-

Homebuilder outlook improved in July and is back at pre-pandemic levels as the housing market continued to lure buyers looking for more space and attracted by record-low interest rates.

July 16 -

The Detroit lender disclosed that the consumer bureau had sent a civil investigative demand to Rocket Homes Real Estate for potential violations of the Real Estate Settlement Procedures Act.

July 16 -

Remarks that the head of the mortgage broker association made about a Quicken Loan executive's wife in a video text exchange led to a defamation lawsuit, and housing-finance companies are taking sides.

July 16 -

Managing a major lender in the midst of COVID fears and social unrest has required a rethink of banking norms. Exploring the executive decisions all leaders must consider is the recipient of American Banker's Banker of the Year award.

-

Mortgage rates slid further this week, as the conforming 30-year fixed loan fell below the 3% mark for the first time in the 50 years Freddie Mac has tracked this information.

July 16 -

The consumer agency alleges Townstone Financial's CEO and president made statements on a radio show discouraging applicants living in Black neighborhoods from seeking home loans.

July 15 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

July 15 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

Any intention that Ginnie Mae may have had to slow prepayment rates by changing the rules on RPLs seems to be thwarted by the grim economic reality facing the big banks.

July 15 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Strong growth in refinance volume following several weeks of so-so activity drove a 5.1% week-to-week increase in mortgage applications, according to the Mortgage Bankers Association.

July 15 -

A top Federal Reserve official is issuing a warning about fast-growing and largely unregulated shadow lenders: They were a big factor in why central banks had to save markets earlier this year, and much more needs to be done to assess the risks posed by the sector.

July 15 -

The City of Frisco has experienced a major population boom in the past few decades and has earned the title of fastest-growing city several times by the U.S. Census Bureau.

July 15 -

A recent ruling declaring the Consumer Financial Protection Bureau’s structure unconstitutional signaled that a similar outcome awaits the Federal Housing Finance Agency. But the FHFA will argue in a new case that it does not deserve the same fate.

July 14 -

The rise in late and suspended payments following the coronavirus outbreak in the United States may have helped the FHA realize it's high time to improve the process.

July 14 -

The council created by the Dodd-Frank Act to identify systemic risks launched a review of the market as part of an activities-based approach that shifts focus away from targeting individual firms.

July 14 -

Mortgage applications to purchase new homes were up 54% compared to the same month the year before.

July 14 -

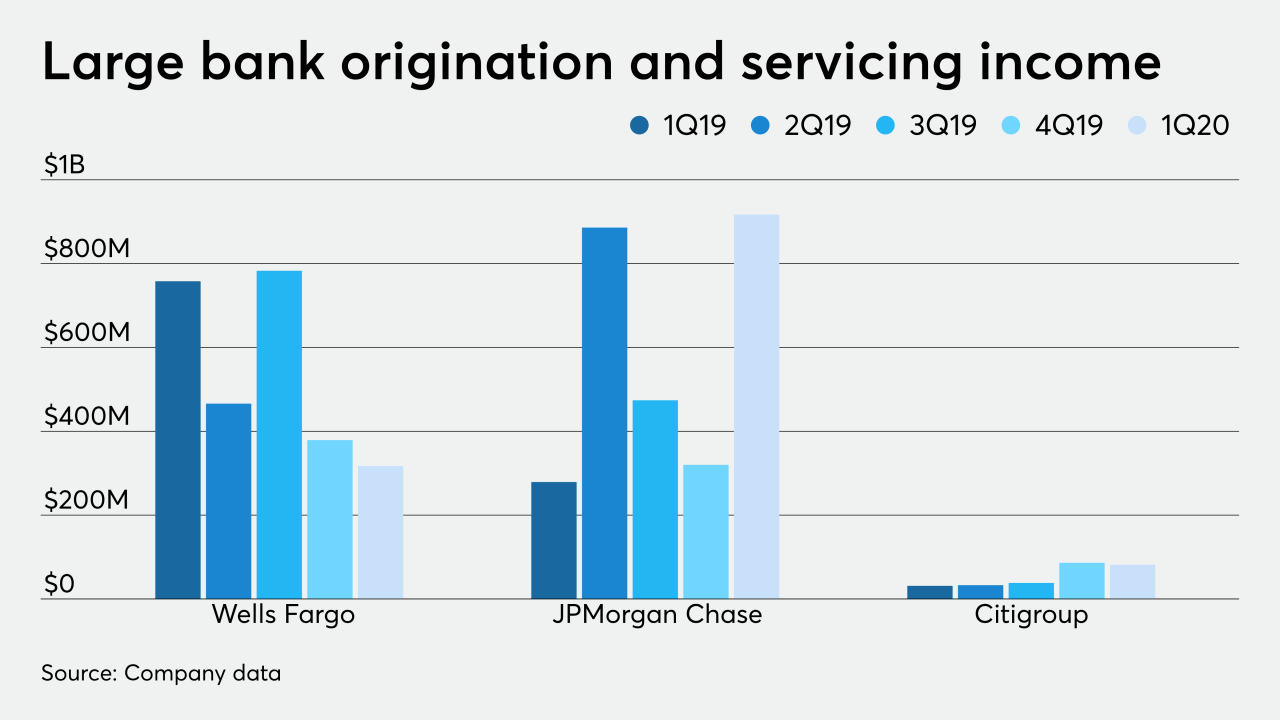

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

The share of Dallas-Fort Worth area homeowners who are behind on their mortgage payments is spiking with the pandemic.

July 14 -

A man who started a mortgage brokers group issued a statement indicating he regretted saying "lewd" personal things about a Quicken Loans executive’s spouse while sparring over a professional matter.

July 13