-

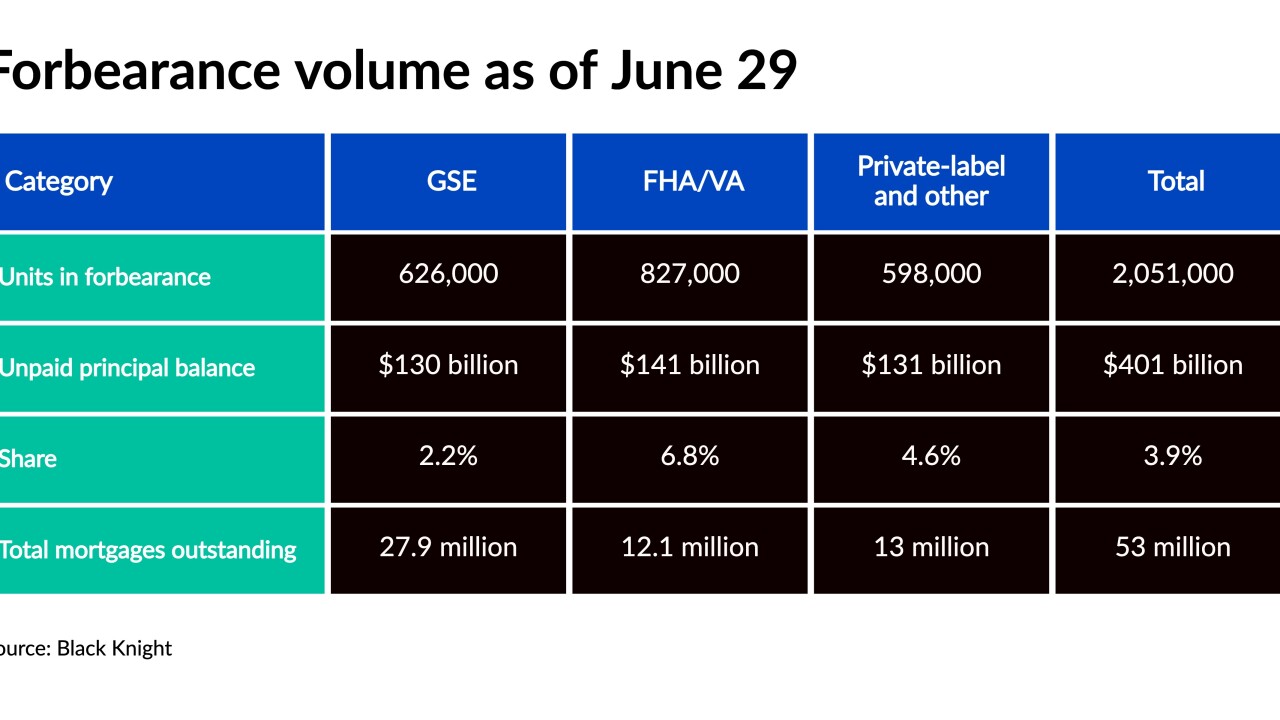

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

The sharp decline suggests borrowers are recovering enough from pandemic-related hardships to leave forbearance plans even before a key expiration date arrives this fall.

July 9 -

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2 -

The long-time title and mortgage technology industry executive wants to reduce the number of public company boards he serves on.

June 14 -

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

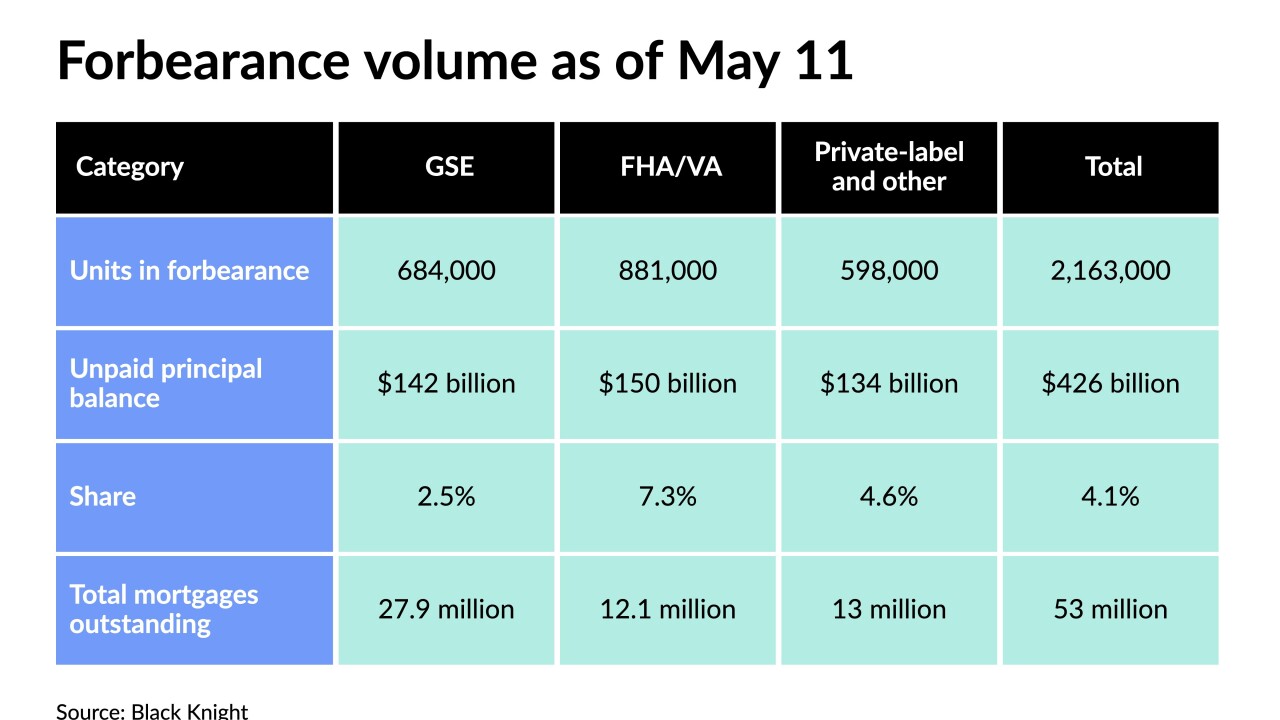

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

However, the decline in Black Knight’s numbers may stem from a previous deadline that policymakers have since extended.

April 9 -

The acquired platform, while remaining stand-alone, will have integrations with Black Knight's Empower loan origination system for mortgage lenders.

March 17 -

The cost associated with borrowing money to finance homes now appears more likely to remain stable rather than continuing to decline, which should eventually slow refinance activity.

February 11 -

Black Knight’s product is designed to assist mortgage lenders in performing due diligence while also preventing heightened risk of foreclosure losses.

January 26 -

The software will aim to take advantage of the anticipated volume growth in this particular type of origination.

January 14 -

With limited plan removals due to the holidays, mortgages in coronavirus-related forbearance rose by 15,000, according to Black Knight.

January 4 -

The data and analytics firm spent much of 2020 battling stakeholders Senator Investments and Cannae Holdings in a bitter war of words. Here’s a timeline of what went down.

December 25 -

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

Recent Black Knight numbers put the average retention rate at a record low for the post-crisis period that followed the Great Recession.

December 7