-

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

Risk aversion, economic momentum and the multidecade nadir of unemployment rates helped push delinquencies to the lowest year-end measure of the 21st century, according to Black Knight.

January 23 -

As the industry shuffles closer to completely digital mortgages, the next wave of technology aims to usher in total automation and uniformity.

January 16 -

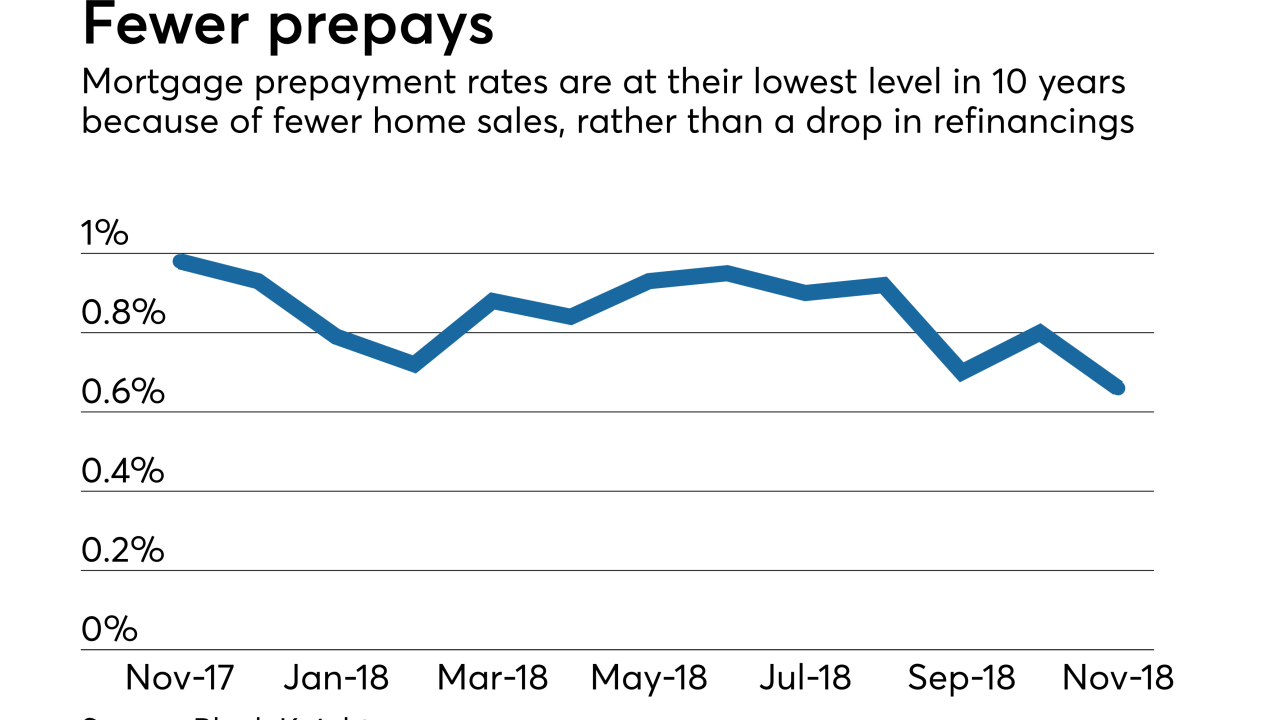

Continual declines in the refinance share of mortgage originations led to prepay rates dropping to their lowest levels since 2009, according to Black Knight.

January 9 -

These days, no wedding is complete without a hashtag combining the happy couple's names. It got us thinking: Why not give mortgage industry M&A deals the same treatment?

December 26 -

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20 -

Weakening prices from the most expensive metro areas caused the first decline in available equity since the market started recovering from the housing crisis, according to Black Knight.

December 10 -

October's loan delinquencies, especially those in serious delinquency, got much healthier after improving from the fallout of the last two hurricane seasons, according to Black Knight.

November 27 -

Lenders are constantly looking for ways they can streamline their operations and produce savings for themselves and their borrowers in order to compete in a leaner market this year.

