-

Consumer perception of the housing market ticked up slightly in December, as potential buyers remain bullish about making a home purchase in 2020, a Fannie Mae report said.

January 7 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 3 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

Polls showing an upswing for President Trump's re-election chances against top potential Democratic candidates favor housing finance and mortgage giants Fannie Mae and Freddie Mac, according to Height Capital Markets.

January 2 -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies' regulator executes plans for their release into the private sector.

December 27 -

The deadline for China Oceanwide to complete its acquisition of Genworth Financial was extended for a 13th time, following completion of the sale of Genworth MI Canada to Brookfield Business Partners.

December 23 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

A dozen of the nation's largest underwriters were accused of colluding with traders to artificially set prices on the secondary market for Fannie Mae and Freddie Mac securities.

December 17 -

The Federal Housing Finance Agency has proposed a plan that would exempt the Federal Home Loan Banks from conducting stress tests.

December 16 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

With more consumers believing it’s a great time to buy a home, the Home Purchase Sentiment Index had its best November since the index's release in 2011, according to Fannie Mae.

December 9 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

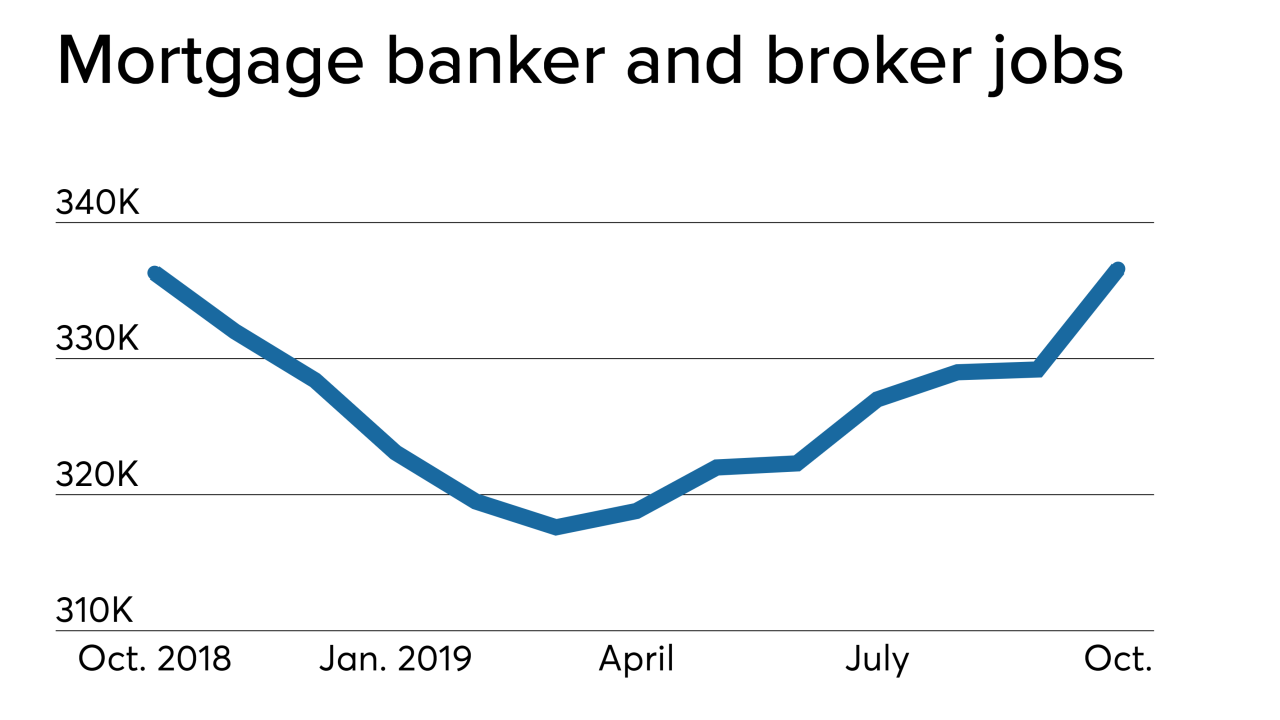

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

For the private-label mortgage-backed securities market to grow, regulators need to focus on collateral management in addition to changes to data disclosure rules.

November 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

The deal, issued through the California Housing Finance Agency, is the first multifamily tax-exempt deal to qualify for the GSE's Green Rewards program.

November 21 -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19