-

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

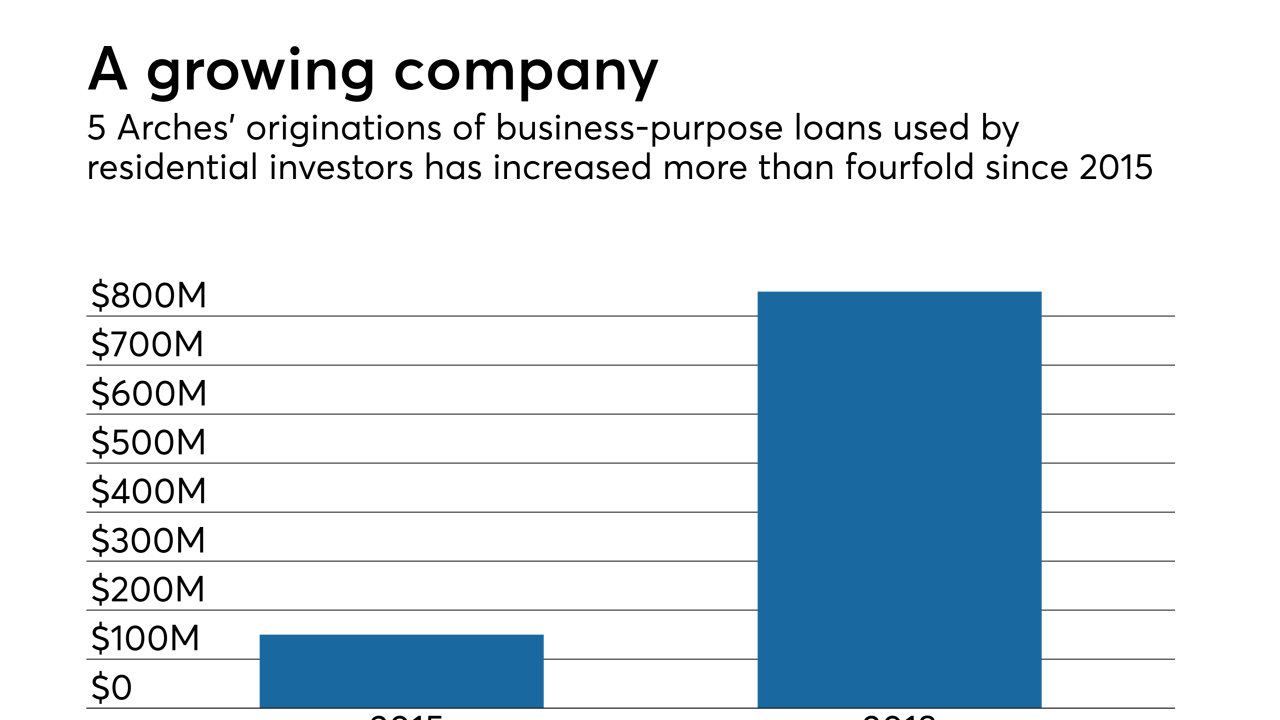

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

A federal appeals court ruling that found the leadership structure of the FHFA unconstitutional will face an "en banc" review later this month.

January 16 -

Residential lender and Warburg Pincus portfolio company Newfi Lending is helping tackle upfront costs for homebuyers with the launch of its 2-1 Buydown Program.

January 10 -

Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

January 9 -

The White House has officially nominated Mark Calabria as the next director of the Federal Housing Finance Agency.

January 8 -

Rising home prices along with a changing perception of the U.S. economy reduced consumer confidence in the housing market to the lowest point of 2018, according to Fannie Mae.

January 7 -

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

Fannie Mae's overall single-family serious delinquency rate dropped another notch in November, according to its most recent report, but the current government shutdown raises questions about whether that trend will continue.

December 31 -

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

After 10 years of conservatorship, the new year could finally usher in big steps toward housing finance reform.

December 27 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Home retention actions from Fannie Mae and Freddie Mac through the first three quarters of 2018 already eclipsed 2016 and 2017 while forfeitures kept declining, according to the Federal Housing Finance Agency.

December 21