-

Ginnie Mae will help issuers with certain servicing obligations if more than 5% of their portfolios are in areas Hurricane Harvey has ravaged.

September 6 -

From payment forbearances to financing to start the rebuilding process, here's a look at five ways homeowners affected by Hurricane Harvey can get mortgage help.

August 31 -

If mortgage rates rise slowly as the economy continues to grow, the impact from the Fed’s unwind on housing likely will result in a decline in refinancing activity.

August 28 Fannie Mae

Fannie Mae -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

Fannie Mae is extending its property inspection waivers to certain purchase mortgages with large down payments.

August 24 -

The gulf between those at the upper ends of the wealth ladder and lower-income Americans has worsened markedly since the financial crisis, despite the trillions of subsidies that taxpayers provide for housing.

August 21

-

The Home Affordable Refinance Program will now expire on Dec. 31, 2018, the FHFA said.

August 17 -

Affordability issues along with a lack of knowledge about home buying are holding millennials back from pursuing homeownership, according to a survey from loanDepot.

August 16 -

Critics of recent False Claims Act enforcement argue the Justice Department is too heavy-handed toward lenders and servicers. But in an industry reputed for shoddy processes during the crisis, perhaps stringent oversight is warranted.

August 11 National Mortgage News

National Mortgage News -

For all the talk that Janet Yellen’s plan to shrink the Federal Reserve’s balance sheet will hurt Treasuries, U.S. mortgage bonds face a bigger test.

August 11 -

Picking a new benchmark for adjustable-rate mortgages is the easy part. Industrywide implementation is where things get tricky.

August 10 -

Dividend payments by Fannie Mae and Freddie Mac are due to come one day after the U.S. is estimated to hit the debt ceiling, raising the stakes in the debate over whether those payments should continue.

August 9 -

The Federal Housing Finance Agency promoted Andre Galeano to oversee its regulation and supervision of the 11 Federal Home Loan banks.

August 9 -

Low-down-payment purchases are on the rise, but not necessarily with the same pre-crisis practices and risk factors.

August 8 -

PHH Corp. will pay the Justice Department $75 million to settle a False Claims Act investigation of its underwriting practices on government-insured mortgages and loans sold to Fannie Mae and Freddie Mac.

August 8 -

The mortgage finance giants Fannie Mae and Freddie Mac could need nearly $100 billion in bailout money in the event of a new economic crisis, according to stress test results released Monday by their regulator.

August 7 -

Credit risk transfers have emerged as more than just a method for mitigating taxpayer exposure. They could be a key component of comprehensive housing finance reform.

August 7 Moody's Analytics

Moody's Analytics -

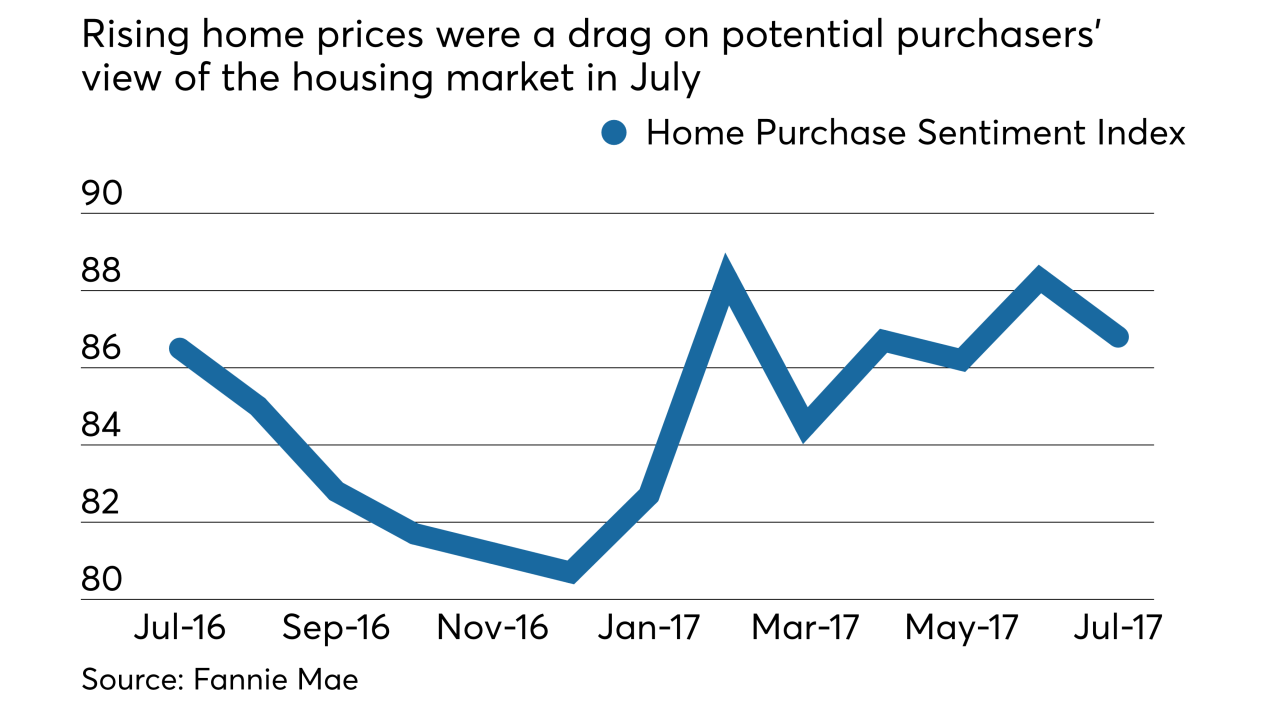

The percentage of people who said July was a bad time to buy a home increased to a survey high because of rising prices, according to Fannie Mae.

August 7 -

The nonbank mortgage sector had its largest one-month employment gain in a year, as independent mortgage bankers and brokers enjoyed stronger-than-expected originations during the second quarter.

August 4 -

The government-sponsored enterprise is still looking for the right balance between offering a product that's attractive to investors and a cost-effective way to reduce risk.

August 3