-

Refinance volume slipped following growth in mortgage rates, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

February 15 -

The year-over-year median home sale price dropped in January for the first time since February 2012 in metro Portland, according to new numbers from the Regional Multiple Listing Service.

February 15 -

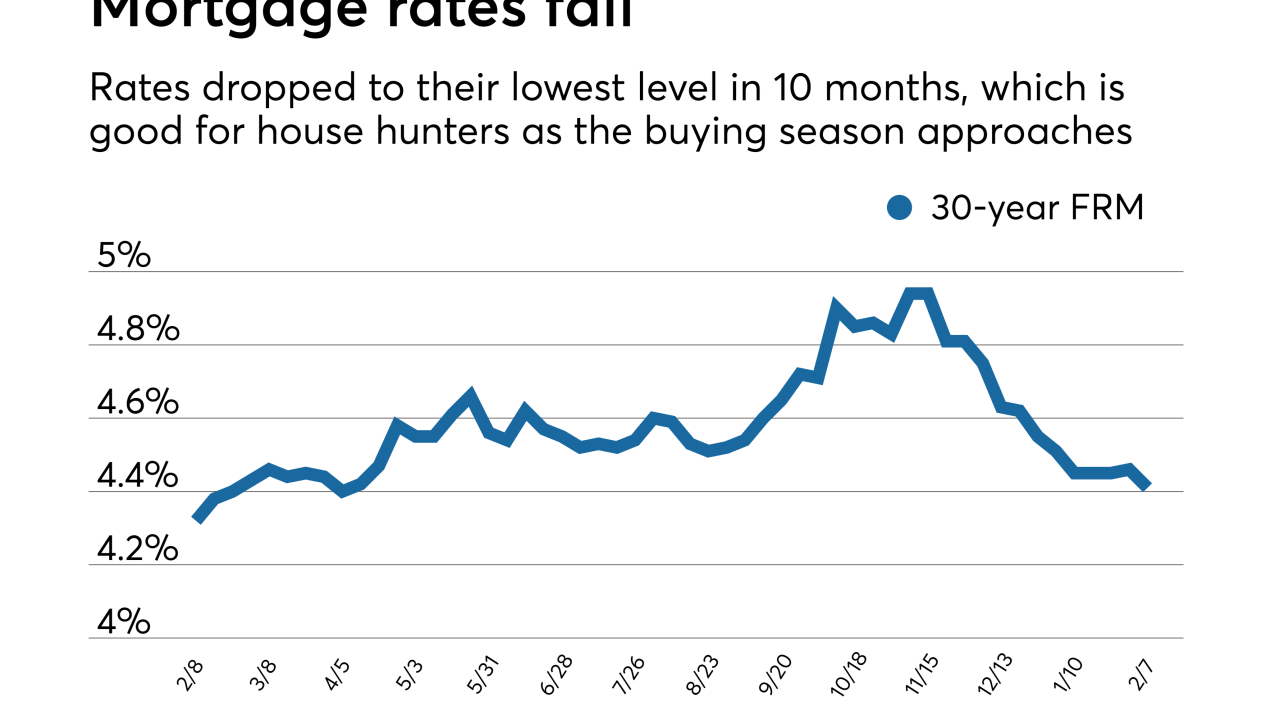

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

February 14 -

Taylor Morrison Home Corp. mortgage volume inched down during the fourth quarter, but is hoping a recently added rate-buydown feature could bolster future lending.

February 13 -

Mortgage applications decreased 3.7% from one week earlier, because of consumer concerns over the direction of the economy outweighed lower interest rates, according to the Mortgage Bankers Association.

February 13 -

Charlotte's housing market got off to a slow start in 2019, and some experts say that the government shutdown is partially to blame.

February 13 -

Stable equity and debt availability should keep multifamily and commercial real estate originations in line with 2017's peak, according to the Mortgage Bankers Association.

February 11 -

The market for new homes in Houston is expected to be flat for the next couple of years amid a tight supply of lots, a local housing analyst said.

February 11 -

Millennials are unfazed by the short supply of starter homes in a competitive market based on the rising share of December's purchase mortgages, according to Ellie Mae.

