-

Consumers have higher household incomes and more faith in cooling home price and mortgage rate growth than they did a year ago, which could allude to a stabilized housing market in 2019, according to Fannie Mae.

February 7 -

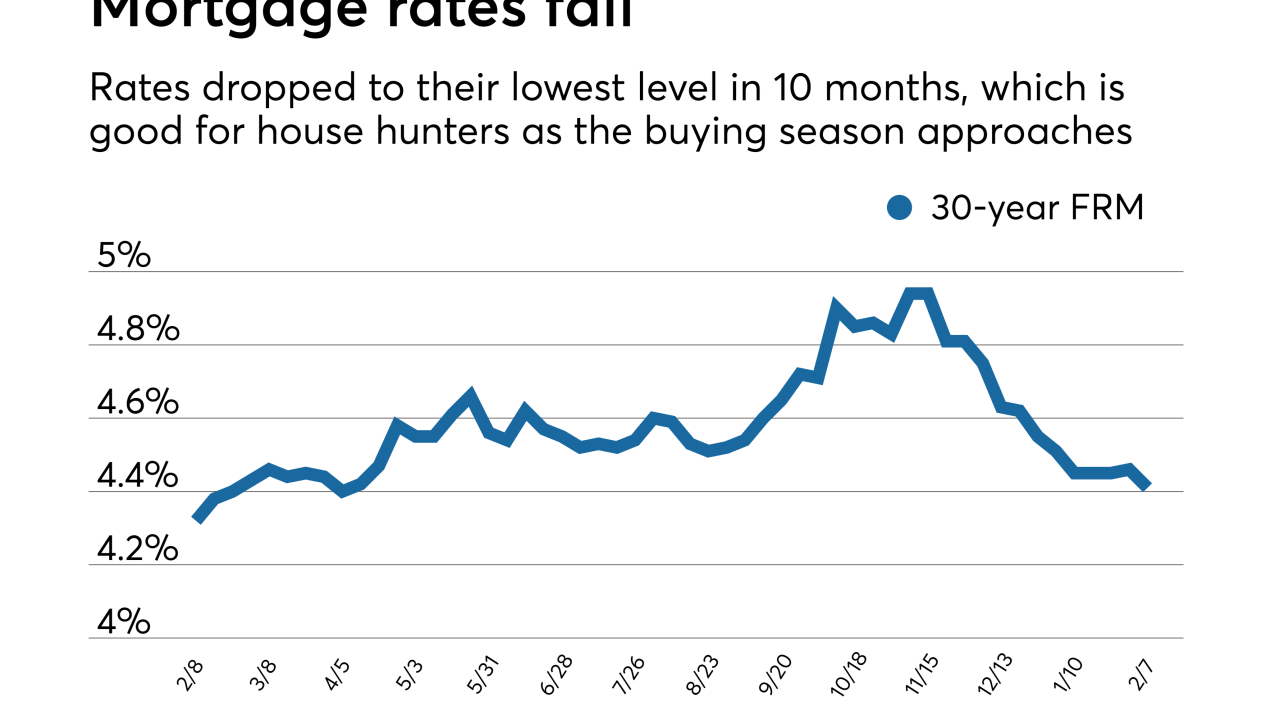

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

Mortgage applications decreased 2.5% from one week earlier, even as interest rates fell to their lowest levels in 10 months, according to the Mortgage Bankers Association.

