-

The pandemic drives home the point that without those funds being siphoned off, the recent fee hikes would not be necessary.

September 2 Community Home Lenders Association

Community Home Lenders Association -

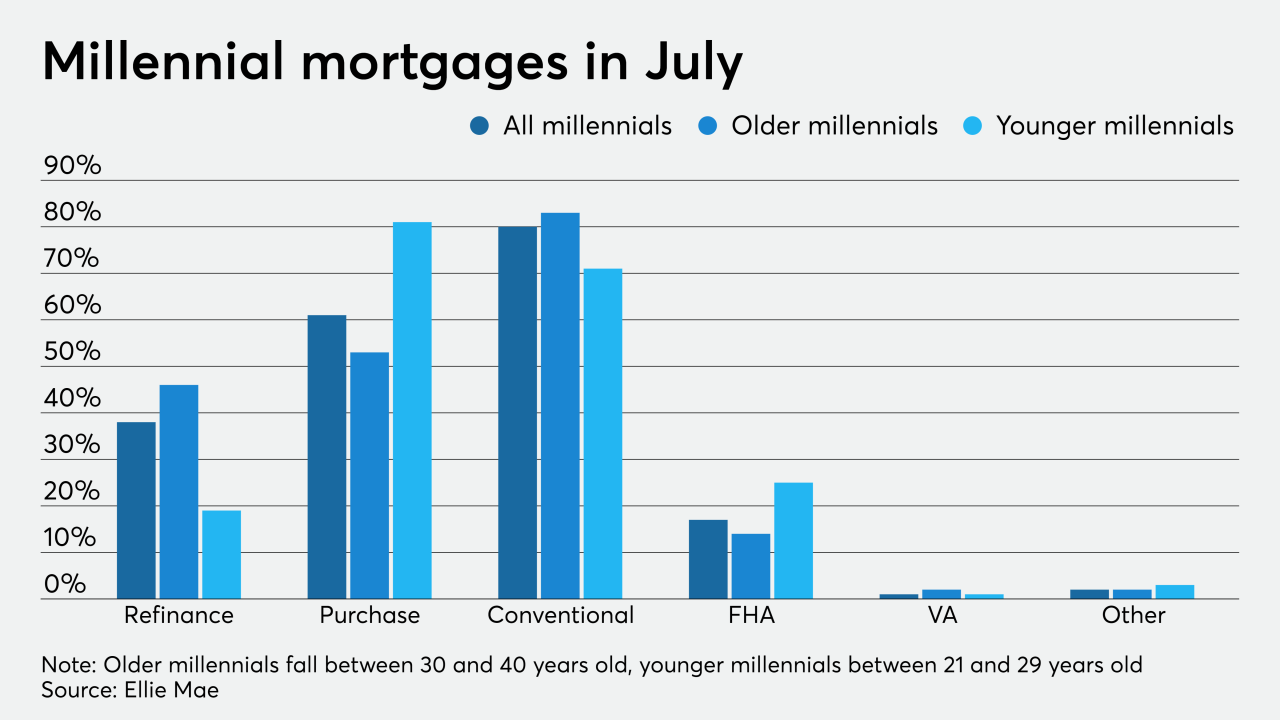

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Home prices continue to accelerate in Southwest Florida, but at a slower pace than the state and the nation.

September 2 -

This proposed Libor replacement is an imaginary, backward-looking benchmark dreamed up by the economists at the Fed with no discernible market.

September 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2 -

Individuals who received a coronavirus stimulus check earlier this year also qualify for the protection, as do couples who jointly file their taxes and expect to earn less than $198,000.

September 1 -

Following its deadline for written comments on the topic last month, the Federal Housing Finance Agency is scheduling events that will focus on two key themes emerging in responses.

September 1 -

Neither side opted to invoke their Aug. 31 termination rights and the deal is set to close by the end of September.

September 1 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

America's real estate meccas aren't what they used to be as COVID-19 revives U.S. mobility.

September 1 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

Cannae and Senator said they are looking to stop CoreLogic from unilaterally cancelling a vote on changing the members of its board.

August 31 -

In spite of the COVID-19 pandemic, Napa County home sales skyrocketed in July, rising 79.8% from June to July, the California Association of Realtors reported.

August 31 -

The company said the sale will provide more consistent financial results and allow it to redeploy funds to support other businesses.

August 31 -

Homebuyers are favoring newly built properties at the highest rate in more than a decade.

August 31 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

Also: NMN analyzes political donations from the industry, foreclosure and eviction ban extended to year's end.

August 28 -

The DocVerify deal adds to Black Knight's goal of providing tools for each step in the home-buying and mortgage processes.

August 28