February 8 -

Home sellers in metro Denver came out ready to play ball in a big way in January, but buyers didn't show up to meet them in equal numbers.

February 8 -

Consumers have higher household incomes and more faith in cooling home price and mortgage rate growth than they did a year ago, which could allude to a stabilized housing market in 2019, according to Fannie Mae.

February 7 -

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

Mortgage applications decreased 2.5% from one week earlier, even as interest rates fell to their lowest levels in 10 months, according to the Mortgage Bankers Association.

February 6 -

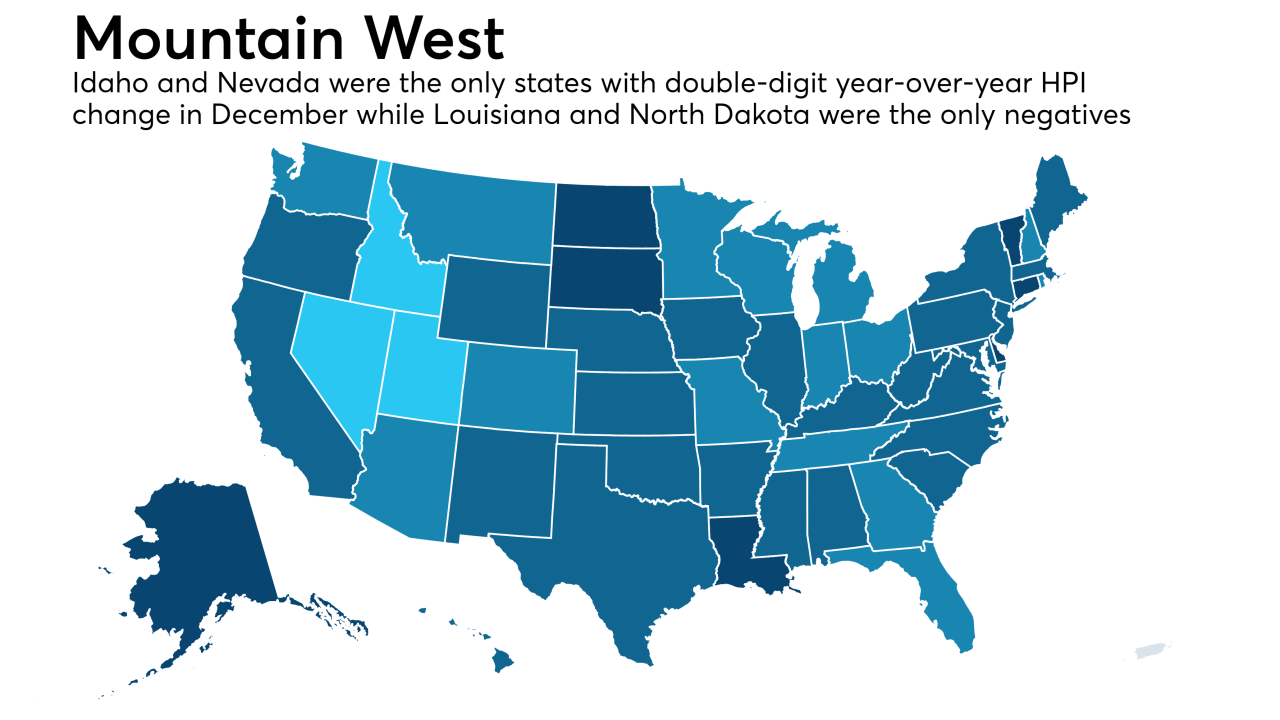

Inventory deficiency and affordability issues kept sales down and hampered home price growth, according to CoreLogic.

February 5 -

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

The seven-year fever driving up Bay Area home prices may finally be breaking.

February 4 -

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

Without the clashing fervor of potential homebuyers competing, fewer sellers are fetching above-listing prices on their houses, according to Zillow.

February 1 -

The housing market's chill grew colder in December, as sales plunged across Southern California and home prices barely rose.

February 1 -

Affordability remains a challenge for homebuyers, but barely any mortgage lenders attribute last year's sluggish home sales to insufficient consumer income or lack of loan products for new buyers, according to Fannie Mae.

January 31