-

The 48,390 homes dubbed at extreme or high risk from the California wildfires burning through the state could cost $18 billion in reconstruction, according to a CoreLogic analysis.

November 14 -

Consumers blame speculative home flippers and wealthy out-of-towners for soaring home prices, but the blame may be misplaced, given many economists' views about the broader factors at play.

November 13 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8 -

The prospect of growing mortgage rates took a negative hit on consumer perception of home buying and selling during October, according to Fannie Mae.

November 7 -

The Federal Housing Finance Agency is leaving the government-sponsored enterprises' multifamily caps for 2019 unchanged at $35 billion per agency, but is making other changes to prerequisites for excluded loans.

November 6 -

Returns on mortgage-backed securities in October lagged Treasuries by 37 basis points, the most since November 2016.

November 5 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2 -

Laurel Davis, VP, credit risk transfer at Fannie Mae, explains why the switch to a REMIC structure for CAS is important, and why it took so long.

November 2 -

Walker & Dunlop acquired commercial mortgage banker iCap Realty Advisors as part of its strategic plan to increase its annual originations by at least one-third in the next two years.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

The structure reduces counterparty risk in the GSE's benchmark Connecticut Avenue Securities program; it also expands the investor base.

October 30 -

Fannie Mae has priced more securities that support a transition away from the London interbank offered rate.

October 26 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

Incenter Mortgage Advisors is facilitating the sale of $3.7 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans, roughly one-third of which have private mortgage insurance.

October 19 -

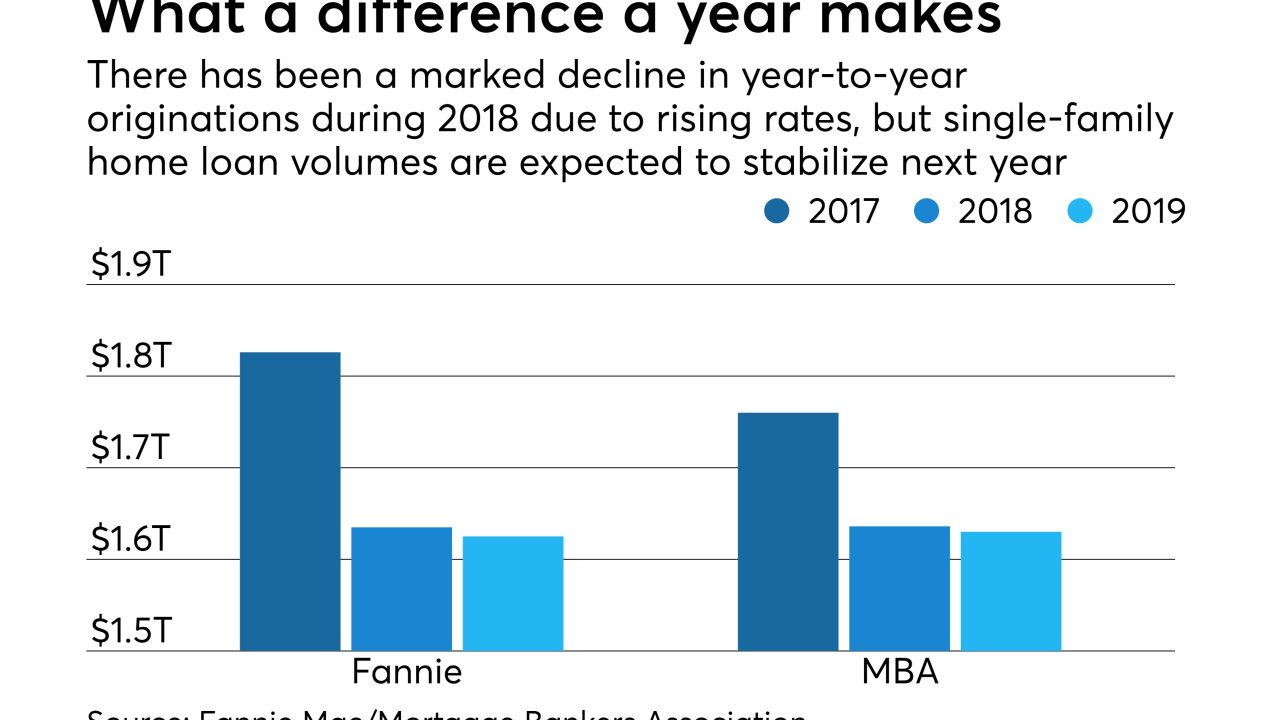

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

The departing CEOs of Fannie Mae and Freddie Mac oversaw significant cultural and operational shifts that made the housing finance system safer and more responsive to market needs, but a tough job lies ahead for their successors.

October 16 -

The Federal Housing Finance Agency, Fannie Mae and Freddie Mac have launched an online clearinghouse with resources to assist lenders in serving borrowers with limited English proficiency.

October 15 -

Industry downsizing resulted in an increase in critical defects found in closed mortgages as loan packaging errors continued to rise during the first quarter, according to Aces Risk Management.

October 15 -

The REIT is purchasing another $500 million of credit risk transfer notes through Fannie's L Street Securities program; this is its first deal rated by Fitch.

October 15