-

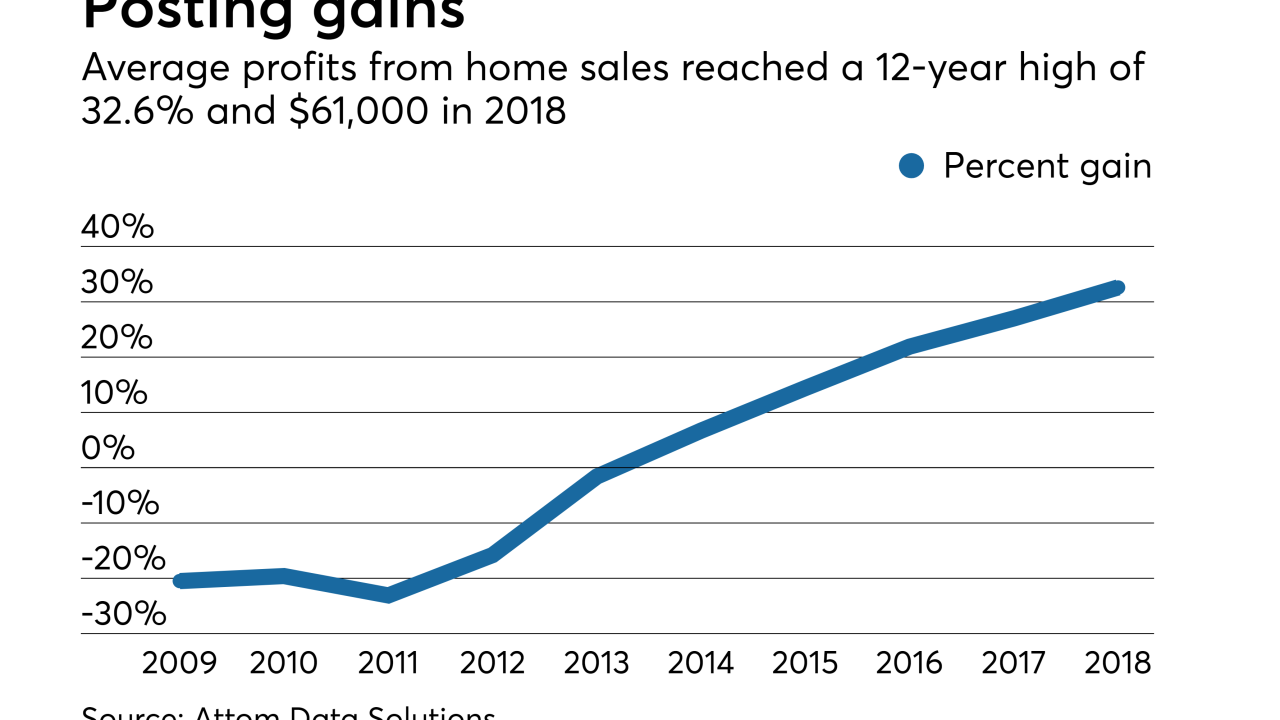

While home sellers gained the most money on their houses since 2006, the fading impact of tax cuts and slow rise of mortgage rates could shorten upcoming margins, according to Attom Data Solutions.

January 31 -

Mortgage application defect risk was at its highest level in four years because of higher interest rates as well as natural disasters during the latter part of 2018, according to First American.

January 31 -

Mortgage rates moved up slightly after weeks of moderating, but are still low enough not to affect the upcoming prime home buying period, according to Freddie Mac.

