-

A top Federal Reserve official is issuing a warning about fast-growing and largely unregulated shadow lenders: They were a big factor in why central banks had to save markets earlier this year, and much more needs to be done to assess the risks posed by the sector.

July 15 -

The City of Frisco has experienced a major population boom in the past few decades and has earned the title of fastest-growing city several times by the U.S. Census Bureau.

July 15 -

A recent ruling declaring the Consumer Financial Protection Bureau’s structure unconstitutional signaled that a similar outcome awaits the Federal Housing Finance Agency. But the FHFA will argue in a new case that it does not deserve the same fate.

July 14 -

The rise in late and suspended payments following the coronavirus outbreak in the United States may have helped the FHA realize it's high time to improve the process.

July 14 -

The council created by the Dodd-Frank Act to identify systemic risks launched a review of the market as part of an activities-based approach that shifts focus away from targeting individual firms.

July 14 -

Mortgage applications to purchase new homes were up 54% compared to the same month the year before.

July 14 -

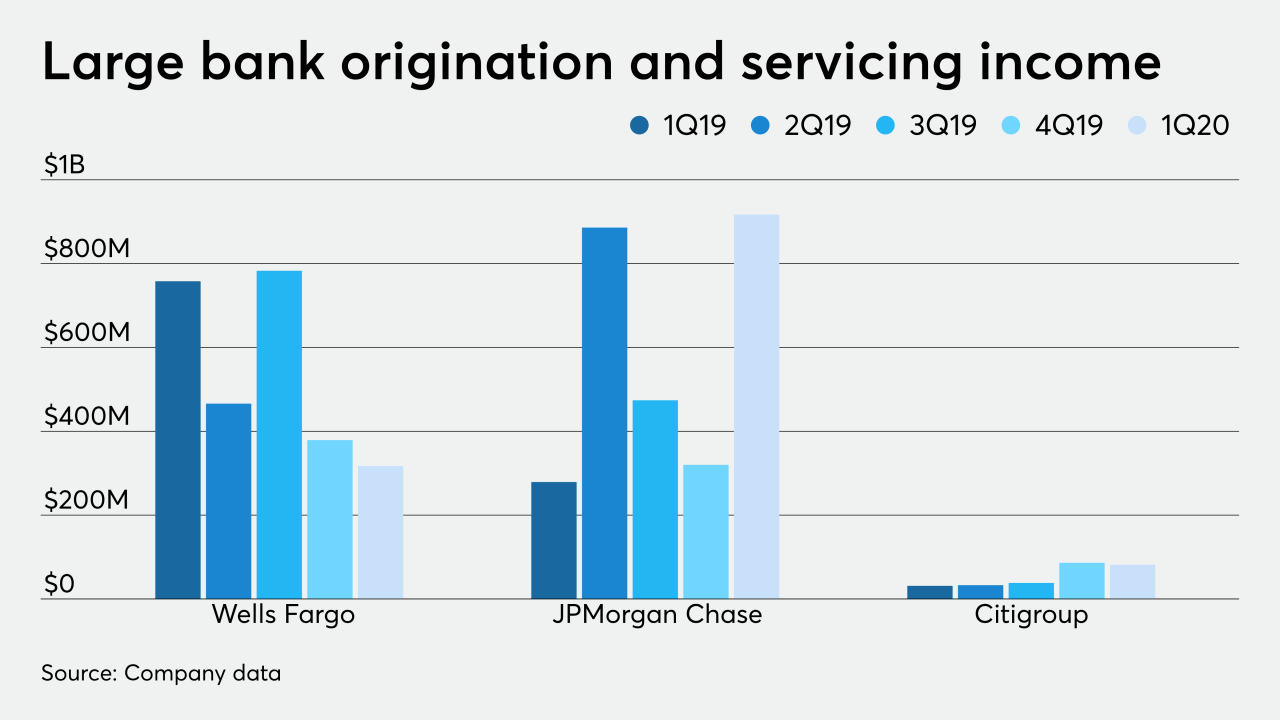

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

The share of Dallas-Fort Worth area homeowners who are behind on their mortgage payments is spiking with the pandemic.

July 14 -

A man who started a mortgage brokers group issued a statement indicating he regretted saying "lewd" personal things about a Quicken Loans executive’s spouse while sparring over a professional matter.

July 13 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

The amount far surpassed that of any other servicer required to purchase Ginnie Mae-backed loans that were 90 days past due.

July 13 -

B. Riley FBR raised its ratings for both Fannie Mae and Freddie Mac to sell from neutral on the possibility the net worth sweep is declared illegal.

July 13 -

The existing framework should not be revised until a consensus has been achieved among stakeholders, including civil rights experts, according to Quicken.

July 13 -

Policymakers have eased some rules and the Supreme Court recently dealt a blow to the Consumer Financial Protection Bureau. But as the landmark legislation approaches its 10th anniversary, the post-crisis regulatory regime has stayed largely intact.

July 13 -

However, those who aren't current bank customers need to have $1 million in a qualifying account.

July 10 -

A more than $5 billion offering going up for bid is one of the first large transactions seen since the coronavirus complicated trading.

July 10 -

A significant number of plans that expired at the end of June were not renewed, Black Knight said.

July 10 -

Congress should act in the next relief bill to provide the additional resources needed to build more affordable housing.

July 10 National Community Renaissance

National Community Renaissance -

A subprime-related settlement between the government and Deutsche Bank provided meaningful benefits to some U.S. consumers in need, according to a new report. But the author acknowledged that those gains could prove illusory for some consumers given the coronavirus crisis.

July 10