-

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

The cost associated with borrowing money to finance homes now appears more likely to remain stable rather than continuing to decline, which should eventually slow refinance activity.

February 11 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

With low mortgage rates billowing demand as homebuying season approaches, consumer confidence for selling jumped in January, according to Fannie Mae.

February 8 -

Whether or not the cost of home loans go up may hinge on the labor market recovery, and right now bond yields suggest they are heading in one particular direction long term.

February 4 -

With the shift to a low-rate environment dominated by no cash-out refinancing, use of an alternative to traditional valuations has soared.

February 2 -

Investors were also reacting to the inauguration of Joe Biden and uncertainty over additional fiscal relief, Freddie Mac’s Chief Economist Sam Khater said.

January 28 -

In a year beset with a pandemic, tornadoes and civil unrest, one bright spot that emerged in 2020 was a residential real estate market that enjoyed record-high sales and home prices in Chattanooga, Tenn.

January 21 -

After last week’s spike, mortgage rates dropped back to near historic lows, as broader worries about the pandemic and the economy came back to the fore for investors.

January 21 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

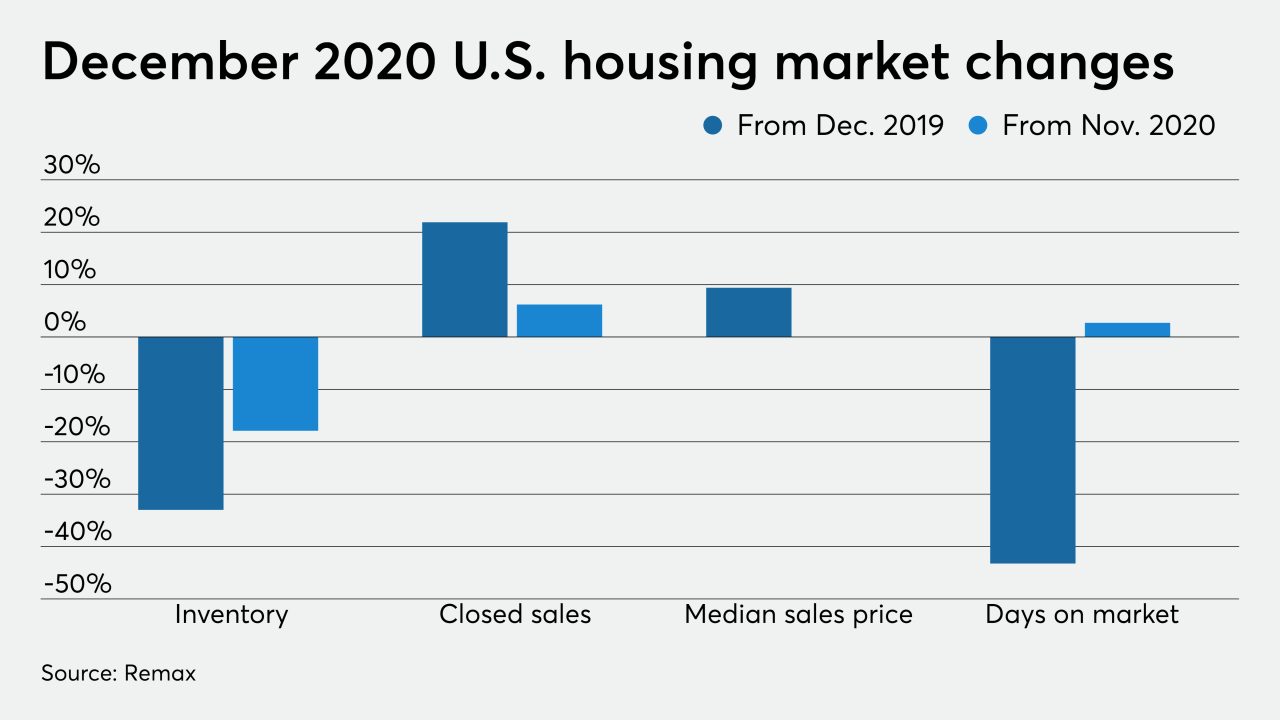

Bottomed-out mortgage rates cut listing times and housing inventory while sales volume and average prices jumped annually.

January 19 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

The pandemic-fueled exodus from New York City propelled nearby Westchester County to its strongest year for home sales in more than two decades.

January 15 -

Mortgage rates, whose movements until now had not reflected gains in the benchmark 10-year Treasury yield, rose 14 basis points this week, according to Freddie Mac.

January 14 -

Cash offers are taking priority in the Boise, Idaho, area, shutting out homebuyers who need a conventional mortgage.

January 13 -

Mortgage applications increased 16.7% from one week earlier to their highest level in 10 months, although rates rose in expectation of additional government pandemic relief, according to the Mortgage Bankers Association.

January 13 -

For eight years after the Great Recession, home prices in metro Atlanta climbed steadily but slowly. Since mid-summer, they have been soaring.

January 11 -

Housing values are outpacing record-low rates and that’s hurting the entry-level homebuyers, but down payment programs and other traditional measures to assist them may only drive prices to greater heights, according to former Freddie Mac CEO Don Layton.

January 8 -

Metro Denver's housing market ended 2020 with a bang, popping the roof with a record-high number of home sales and busting through the basement with the fewest listings available for sale.

January 8