-

The bucket of homeowners in the money to refinance includes anyone who bought a home in the last 18 months, and lenders are on the phone calling them.

September 3 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

Home price gains in the Twin Cities metro have outpaced the national average for much of the year, but those gains have cooled in recent months.

September 3 -

In a reprieve for Southern California's sluggish housing market, home sales rose in July from a year earlier. It was the first sales increase in 12 months.

September 3 -

A growing share of refinances born by lower rates is pushing down risk levels for fraud on a mortgage application, according to First American.

August 30 -

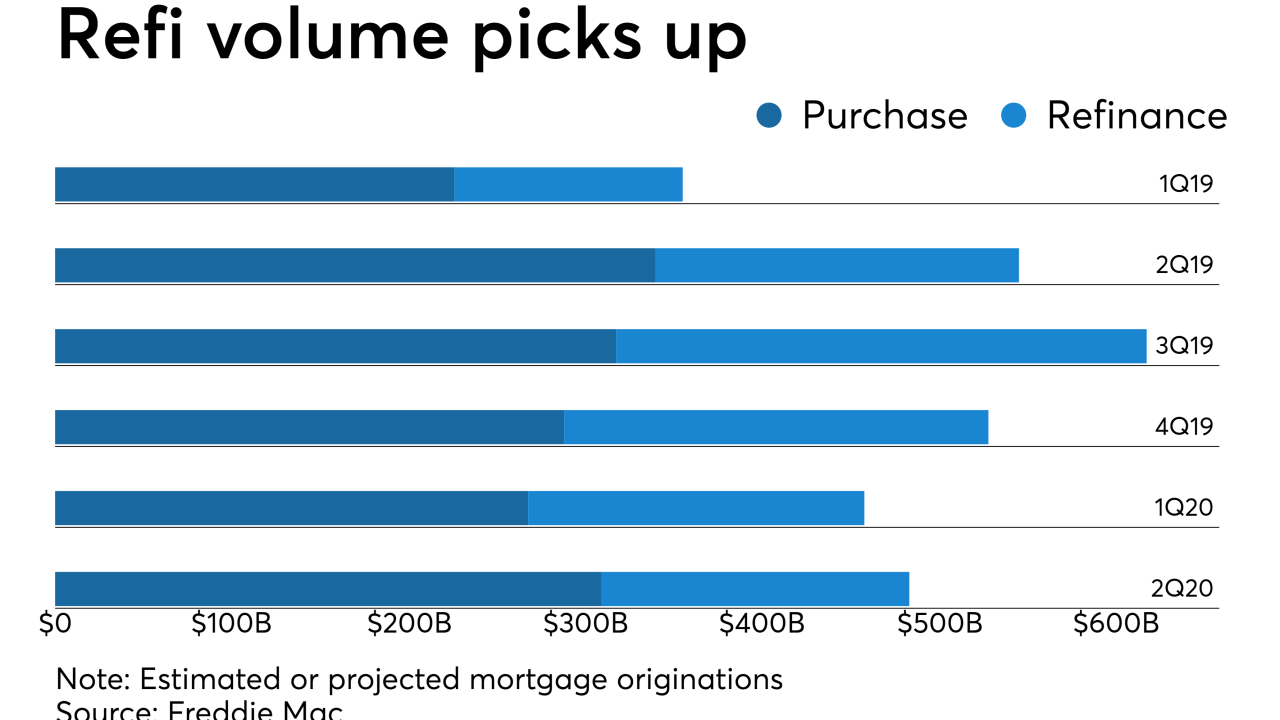

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Contract signings to purchase previously owned homes fell in July by the most since early 2018, indicating a pause in buyer interest even against a backdrop of falling mortgage rates, a firm job market and steady income gains.

August 30 -

Mortgage debt climbed to a new peak of $9.4 trillion in the second quarter and the distribution across the U.S. varies greatly.

August 29 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

Single-family home prices in Colorado Springs rose by 8.2% from the second quarter of last year to the second quarter of 2019, which ranked as the fifth highest appreciation rate among the nation's 100 largest metro areas.

August 29 -

Portland-area home price growth held steady in June amid a nationwide slowdown.

August 29 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28 -

Dallas-area home price gains continued to lag national increases in the latest housing market update.

August 28 -

Though advocates and industry are rarely aligned, they are starting to coalesce around a plan that would call for the elimination of the CFPB’s 43% debt-to-income limit as part of its qualified mortgage rule.

August 27 -

While affordability continues to affect homebuyers, rising income combined with descending interest rates and decelerating housing values boosted the purchase market, according to First American.

August 27 -

Homes in the Rockford, Ill., region sold for $147,000 on average last month, the highest monthly average price since July 2006.

August 27 -

Digitizing the lending experience can go a long way toward boosting mortgage applications even as interest rates continue to fluctuate.

August 26 Fincity

Fincity -

Lower interest rates that have the power to reduce house payments are triggering a surge in mortgage refinancing activity and giving real estate agents hope that more affordable rates can lift area home sales that are barely lagging behind 2018.

August 26 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22 -

Mortgage rates continued to drop this week and hit their lowest levels since November 2016, while stimulating the real estate market and the economy, according to Freddie Mac.

August 22