-

The inventory of homes for sale is at a seven-year low and that is likely to continue to shrink in the coming months, a Zillow report said.

January 21 -

Sales of single-family houses in the Greater Hartford area recorded a lackluster 2019, barely gaining any ground over the previous year.

January 21 -

Home sellers in Albuquerque experienced some fortune in 2019 with increased home prices and increased sales across multiple categories, according to the Greater Albuquerque Association of Realtors.

January 21 -

IBM called for rules aimed at eliminating bias in artificial intelligence to address concerns which range from identifying faces in security-camera footage to making determinations about mortgage rates.

January 21 -

The rate of home sales reached a 33-month peak in December, swinging the pendulum of supply and demand, and pushing value appreciation to a 19-month high, according to Redfin.

January 17 -

Mortgage loan officer compensation remained level year-over-year as an unexpected surge in originations surprised employers expecting it to be a down year, an LBA Ware report said.

January 17 -

Groundbreakings on new homes surged in December to a 13-year high, giving the housing market momentum heading into the new year amid low mortgage rates, solid job growth and optimistic buyers and builders.

January 17 -

Homebuilder sentiment posted the highest back-to-back readings since 1999, as developers saw a surge in prospective buyers and a bump in the sales outlook.

January 16 -

Mortgage rates for the most part were stable this past week as the markets looked warily at economic and geopolitical events, according to Freddie Mac.

January 16 -

With home price appreciation decelerating, the top end of the marketplace appears to be taking the biggest hit, according to Zillow.

January 15 -

Mortgage application activity increased 30.2% from one week earlier as purchases were at their highest level in over a decade along with substantial growth in refinancings, according to the Mortgage Bankers Association.

January 15 -

More than half of Columbus homebuyers are millennials, according to a new study from the mortgage lead generation company LendingTree.

January 14 -

When it comes to purchasing a home vs. renting on the affordability continuum, the reasonably priced properties skew towards less populated areas, according to Attom Data Solutions

January 14 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

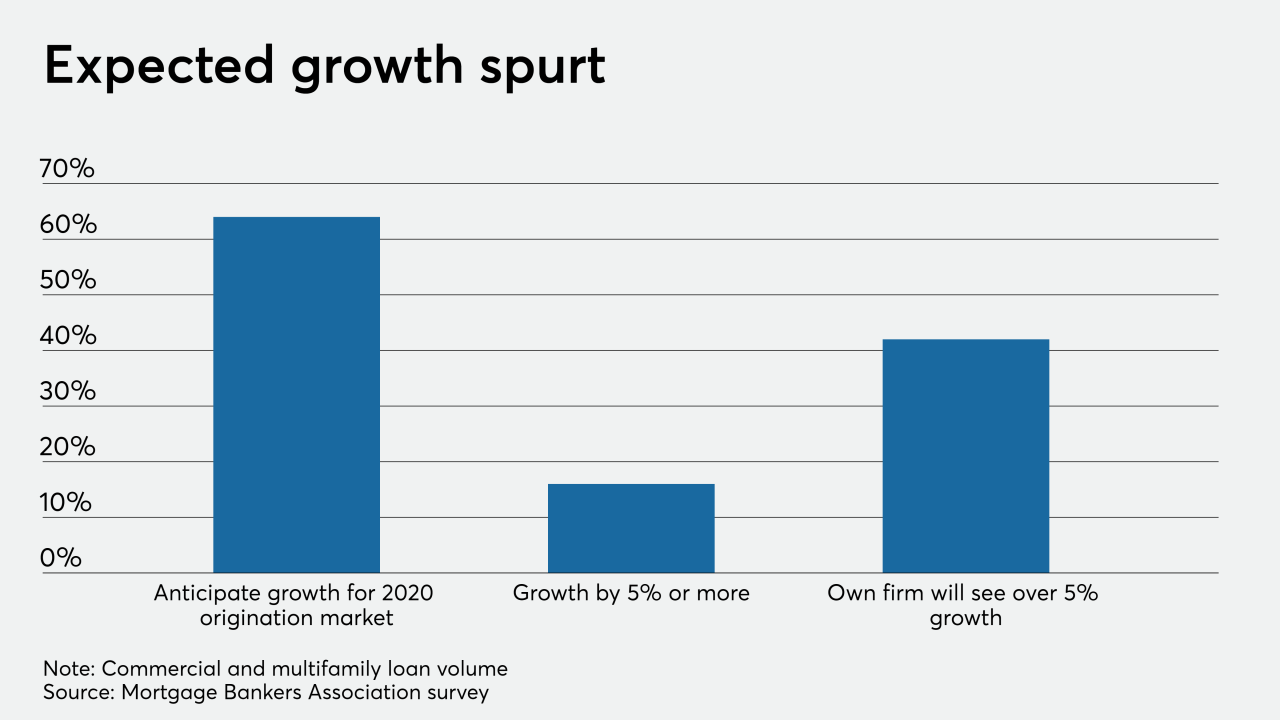

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

Home sellers in the suburbs north of New York City discounted their way to a strong fourth quarter, whittling pricing to levels that even luxury buyers found appealing

January 9 -

Mortgage rates fell to their lowest level since October as the financial markets reacted to rising tensions caused by the U.S. government's killing of an Iranian general, Freddie Mac said.

January 9 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

December home sales in the Houston area jumped 14% from the year before, capping a dramatic turnaround over the course of 2019.

January 9 -

Mortgage applications decreased 1.5% on a seasonally adjusted basis from two weeks earlier amid the annual end-of-year slowdown despite lower rates from global tensions, according to the Mortgage Bankers Association.

January 8