February 6 -

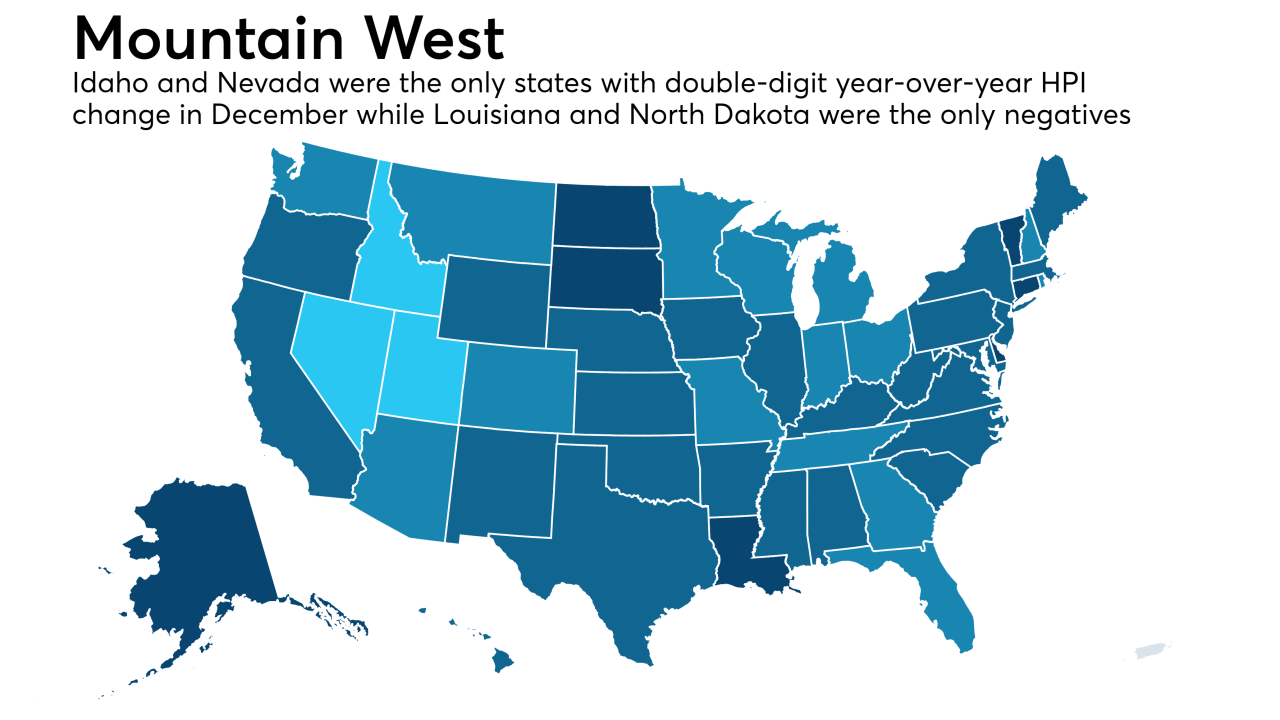

Inventory deficiency and affordability issues kept sales down and hampered home price growth, according to CoreLogic.

February 5 -

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

The seven-year fever driving up Bay Area home prices may finally be breaking.

February 4 -

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

Without the clashing fervor of potential homebuyers competing, fewer sellers are fetching above-listing prices on their houses, according to Zillow.

February 1 -

The housing market's chill grew colder in December, as sales plunged across Southern California and home prices barely rose.

February 1 -

Affordability remains a challenge for homebuyers, but barely any mortgage lenders attribute last year's sluggish home sales to insufficient consumer income or lack of loan products for new buyers, according to Fannie Mae.

