-

The investors seeking to take over CoreLogic plan to solicit support from fellow shareholders to replace nine directors, after the company refused to engage in talks over their $7 billion proposal to take it private.

July 29 -

Mortgage applications decreased 0.8% from one week earlier as the latest spread of COVID-19 weighed on the minds of consumers looking to buy or refinance, according to the Mortgage Bankers Association.

July 29 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

With inventory tight and demand compounded by a nonexistent spring home-buying season, a fifth of all buyers waived inspection or appraisal contingencies to win bidding wars, according to Redfin.

July 29 -

The housing agency's prior permanent chief, Brian Montgomery, left the position after he was tapped to become deputy HUD secretary.

July 28 -

The enhanced jobless benefits in the coronavirus relief law enacted in March helped limit delinquencies and maintain consumer spending, analysts say. In their follow-up stimulus plan, Senate Republicans want to cut those benefits from $600 to $200 a week.

July 28 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

The company's second-quarter net income was $116 million, with mortgage banking revenue of $239 million.

July 28 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

The U.S. homeownership rate, led by young buyers, jumped to the highest since 2008, signaling that the housing boom underway before the pandemic has only accelerated.

July 28 -

Rocket Cos., the parent of the mortgage giant founded by billionaire Dan Gilbert, is seeking to raise as much as $3.3 billion in a U.S. initial public offering.

July 28 -

The number of loans going into coronavirus-related forbearance dropped for the sixth consecutive week, as the growth rate fell 6 basis points between July 13 and July 19, according to the Mortgage Bankers Association.

July 27 -

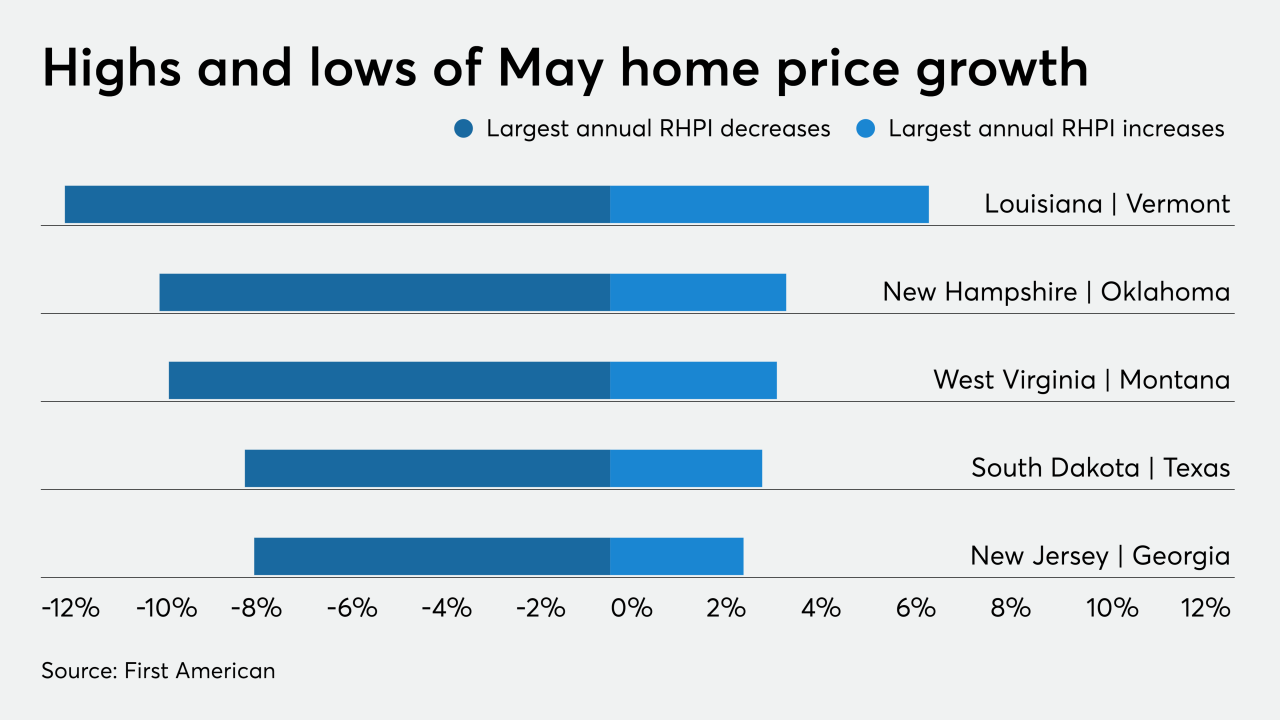

Tight inventory is expected to drive home prices higher over the summer, according to First American.

