-

Estimates suggest public funds in aggregate may be adequate to cover arrears and potentially keep many in their homes as the eviction ban ends, but may not be evenly distributed.

July 1 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1 -

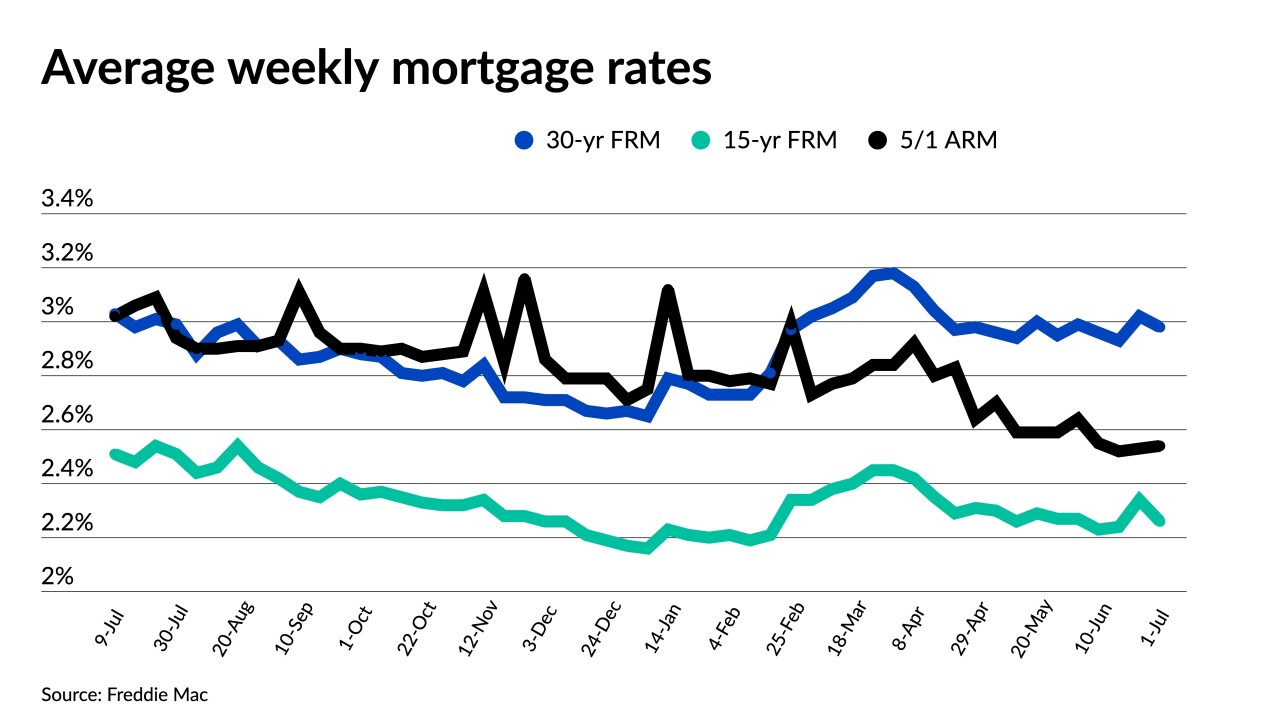

Markets react calmly to inflationary worries, but short supply and rising home prices loom as a greater concern.

July 1 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1 -

The ruling confirms that a state precedent regarding forward mortgages also applies to home equity conversion loans.

July 1 -

Federal Reserve officials who favor prioritizing mortgage-backed securities when they begin to scale back asset purchases have added Governor Christopher Waller to their ranks.

July 1 -

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

The deal comes after a tumultuous 12-month period for CoreLogic, which saw itself twice targeted for acquisition.

June 30 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

Limited housing supply, climbing rates cause applications to decline across the board.

June 30 -

Edward Al-Hussainy, senior interest rate and currency analyst at Columbia Threadneedle, will discuss the economy, inflation and the Federal Reserve.

-

Chief Justice John Roberts and Justice Brett Kavanaugh joined the court’s three liberals in rejecting calls by landlords and real estate trade associations to block the measure from the U.S. Centers for Disease Control and Prevention.

June 30 -

Six online lenders and the National Community Reinvestment Coalition have asked the Consumer Financial Protection Bureau for clarity on whether disparate-impact rules apply to lending decisions made by machines.

June 29 -

Democrats are pushing for a public-sector alternative to the three main credit bureaus, but Republicans argue that the government is ill-equipped to safely handle consumer data and produce accurate reports.

June 29 -

Fewer borrowers are suspending payments for pandemic hardships but some who got back on track are having trouble again, and deadlines could spur a final round of new requests.

June 28 -

The Consumer Financial Protection Bureau issued a temporary final rule that allows mortgage servicers to initiate foreclosures on abandoned properties and certain delinquent borrowers, but it also outlined additional measures that shield distressed homeowners.

June 28 -

Ginnie Mae is allowing lenders to securitize modified home loans with this extended term as the Biden administration works to make more housing options available for struggling borrowers.

June 25 -

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

The 2013 rule, which was weakened under the Trump administration, established a comparatively low bar for plaintiffs alleging discrimination.

June 25 -

The Supreme Court decision cleared the way for further revisions to the agreements between the Federal Housing Finance Agency and the Treasury, which could include dismissing the January changes.

June 25