January 31 -

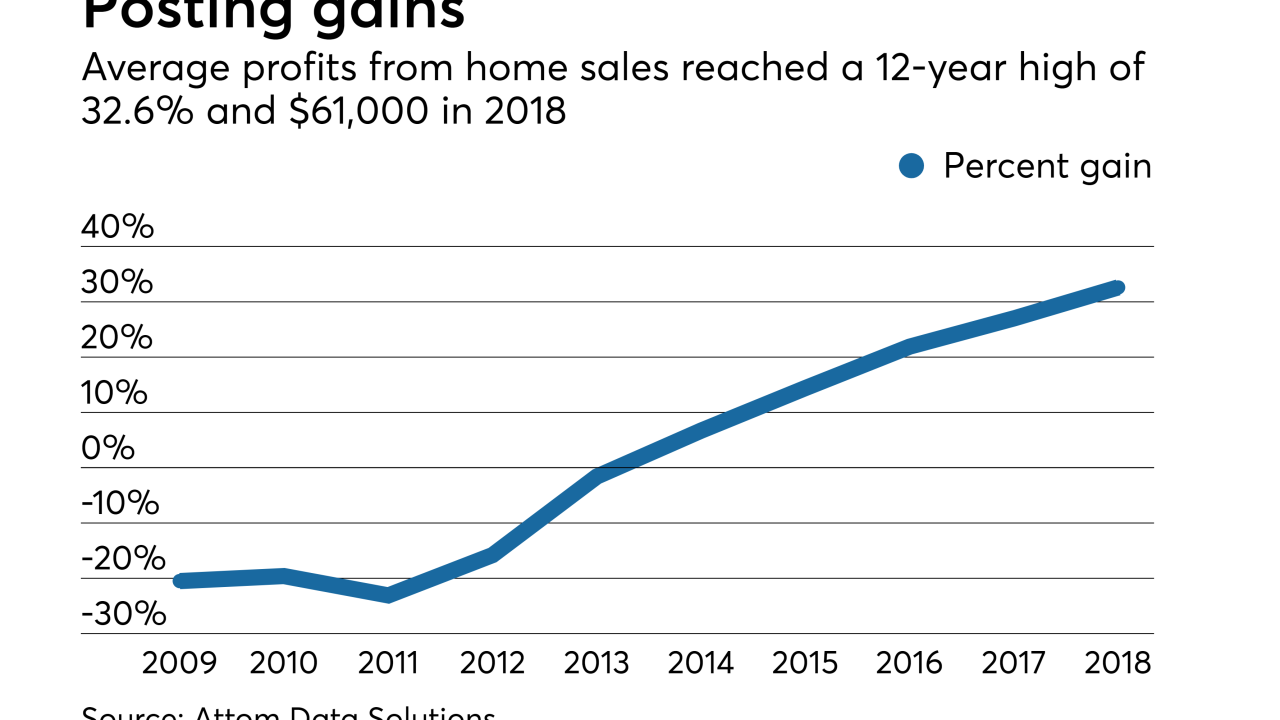

While home sellers gained the most money on their houses since 2006, the fading impact of tax cuts and slow rise of mortgage rates could shorten upcoming margins, according to Attom Data Solutions.

January 31 -

Mortgage application defect risk was at its highest level in four years because of higher interest rates as well as natural disasters during the latter part of 2018, according to First American.

January 31 -

Mortgage rates moved up slightly after weeks of moderating, but are still low enough not to affect the upcoming prime home buying period, according to Freddie Mac.

January 31 -

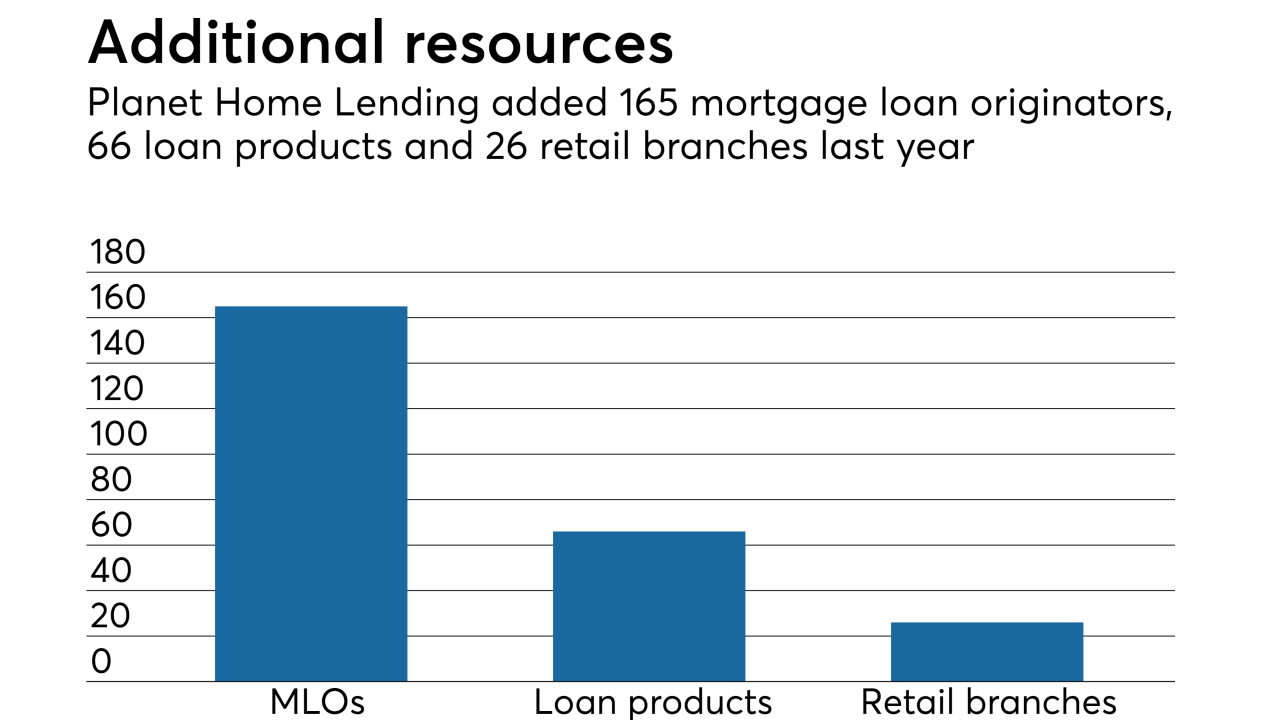

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

Contract signings to purchase previously owned homes unexpectedly fell for the third straight month in December, yet another sign the housing market is struggling amid elevated property prices and borrowing costs.

January 30 -

Mortgage application activity decreased 3% from one week earlier as rates for conventional loans continued to move higher, according to the Mortgage Bankers Association.

January 30 -

Sales of single family-homes in the Tampa Bay area plunged in December as prices again rose.

January 30 -

Home prices in 20 U.S. cities rose in November at the slowest pace since early 2015, decelerating for an eighth straight month as buyers balk at the ever-receding affordability of properties.

January 29 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28