-

The bank is adding trusted contacts, specialized teams and new tech against scams, but consumer advocates say reimbursement is the key missing piece.

November 17 -

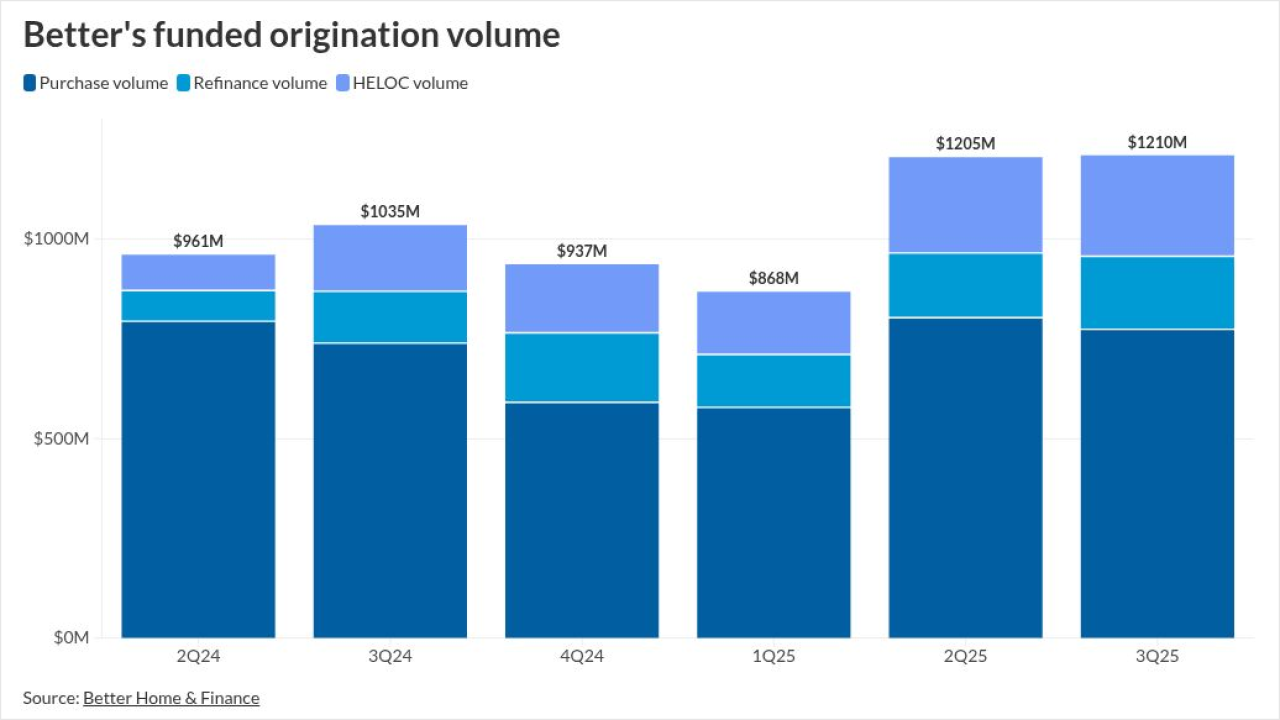

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

The government shutdown added an additional dose of pessimism about the U.S. economy to panelists' outlooks, Wolters Kluwer said in its latest survey.

November 12 -

The lawsuit targets Zillow Flex, in which participating agents must meet Zillow Home Loans pre-approval quotas to maintain access to high quality leads.

November 12 -

The Treasury secretary highlighted the impacts the bond market has on affordability and previewed regulatory tweaks the administration is eyeing to keep yields stable and credit flowing.

November 12 -

Federal Reserve Bank of Atlanta President Raphael Bostic won't seek reappointment following the end of his current term on Feb. 28, 2026.

November 12 -

Besides adding 60 days to the partial claim deadline in some cases, the bill also has provisions for buyer agent payments for Veterans Affairs borrowers.

November 12 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

The FHFA director hinted at a partnership in the works and doubled down on criticism of homebuilders and the Fed chair in a housing conference interview.

November 7 -

A trade group for participants in the clean energy loan program argues the upcoming regulations will be too burdensome and costly for participants.

November 7 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

Federal Reserve Gov. Christopher Waller said there was a popular "misunderstanding" Thursday regarding who can qualify for a "skinny" master account, noting that only firms with a bank charter would qualify for approval.

November 6 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

A new research report this week found AI could 'unlock' $370 billion in profits for banks, though they're not yet ready to capture it. But big-bank executives say they are already seeing measurable results from their generative and traditional AI investments.

November 6 -

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

November 6