-

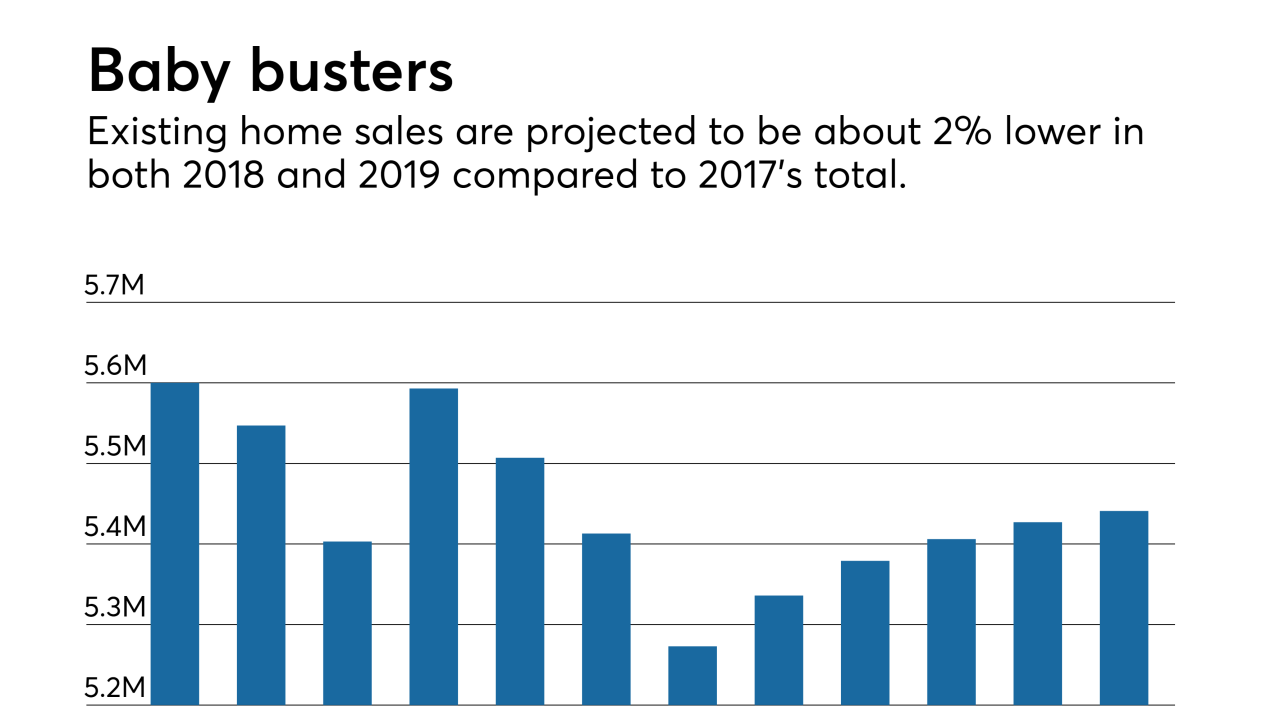

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

New financing options and better inventory have bolstered the manufactured housing sector. Is this the answer to lenders' purchase-market woes?

