-

As the nation struggles with the coronavirus, now is not the time to make major revisions to the Community Reinvestment Act.

April 20 NeighborWorks America

NeighborWorks America -

Bay Area home prices rose substantially in March despite a drop in sales compared with last March, but those numbers reflect deals entered into before most counties imposed shelter-in-place orders.

April 19 -

As federal stimulus checks land in bank accounts in coming days, a sobering reality may hit many Bay Area residents — the money will cover less of their housing costs than anywhere else in the country.

April 16 -

The nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

April 16 -

The National Credit Union Administration is giving lenders and borrowers extra time to complete appraisals to ensure mortgages are still being completed despite the pandemic.

April 16 -

Mortgage rates slipped this week as the coronavirus keeps affecting the overall U.S. economy, according to Freddie Mac.

April 16 -

New-home construction declined in March from the previous month by the most since 1984 as the pandemic started to take a bigger toll on the housing market and broader economy.

April 16 -

From the crossroads of America down to the bayou, here's a look at 12 housing markets where it's the most financially prudent to buy a home rather than rent, according to First American.

April 16 -

The agency is still moving forward on key regulations dealing with payday lending and mortgage underwriting despite new demands posed by the crisis.

April 15 -

In the Philadelphia metropolitan area, new listings are down almost 43% from March 1 to April 5, when the number of new listings typically grows by roughly 52%, according to Zillow.

April 15 -

Homebuilder sentiment plunged in April to the lowest level in more than seven years as the coronavirus pandemic kept potential buyers quarantined and paralyzed construction in much of the country.

April 15 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

April 15 -

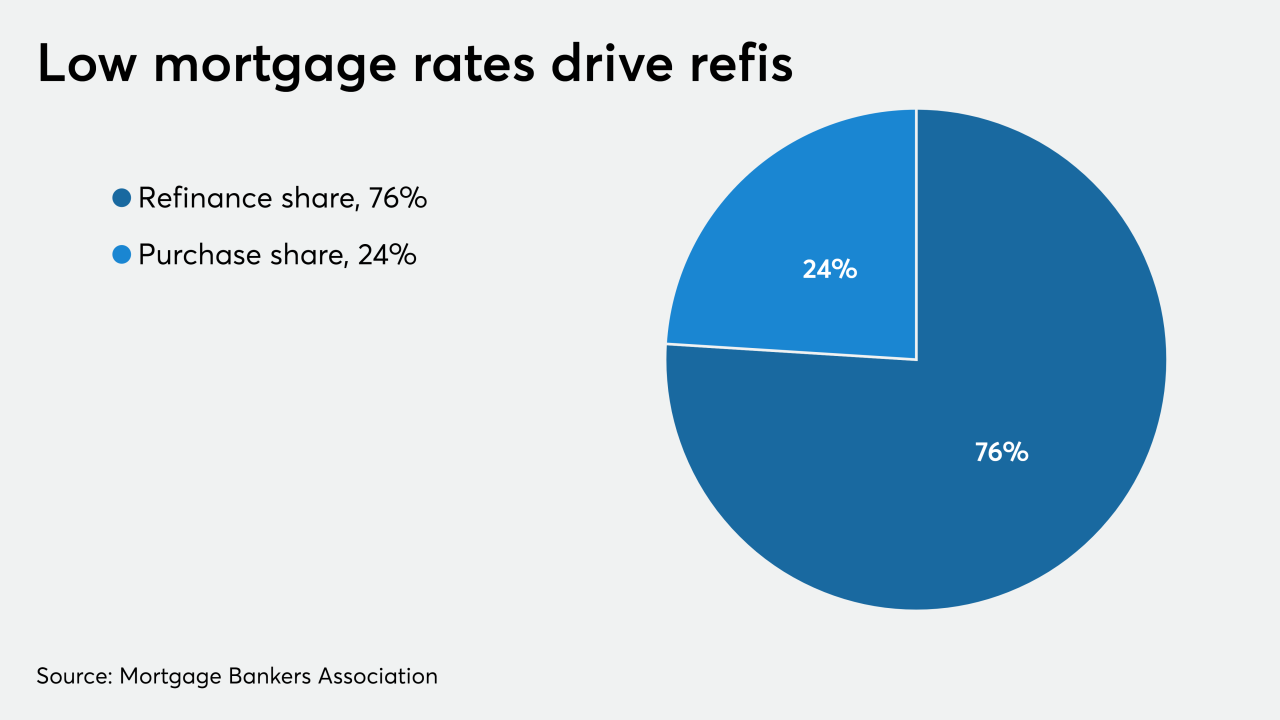

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

The nascent market for private U.S. mortgages is teetering on the brink of collapse as the coronavirus crisis imperils years of work to lessen the government's role in home lending.

April 14 -

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

Purchase originations will recover somewhat in the third and fourth quarters as home sales pick up.

April 14 -

January saw the lowest mortgage delinquency rate in over 20 years, according to CoreLogic.

April 14 -

At issue is whether the U.S. should step in now to save nonbank mortgage servicers to head off damage to the housing market.

April 13 -

Researchers predict that the rate will rise in step with unemployment rate projections.

April 13