July 27 -

Optimal Blue is being combined with Compass Analytics.

July 27 -

Whalen: "It is tempting to think that low interest rates will cure all ills in the housing sector, but this view is seriously in error, as we learned in 2008."

July 27 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

After steep year-over-year declines in home sales in April and May, Tampa Bay's housing market showed signs of a strong rebound in June from pandemic-induced sluggishness, according to new figures released by Florida Realtors.

July 27 -

Citing possible exploitation, Bank of America instituted a policy that put limits on loans to persons in guardianship. It later ended the policy.

July 24 -

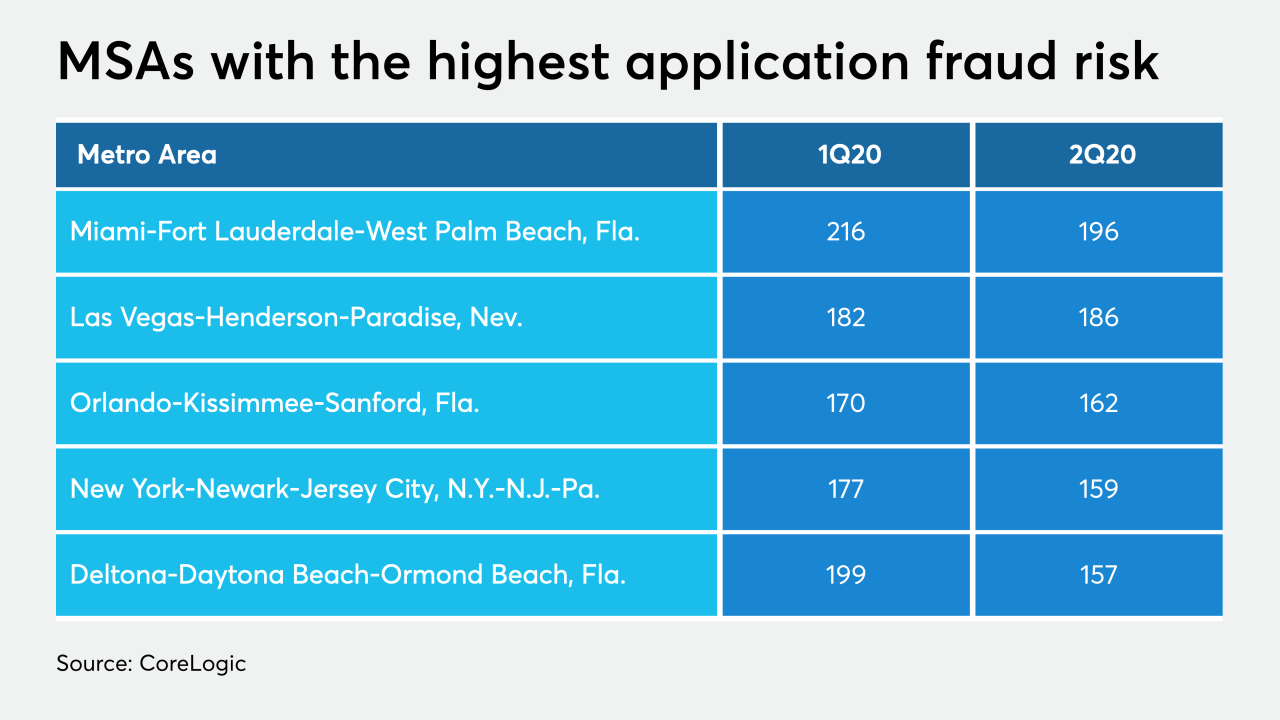

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24 -

The Trump administration's executive order to terminate and replace federal enforcement of anti-discrimination policies at the local level, citing the burden it put on municipalities, enraged advocates of equitable housing practices.

July 23 -

JPMorgan Chase Asset and Wealth Management Private Bank is pooling over 400 seasoned mortgage loans from its high-net worth clients. The loans are considered low-risk, but were not tested against CFPB qualified-mortgage standards.

July 23