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

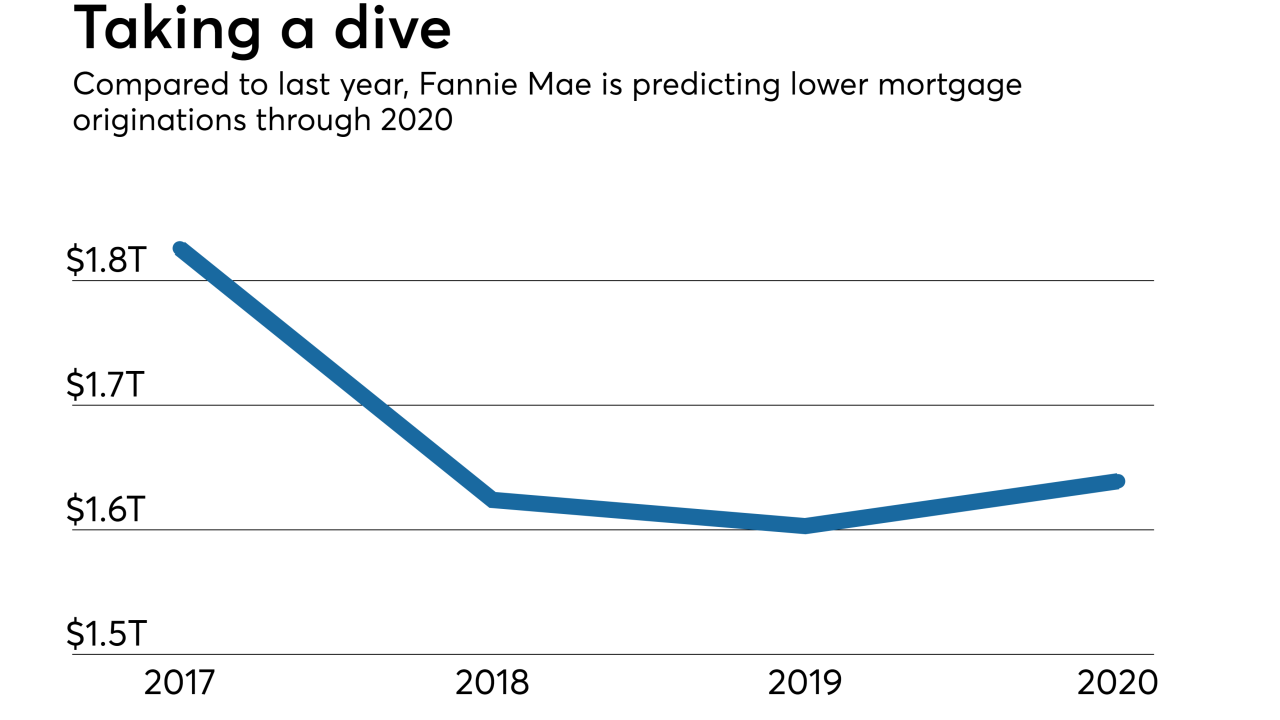

Fannie Mae's economic growth forecast for 2018 inched up slightly, but a strong labor market won't mean the same positive results for housing.

November 20 -

The Trump administration should consider putting much of the subsidized mortgage lending done by the federal government under the government-sponsored enterprises to improve efficiency and transparency.

November 19Walker & Dunlop -

The end of one-party rule in Washington could move the needle on efforts to devise a new housing finance framework.

November 18 -

A U.S. regulator's plan to boost capital in the mortgage-finance giants won't work unless investors get "compensated" for the billions of dollars the government has collected from the companies in recent years, one shareholder said.

November 16 -

Fannie Mae completed 10 traditional and front-end credit risk insurance transactions during 2018, sharing $2.6 billion of risk, including $192 million in its final deal of the year.

November 15 -

The 48,390 homes dubbed at extreme or high risk from the California wildfires burning through the state could cost $18 billion in reconstruction, according to a CoreLogic analysis.

November 14 -

Consumers blame speculative home flippers and wealthy out-of-towners for soaring home prices, but the blame may be misplaced, given many economists' views about the broader factors at play.

November 13 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8 -

The prospect of growing mortgage rates took a negative hit on consumer perception of home buying and selling during October, according to Fannie Mae.

November 7 -

The Federal Housing Finance Agency is leaving the government-sponsored enterprises' multifamily caps for 2019 unchanged at $35 billion per agency, but is making other changes to prerequisites for excluded loans.

November 6 -

Returns on mortgage-backed securities in October lagged Treasuries by 37 basis points, the most since November 2016.

November 5 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2 -

Laurel Davis, VP, credit risk transfer at Fannie Mae, explains why the switch to a REMIC structure for CAS is important, and why it took so long.

November 2 -

Walker & Dunlop acquired commercial mortgage banker iCap Realty Advisors as part of its strategic plan to increase its annual originations by at least one-third in the next two years.

November 2