-

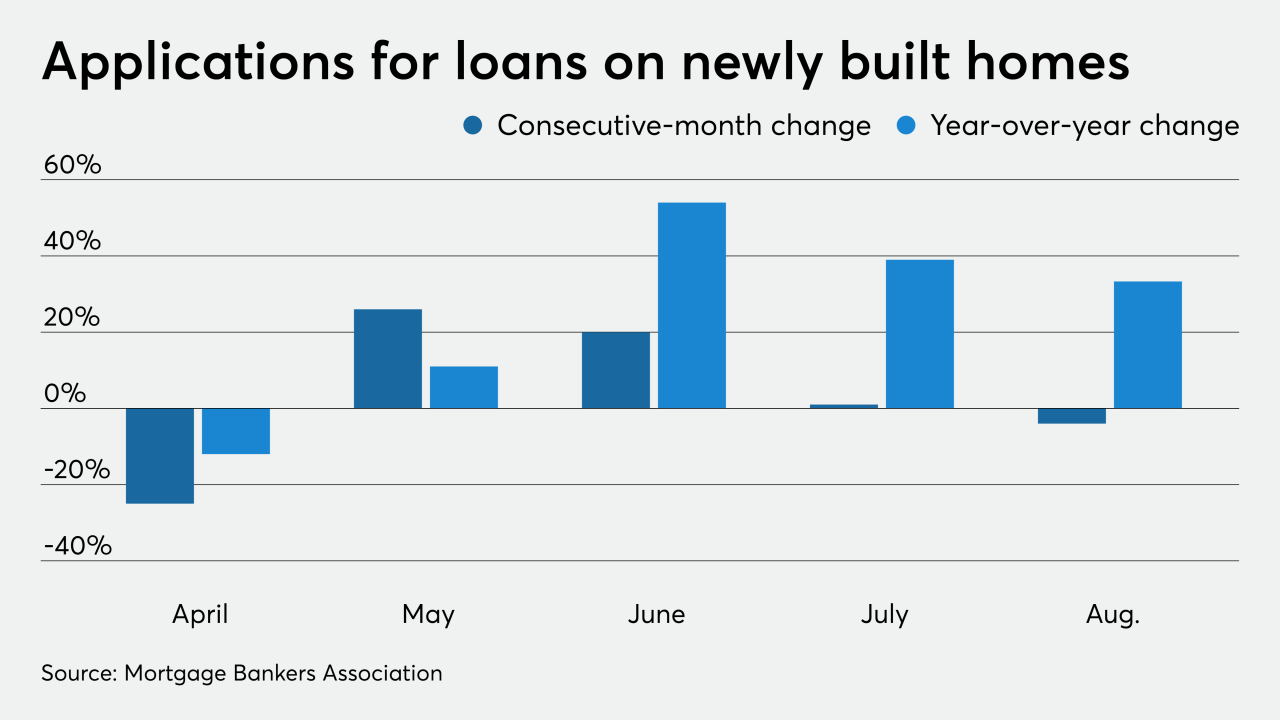

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

Even though second-quarter originations were nearly double the same period in 2019, most were refinancings, which generate less revenue for title companies.

September 11 -

The Spokane County, Wash., housing market continues to show resilience during the coronavirus pandemic as the median closing price skyrocketed to a record-breaking $317,000 in August.

September 11 -

Mortgage rates fell 7 basis points this week to yet another record low in the 49-year history of the Freddie Mac Primary Mortgage Market Survey, as stock market indicators sank during the period.

September 10 -

Homebuyers are fleeing dense Bay Area neighborhoods for Wine Country environs, heating up a local real estate market rapidly recovering from a pandemic-induced slowdown.

September 9 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

Residential real estate has been a hot commodity in the Sioux City, Iowa, metro this summer, with prices and demand rising while interest rates and supply are low.

September 8 -

New Yorkers fleeing the city and cooped-up workers in cramped home offices are helping fuel a hot home sale market in Connecticut, with properties selling at a dizzying pace.

September 8