-

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

Cannae and Senator said they are looking to stop CoreLogic from unilaterally cancelling a vote on changing the members of its board.

August 31 -

In spite of the COVID-19 pandemic, Napa County home sales skyrocketed in July, rising 79.8% from June to July, the California Association of Realtors reported.

August 31 -

The company said the sale will provide more consistent financial results and allow it to redeploy funds to support other businesses.

August 31 -

Homebuyers are favoring newly built properties at the highest rate in more than a decade.

August 31 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

Also: NMN analyzes political donations from the industry, foreclosure and eviction ban extended to year's end.

August 28 -

The DocVerify deal adds to Black Knight's goal of providing tools for each step in the home-buying and mortgage processes.

August 28 -

Blackstone Group, which led Wall Street's initial foray into the single-family rental business, is making a new investment in suburban houses at a time when the COVID-19 pandemic is pressuring traditional commercial real estate.

August 28 -

Refinancing has been one of the bright spots in a difficult year for lending, and the industry has concerns that a fee to be imposed by Fannie Mae and Freddie Mac could slow down the business.

August 28 -

-

Pending home sales rose in July by more than forecast to the highest level since 2005, signaling the housing market’s sharp recovery will continue with borrowing costs to stay low for the foreseeable future.

August 27 -

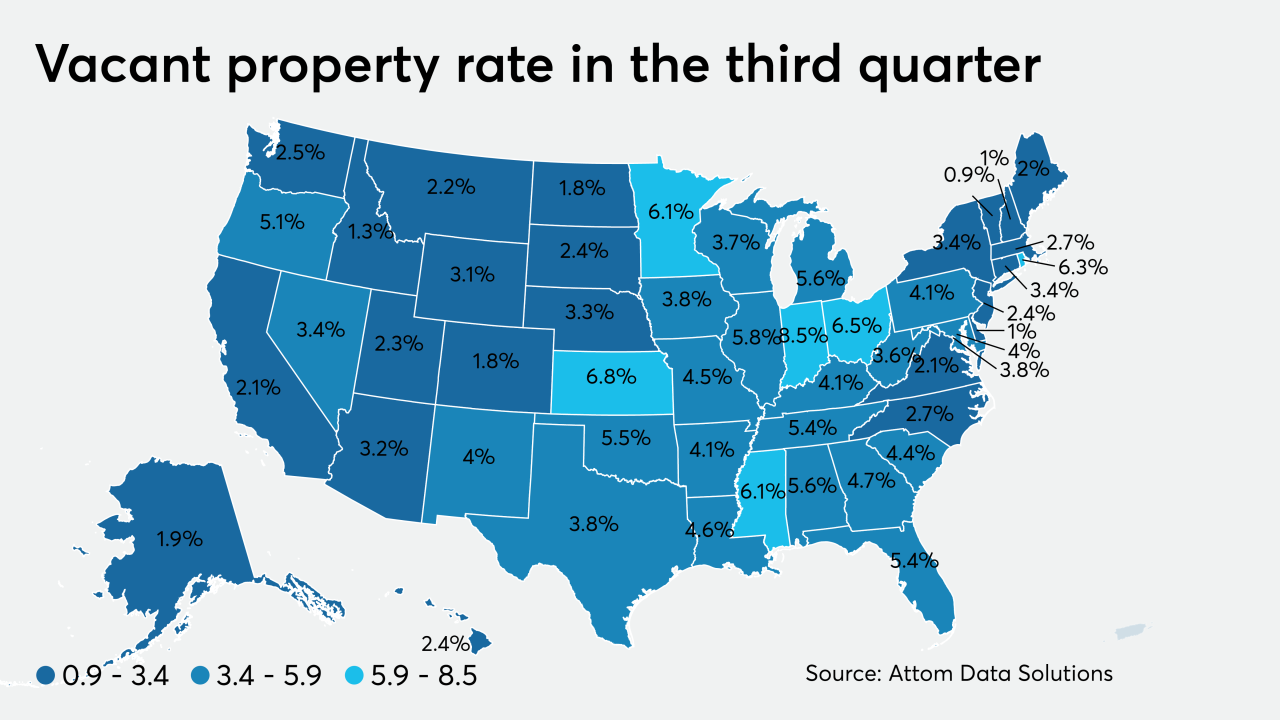

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

As the end of the first six-month forbearance period arrives, the impact of the new cap is coming into focus.

August 27 -

Many mortgage companies are hoping to operate remotely through year-end and are asking regulators for relief to that end.

August 27 -

Mortgage rates decreased by 8 basis points this week, remaining near record lows, while a strong purchase market should continue into the fall, according to Freddie Mac.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

Party polarization and racial equity issues make it tougher for trade groups to manage internal divisions while ensuring the field supports those who get their hands on the levers of power.

August 27