Change looms on the horizon for the mortgage industry — both in the products it offers and in the borrowers it serves.

Demographic shifts in household formation are creating a more diverse pool of would-be homebuyers. But those shifts, particularly as they pertain to the growth of Hispanic and black households, present unique challenges to lenders.

Black and Hispanic consumers are, according to the Consumer Financial Protection Bureau, more likely to be "credit invisible" than white consumers. Overall,

While 15% of black and Hispanic consumers are credit invisible, only 9% of white consumers find themselves in such a position.

The CFPB further reported that 19 million consumers have credit records that are considered unscorable. Again, black and Hispanic consumers were more likely to find themselves in this group than their white peers.

One factor that leads to these disparate outcomes can be culture. For instance, many in the Hispanic community do not trust the banking system because of the failures of financial institutions in the countries their families originally immigrated from, according to Patricia Arvielo, president of New American Funding, a nonbank mortgage lender based in Tustin, Calif.

"We still conduct our financial lives in cash — it makes us feel safe and secure to have access to cash," Arvielo said. "That doesn't mean that it's wrong, it's just different."

And now, economists once again expect interest rates to increase, which would result in plunging refinance volume.

For lenders, refinances have been their bread and butter in recent years — easy to obtain and relatively low risk. But with that market drying up, lenders are grappling with how to safely tap into underserved borrower segments and specifically, how to underwrite borrowers

Recent efforts to make the credit box more inclusive in today's highly-regulated market have largely relied on manual processes and balance sheet lending. But these strategies are costly, cumbersome and difficult to scale.

As these market trends intensify, demand for new automation and strategies to effectively serve these borrowers will grow in tandem. And the lenders that excel in developing these approaches could come to gain a major competitive advantage in the mortgage market of the future.

Time and again, economists have predicted an uptick in interest rates, only to see some factor intervene and keep rates near record lows, such as the United Kingdom's vote in June to exit the European Union.

Now though, conditions finally appear to favor an increase in rates. In the immediate aftermath of the presidential election, President-elect Donald Trump's victory triggered higher Treasury note rates and a lower value for the dollar. Those results corroborated previous forecasts that suggested higher mortgage interest rates on the horizon.

The interest rate for a 30-year fixed-rate mortgage is expected to average 4.2% in 2017, increasing gradually from this year's average of 3.6%, the Mortgage Bankers Association said in a forecast released in late October prior to the presidential election. And with higher interest rates always comes a drop in refinance activity.

Refinance activity is predicted to fall from $901 billion in 2016 to $529 billion in 2017, the MBA said. Additionally, the median price of existing homes is expected to increase to roughly $244,000 from $235,000, which threatens to exacerbate housing affordability problems nationwide.

At the same time, the make-up of the prospective home-buying population continues to become more diverse.

Minorities will account for more than two-thirds of the

Given the large number of Hispanic and black households being formed, lenders will need to develop an understanding of these consumers' cultural attitudes toward credit.

Many minority consumers may display tendencies toward lower usage of credit products. One exception though is retail credit lines that come with promotional deals for consumer products. But even then, responsible uses of credit can hurt minority consumers' credit scores.

For instance, Hispanic consumers often will open store cards to get discounts on major purchases, pay off the credit card quickly and then never use it again, Arvielo said. "The algorithm with the credit scoring model doesn't work because they're not continuing to use the credit card," she said, adding that credit models will also disqualify these consumers as cash borrowers since they have open trade lines.

Similarly, many minority consumers do not have easy access to traditional financial services because of a lack of bank branches and other institutions in their neighborhoods, said Maurice Jourdain-Earl, managing director at ComplianceTech, a fair lending consultant and software vendor in McLean, Va. As a result, many of these consumers turn to currency exchanges and payday lenders for their financial needs, which Jourdain-Earl said can also ding their credit reports.

"You end up with an aggregate outcome that's going to be adverse for certain communities, simply because they didn't have access," he said.

These challenges come to a head when consumers with nontraditional credit profiles apply for a mortgage because the automated systems lenders use to qualify borrowers often can't process applications with missing or nonstandard information.

"The automated systems cannot touch the nuances of lifestyle, income source and behavior patterns that someone with nontraditional credit may present," Jourdain-Earl said. "Therefore, it's not programmed to render an answer for someone that doesn't fit the model."

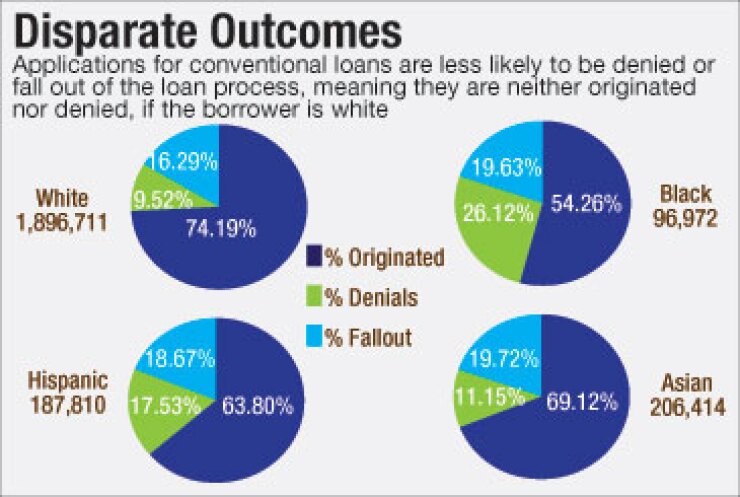

As a result, the higher number of minority consumers with nontraditional credit backgrounds contributes to higher denial rates among black and Hispanic consumers. In 2015, about 26% of conventional loan applications from black applicants and 18% from Hispanic applicants were denied, versus 10% of those from white applicants, according to a ComplianceTech analysis of Home Mortgage Disclosure Act data.

Of course, these issues are not exclusive to minority or low- to moderate-income borrowers. Having a thin credit file can prevent anyone from getting a loan, as Altavera Mortgage Services President and CEO Brian Simons found.

"I've never carried any debt," he said. "I had one credit card and that was it. When my wife and I went to go buy a house, I couldn't get a loan because I had no trade lines."

As a result, the house and the loan are in his wife's name alone.