-

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

Mortgage rates jumped 6 basis points over the past week, which led to the largest year-over-year gain in over four years, according to Freddie Mac.

September 13 -

Staggering home prices and steep tax rates are pushing people from expensive cities along the coasts to more affordable locales.

September 12 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

The number of workers employed by nonbank mortgage lenders and brokers reversed course and inched lower in July as affordability constraints and limited income gains reduced demand.

September 7 -

The typical homeowner spends 17.5% of their income on monthly mortgage payments, according to Zillow's second quarter affordability report.

September 6 -

Mortgage rates inched higher for the second straight week and further increases are likely in the near term, according to Freddie Mac.

September 6 -

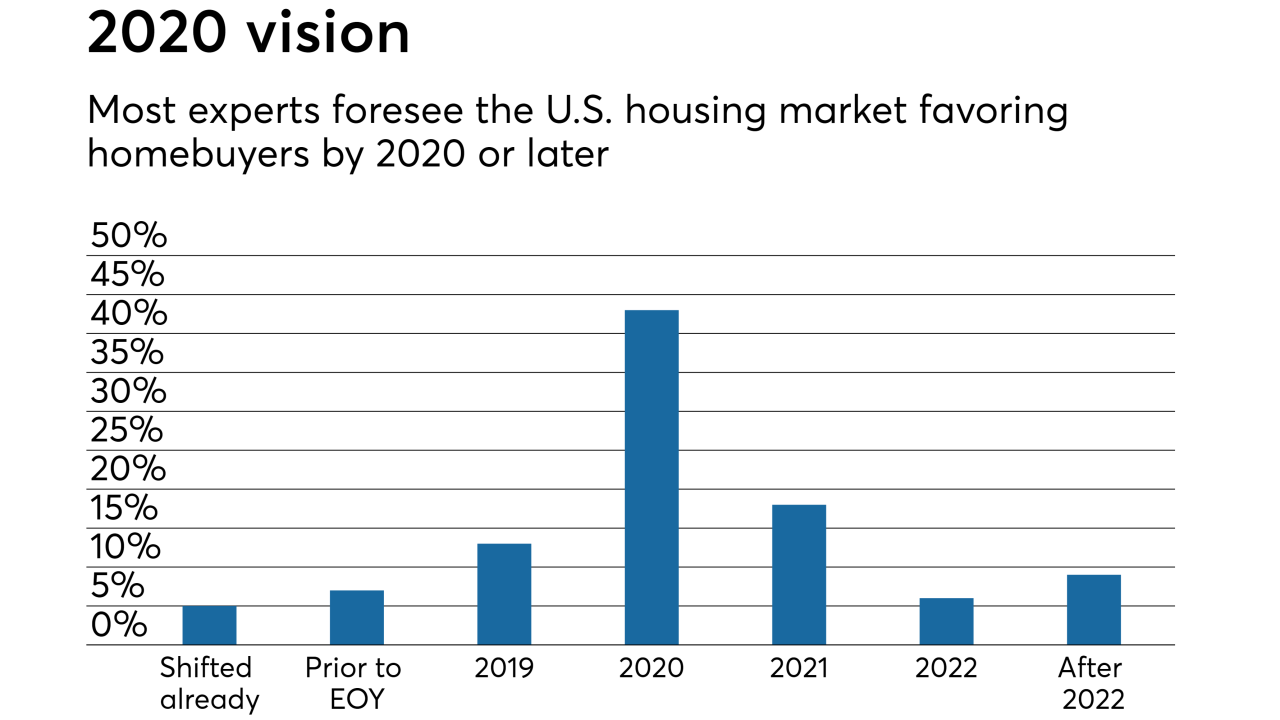

After home prices soared due to a lack of inventory and a recovering economy, three-quarters of experts believe the shift to a buyer's housing market should come in two years.

September 5 -

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5 -

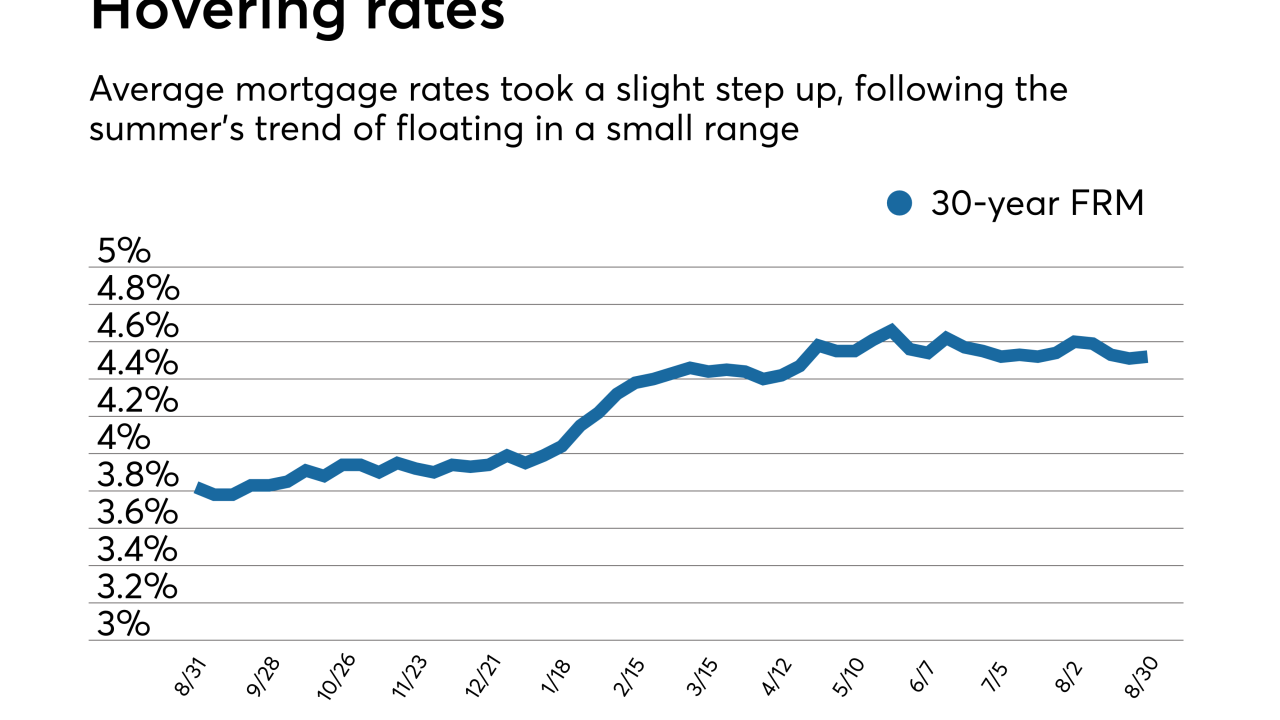

Mortgage rates took small steps up after hitting a four-month low, but continued hovering around the same range they have all summer, according to Freddie Mac.

August 30 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

The Congressional Budget Office has found that restructuring the mortgage market would save the government billions of dollars but may increase the cost of housing.

August 27 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Wells Fargo & Co. is cutting 638 mortgage employees as the nation’s largest home lender contends with a slowdown in the business.

August 24 -

Home prices climbed 6.5% in the second quarter from a year earlier, a slower pace that adds to signs of a cooldown in the market.

August 23 -

Intensifying margin pressure could spur another wave of cost-cutting at nonbank mortgage lenders, unless other strategies, like consolidation or a mortgage servicing book that could increase in value, offset it.

August 23