-

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

Pending home sales rose more than expected in August, reaching the highest level on record as low mortgage rates fuel a housing rally.

September 30 -

Home prices in 20 U.S. cities gained in July, pushed higher by demand for housing that has been fueled by low mortgage rates.

September 29 -

Dallas had the greatest price gains in more than a year the latest nationwide comparison.

September 29 -

Consumer home purchasing power gained steam in July thanks to plummeting interest rates and gains in the median income despite steady price growth, according to First American.

September 28 -

For the majority of borrowers, interest rate research for mortgage refinancing came with unwanted and annoying sales calls, which could ultimately hinder potential business for lenders.

September 28 -

Home sales hit a 15-year high in Duluth, Minn., this summer even as inventory hit a 15-year low.

September 25 -

After an annual gain in July, newly constructed home listings tumbled in August as coronavirus complications caused the largest inventory drops on record, according to Redfin.

September 25 -

Ohio home sales were up 4.2% in August from the same month a year ago, another sign that the fallout from the coronavirus pandemic may be fueling a competitive housing market.

September 25 -

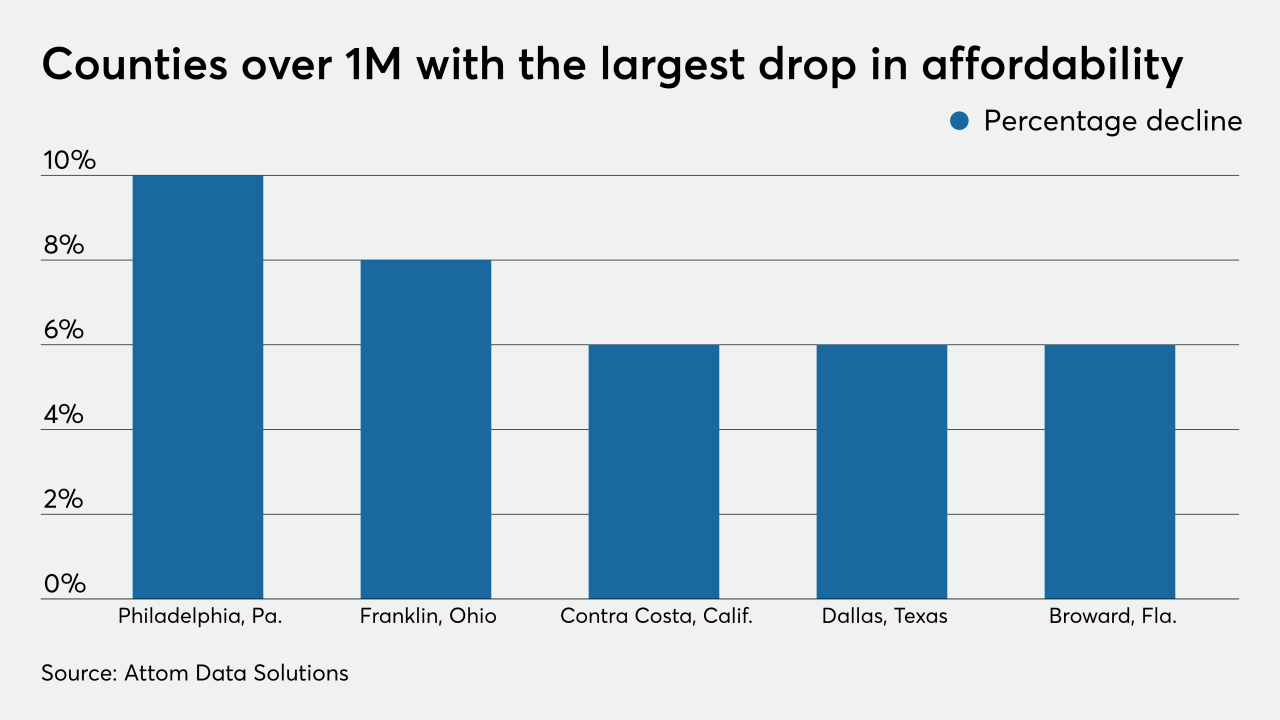

More counties have median home prices above their historic averages for typical wage earners, the company found.

September 24 -

Sales of new homes in the unexpectedly advanced for a fourth month in August to the highest level in almost 14 years as record-low mortgage rates continued to entice buyers into a market with ever-shrinking supply.

September 24 -

Mortgage rates experienced a marginal uptick this week, rising three basis points. But they remained near record lows and possibly soon could track down again, according to Freddie Mac.

September 24 -

A summer resurgence of home buying stretched into August, defying the pandemic to set record home prices and drive sales to a near two-year high, new housing figures show.

September 24 -

Chattanooga, Tenn., home sales continued last month to rebound from the coronavirus-spurred slump in the spring, boosting the median price of homes sold during August to an all-time high.

September 23 -

Mortgage applications increased 6.8% from one week earlier as this summer's surprise purchase demand has carried over to the fall, according to the Mortgage Bankers Association.

September 23 -

But the group is more conservative than Fannie Mae when it comes to interest rate movements over the next six quarters.

September 22 -

Outside the densely populated coastal hubs, annual home sales grew by leaps and bounds, as buying patterns shifted toward more space with less emphasis on proximity to urban centers, according to Redfin.

September 22 -

Sales of previously owned homes remained brisk in August as low mortgage rates and demand for space in the suburbs sustained strength in a housing market that’s a bright spot for the economy.

September 22 -

August was a blockbuster month for home sellers across the 16-county metro, despite the global pandemic and a coming presidential election, which typically puts buyers on edge.

September 21 -

A combination of pent-up demand, low inventory and rock bottom interest rates is making it extra tough for homebuyers with government-backed loans.

September 18