January 31 -

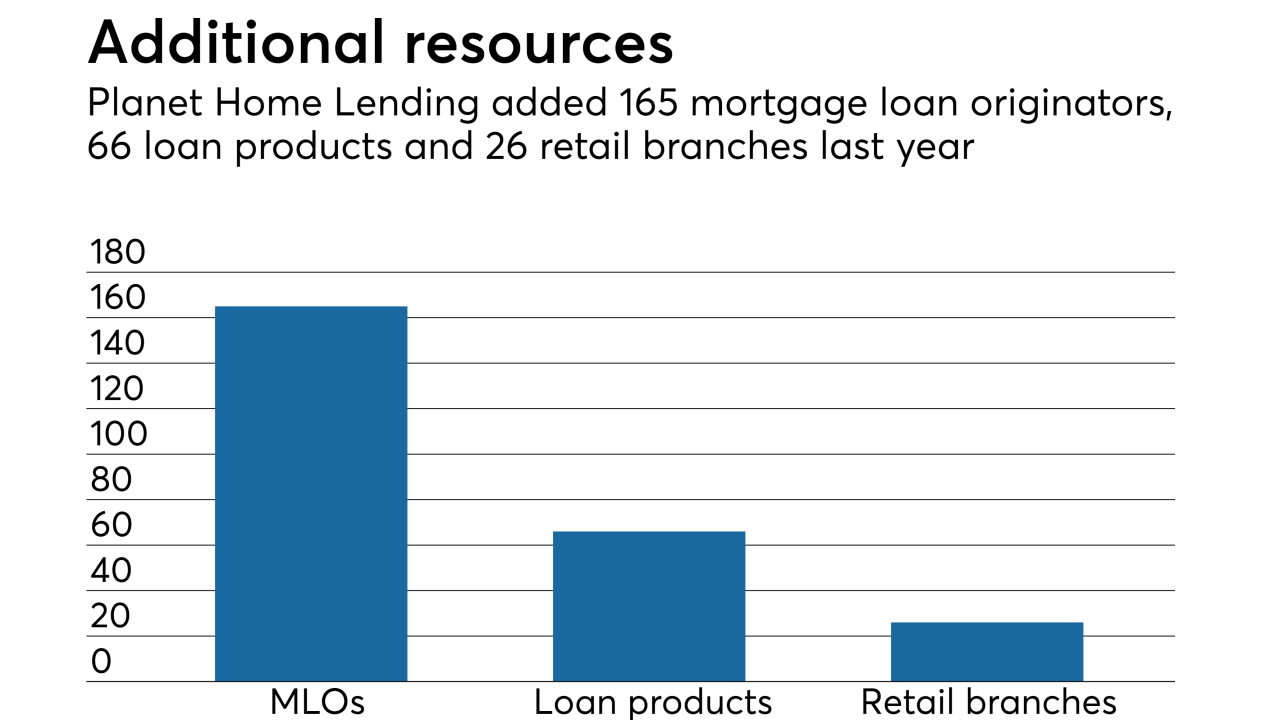

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

Contract signings to purchase previously owned homes unexpectedly fell for the third straight month in December, yet another sign the housing market is struggling amid elevated property prices and borrowing costs.

January 30 -

Mortgage application activity decreased 3% from one week earlier as rates for conventional loans continued to move higher, according to the Mortgage Bankers Association.

January 30 -

Sales of single family-homes in the Tampa Bay area plunged in December as prices again rose.

January 30 -

Home prices in 20 U.S. cities rose in November at the slowest pace since early 2015, decelerating for an eighth straight month as buyers balk at the ever-receding affordability of properties.

January 29 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Property values have continued rising across the country, but six cities bucking the national trend are leading a shift in the housing market, which could lessen affordability hurdles for homebuyers, according to First American Financial Corp.

January 28 -

The percentage of first-time homebuyers financed through builder D.R. Horton's in-house mortgage unit has risen notably as market trends have driven it to intensify its focus on lower-priced housing.

January 25 -

The real estate industry is expecting homebuilders to add more inventory this year, but new-home sales tanked in the closing months of 2018, according to Redfin.

January 25 -

Adjustable-rate mortgages for the second consecutive month hit a post-crisis high, due to strong demand for housing being constrained by a lack of supply, according to Ellie Mae.

January 24 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

The real estate industry is expecting homebuilders, with the aid of local governments, to add more financially attainable starter homes to the market and ease burdens for buyers, according to Redfin.

January 23 -

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

Mortgage application activity decreased from one week earlier as rising interest rates cooled borrowers' interest in getting a loan, according to the Mortgage Bankers Association.

January 23 -

The stock market's volatility during December helped to improve the potential for existing-home sales, although housing's performance remains well below its capacity, First American Financial said.

January 22 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22