales figures so far in 2020.

April 23 -

Mortgage rates were little changed this week as the markets reacted positively to various economic measures coming out of Washington, according to Freddie Mac.

April 23 -

Mortgage fraud risk plummeted in the first quarter of 2020 amid historically low mortgage rates and a boom of refinances, but the coronavirus could create a new set of risks, according to CoreLogic.

April 22 -

Sales of previously owned homes dropped in March by the most since November 2015, representing weaker demand that likely is going to get much worse in coming months as the pandemic bears down on the economy.

April 21 -

The wealthiest, most-reliable mortgage borrowers in the U.S. are hearing an unfamiliar word from lenders: No.

April 21 -

The coronavirus outbreak, along with the shift to a lower paying refinance business, will likely limit commission earnings for the rest of 2020.

April 20 -

The COVID-19 pandemic has caused a mild fluctuation in the Savannah, Ga., area real estate market, but many people are still inking closing contracts. At the same time. local industry leaders and agents are turning to technology to help them find their forever homes.

April 19 -

Mortgage rates slipped this week as the coronavirus keeps affecting the overall U.S. economy, according to Freddie Mac.

April 16 -

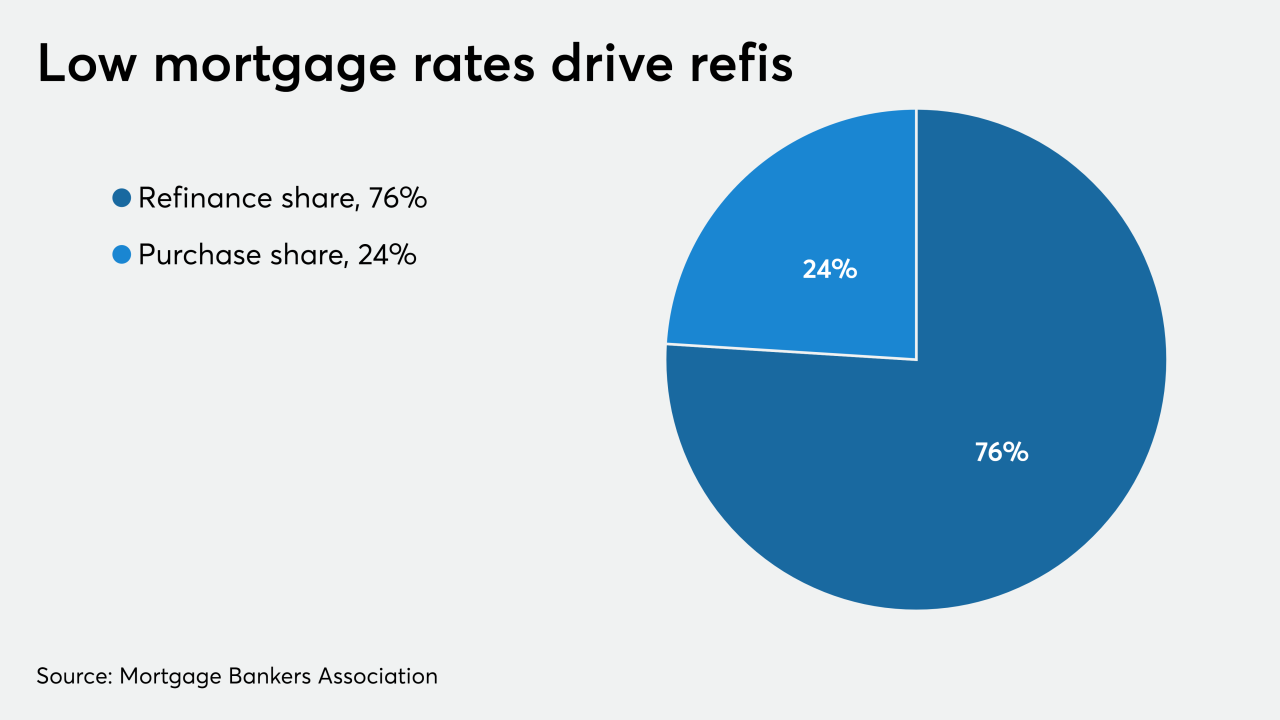

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

Purchase originations will recover somewhat in the third and fourth quarters as home sales pick up.

April 14 -

January saw the lowest mortgage delinquency rate in over 20 years, according to CoreLogic.

April 14 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

North Texas home sales and prices continued to rise in March from a year earlier, but last month's home sales snapshot mostly reflects contracts signed in January and February, before the pandemic hit.

April 10 -

Homebuilders in the Twin Cities kept the construction spigot open during March amid growing concerns about the COVID-19 pandemic.

April 10 -

Mortgage rates remained flat from last week, but are expected to fall further as they continue to lag changes in 10-year Treasury yields, according to Freddie Mac.

April 9 -

Bay Area real estate agents in February eagerly welcomed big crowds packing open houses — and the renewed bidding wars and growing sale prices.

April 8 -

Consumer confidence for home buying fell to its lowest point since December 2016, according to Fannie Mae.

April 7 -

Prices on average are expected to grow at nearly half the rate they were expected to rise before the pandemic hit, according to Veros Real Estate Solutions.

April 6 -

As the mortgage and real estate industries traverse the challenges of the increasingly digital coronavirus landscape, title agents and their integral part of the process can get overlooked.

April 3