-

Jonathan Corr's departure from the nation's largest loan origination system company follows the completion of its sale to Intercontinental Exchange.

September 11 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

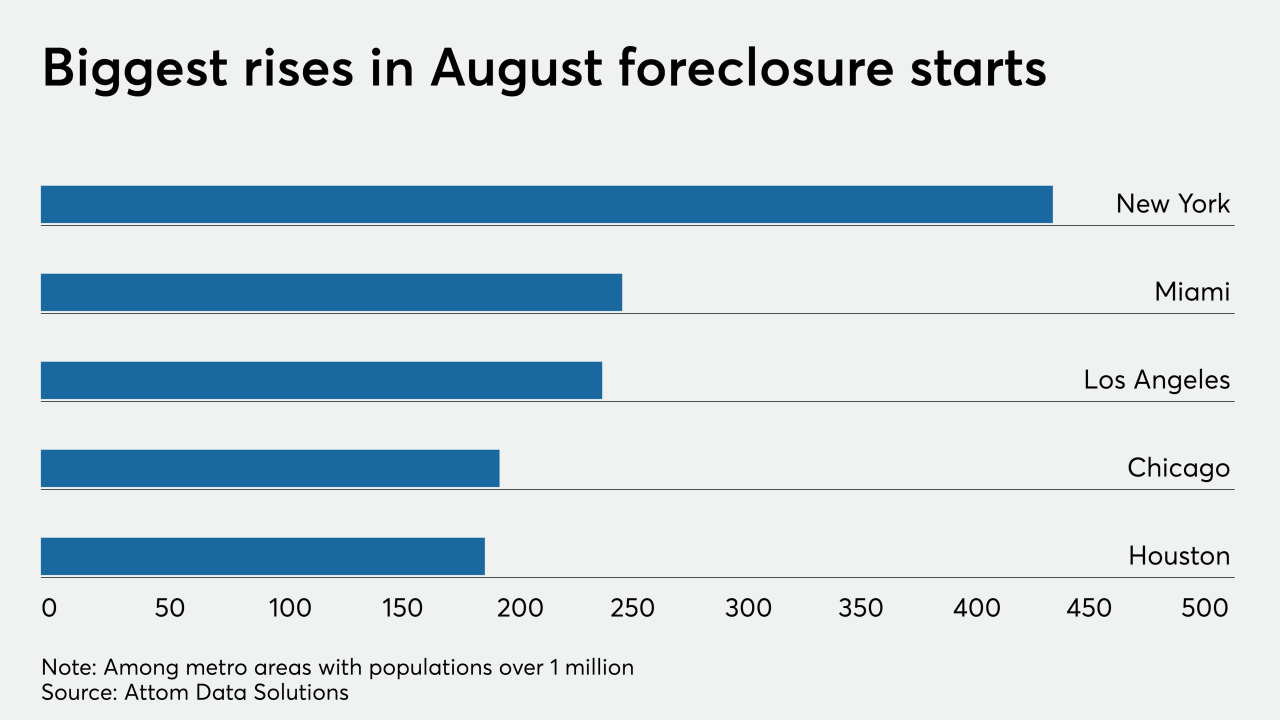

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

The financial industry has praised the measured approach taken in a pending regulation on permitted communications with consumers. But two recent complaints by the bureau against debt collectors reflect a potentially aggressive enforcement stance.

September 11 -

The GSEs began sharing their risk with the private market in new ways during conservatorship, and the Federal Housing Finance Agency’s proposed capital framework currently discourages the use of those strategies. Industry leaders voiced concerns in a FHFA listening session this week.

September 11 -

That, along with continued high refinance volume over the next three months, keeps originators' profit forecasts elevated, Fannie Mae said.

September 11 -

When Jane Fraser takes the reins of Citigroup in February, she will have to tackle the company’s cards slump, lagging performance metrics and challenges presented by employees’ return to the office.

-

The post was vacant since Kristy Fercho left to run Wells Fargo Home Loans in July.

September 10 -

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

Jane Fraser, a longtime Citigroup executive, will be the first female CEO of a major Wall Street bank. She succeeds Michael Corbat, who had held the post for eight years.

September 10 -

Mortgage rates fell 7 basis points this week to yet another record low in the 49-year history of the Freddie Mac Primary Mortgage Market Survey, as stock market indicators sank during the period.

September 10 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

The final version of the amended rule, like the original proposal, makes fair lending claims tougher to prove; but it does soften language that otherwise might have allowed mortgage companies to use algorithms to prove nondiscrimination.

September 9 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

Without further government help, that rate could double again by 2022, CoreLogic said.

September 8 -

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8 -

The regulatory road ahead is as uncertain and risky to banks as the pandemic.

-

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4