-

Home prices in 20 U.S. cities accelerated in January from a year earlier, marking the fifth straight annual gain and corroborating other recent data that showed a flurry of housing market activity prior to the coronavirus pandemic.

March 31 -

With interest rates at historic lows and recent increases in Tucson, Ariz., home values, many jittery homeowners impacted by the coronavirus outbreak are looking to refinance to get their hands on cash.

March 31 -

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

An index of contract signings for the purchase of previously owned U.S. homes unexpectedly increased in February to a three-year high, representing solid housing activity that's likely to retrench because of the pandemic.

March 30 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

The real estate industry, struggling with coronavirus-linked limitations, got a boost with its sales business reclassified as an "essential" industry.

March 29 -

A top U.S. regulator is exploring whether to throw a lifeline to mortgage servicers stressed by the coronavirus pandemic by tapping a program meant to address natural disasters.

March 27 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

March 27 Community Home Lenders of America

Community Home Lenders of America -

Treasury Secretary Steven Mnuchin reiterated Thursday that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he's focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain.

March 27 -

Title underwriters won’t be hit as hard by the coronavirus as other insurers, but related economic changes will challenge them, Fitch Ratings said, in assigning a negative outlook to the sector.

March 26 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

The reprieve from mortgage data collection was among several changes to the agency’s supervisory and enforcement procedures to help firms responding to the COVID-19 pandemic.

March 26 -

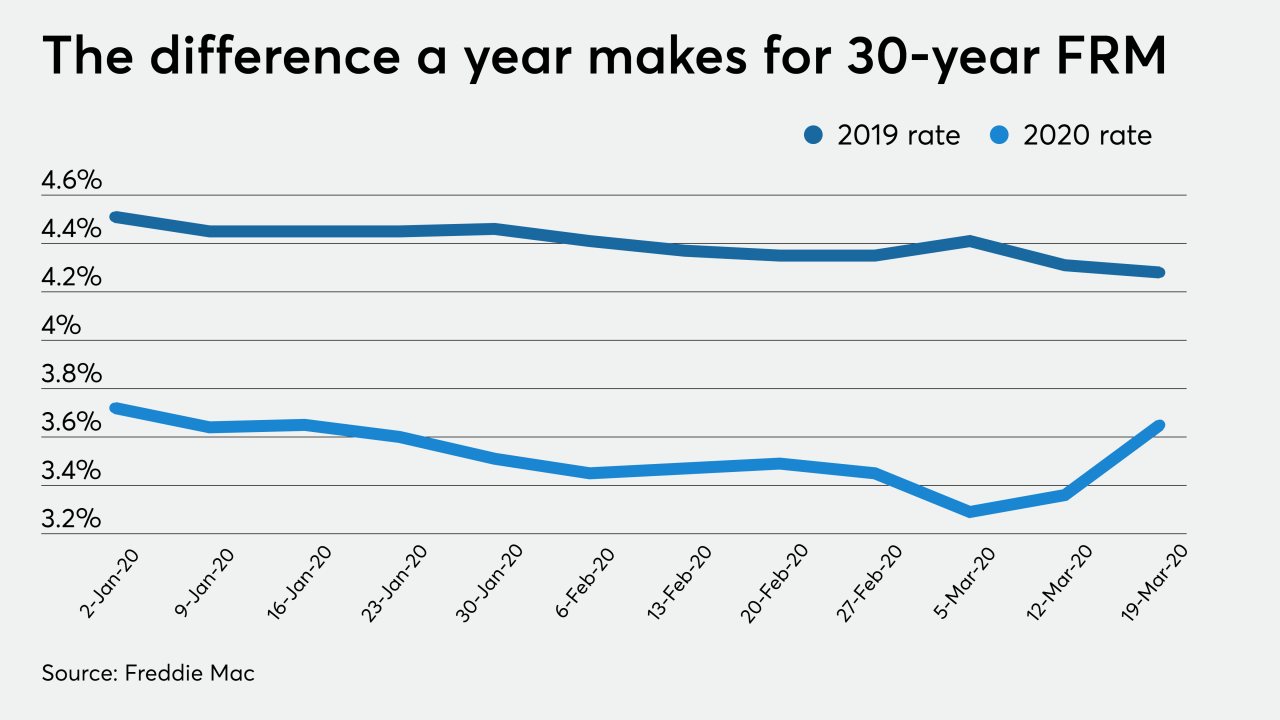

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25 -

JPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with 200 state-chartered banks and credit unions, have agreed to let borrowers skip payments for 90 days if their finances have been upended by the pandemic.

March 25 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

As real estate prices soared in recent years, working-class adults everywhere have increasingly relied on mortgages backed by the Federal Housing Administration — and U.S. taxpayers.

March 25 -

The Department of Housing and Urban Development's 60-day foreclosure halt for Federal Housing Administration borrowers is too short to help reverse mortgage borrowers, a letter from consumer groups stated.

March 25 -

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25