November 12 -

Black Knight added to its mortgage loan data product offerings by acquiring Ernst Publishing, an Albany, N.Y.-based provider of recording fee, transfer tax and title premium fee information.

November 7 -

Excellent credit quality and strong performance of post-housing-crisis originations resulted in a steep decline in foreclosure starts in September, according to Black Knight.

November 5 -

Black Knight's third-quarter net earnings were slightly below the same period last year, although total revenue increased by 7% compared with one year prior.

October 30 -

After falling to its lowest level in over 12 years, servicers expected September's surge in delinquencies following the damage of Hurricane Florence, according to Black Knight.

October 24 -

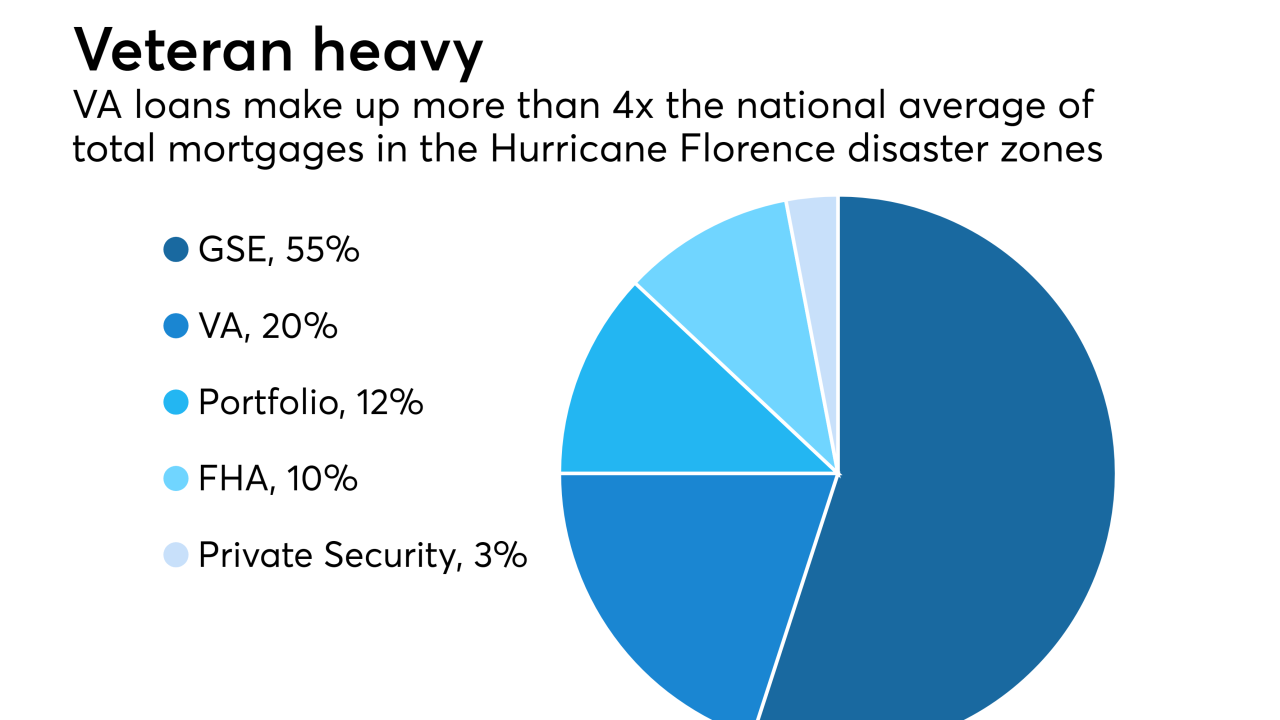

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

An artificial intelligence platform that integrates with key industry utilities and keeps critical data at lending professionals' fingertips was selected as the top fintech demo by attendees of the 2018 Digital Mortgage Conference.

September 26 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Home price appreciation slowed throughout 64% of the U.S., a boon to affordability, according to Black Knight's most recent three-month figures.

August 6 -

Black Knight reported net earnings of $40 million for the second quarter as adjusted revenue from its servicing and origination software businesses grew by 7% over the previous year.

July 31