-

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

November 20 -

Frank Cassidy, who is currently principal deputy assistant secretary at the Department of Housing and Urban Development, will soon face a full Senate vote.

November 20 -

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

-

Rocket enters the crowded DSCR market with a product for experienced investors, joining rivals as non-QM lending grows and demand for single-family rentals stays strong.

November 19 -

Federal Reserve Gov. Stephen Miran argues that banks holding excess reserves are keeping the central bank's balance sheet bigger than it should be, and suggested that regulatory changes could help bring those reserves down.

November 19 -

Travis Hill's nomination to lead the Federal Deposit Insurance Corp. was recommended favorably by the Senate Banking Committee to the full Senate Wednesday morning in a 13-11 party-line vote.

November 19 -

A "spike in unusual traffic" caused service degradation for the infrastructure giant, disrupting digital banking for customers.

November 18 -

An activist investor is seeking more information on how, and when, the largest bank deal of 2025 came together.

November 18 -

Federal Reserve Gov. Christopher Waller said in a speech Monday that private and public-sector data suggests that the labor market is continuing to weaken, making a 25 basis point rate cut in December a prudent choice.

November 17 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

The bank is adding trusted contacts, specialized teams and new tech against scams, but consumer advocates say reimbursement is the key missing piece.

November 17 -

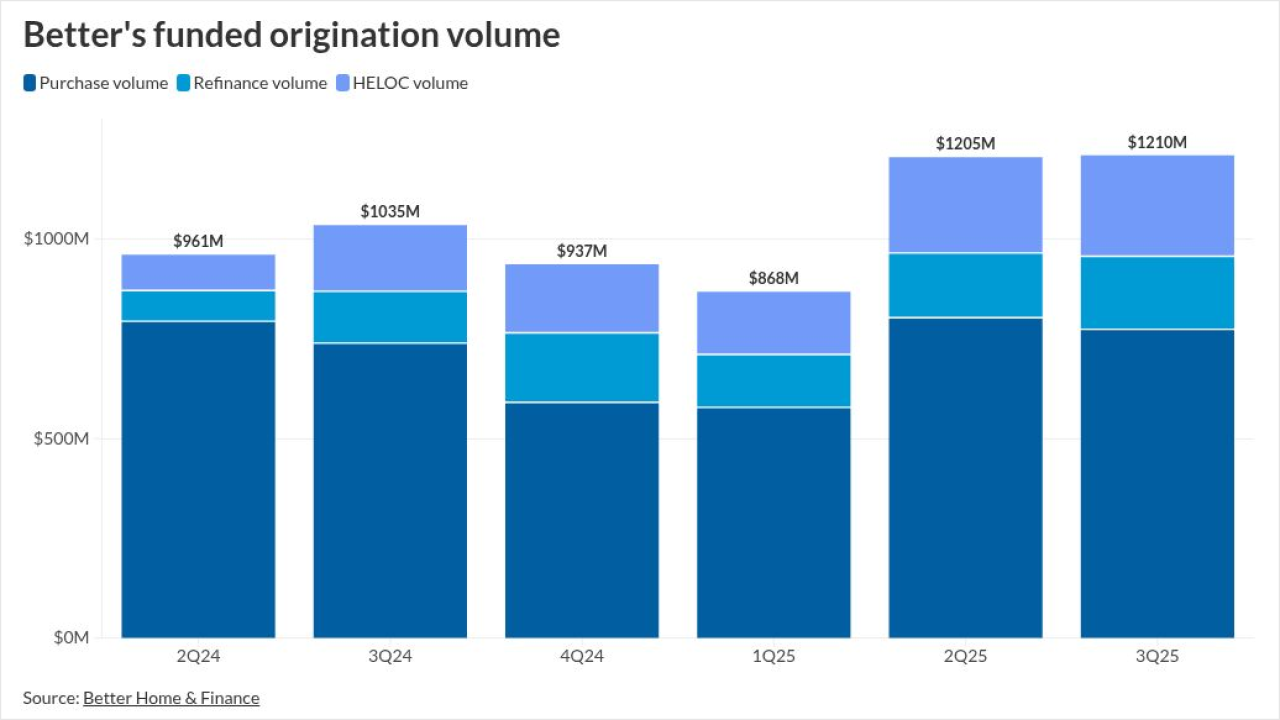

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

The government shutdown added an additional dose of pessimism about the U.S. economy to panelists' outlooks, Wolters Kluwer said in its latest survey.

November 12 -

The lawsuit targets Zillow Flex, in which participating agents must meet Zillow Home Loans pre-approval quotas to maintain access to high quality leads.

November 12 -

The Treasury secretary highlighted the impacts the bond market has on affordability and previewed regulatory tweaks the administration is eyeing to keep yields stable and credit flowing.

November 12 -

Federal Reserve Bank of Atlanta President Raphael Bostic won't seek reappointment following the end of his current term on Feb. 28, 2026.

November 12 -

Besides adding 60 days to the partial claim deadline in some cases, the bill also has provisions for buyer agent payments for Veterans Affairs borrowers.

November 12 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11