-

Fannie Mae is extending its property inspection waivers to certain purchase mortgages with large down payments.

August 24 -

The gulf between those at the upper ends of the wealth ladder and lower-income Americans has worsened markedly since the financial crisis, despite the trillions of subsidies that taxpayers provide for housing.

August 21

-

Freddie Mac has gotten the green light for its appraisal alternative for purchase loans, and has released information about how similar automated collateral evaluations for refinances have performed.

August 18 -

The Home Affordable Refinance Program will now expire on Dec. 31, 2018, the FHFA said.

August 17 -

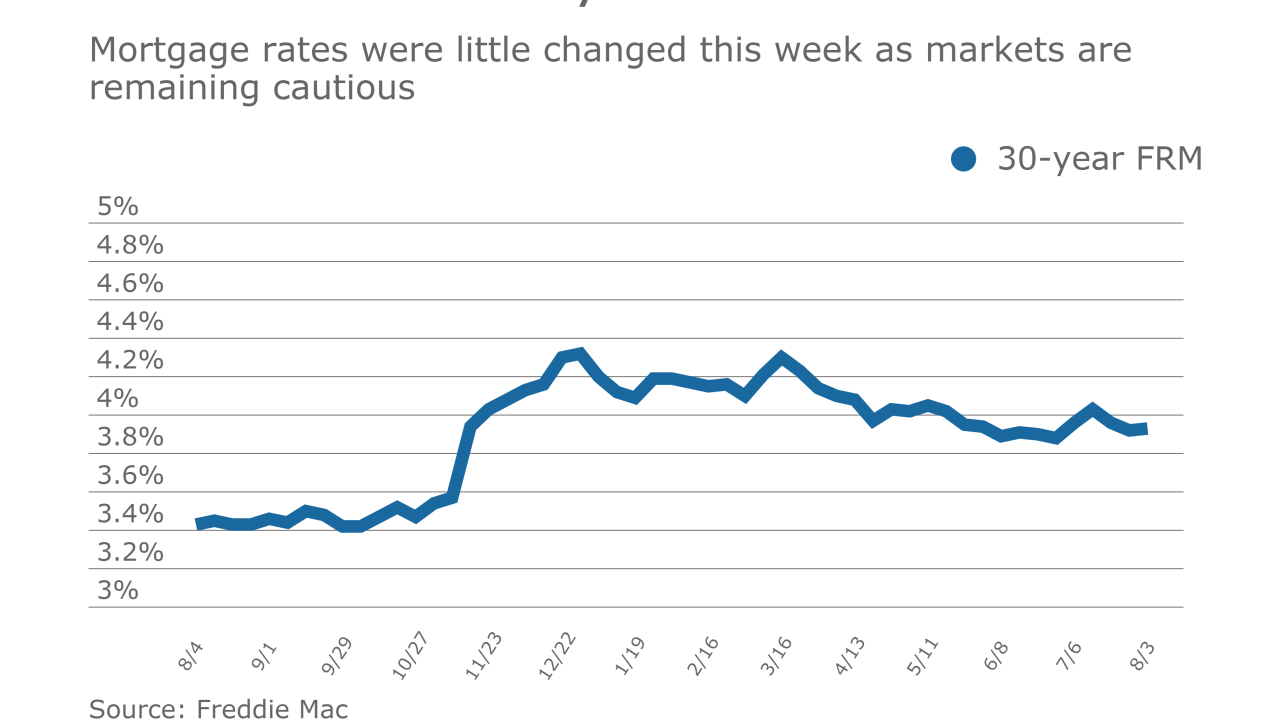

Mortgage rates continued to move lower as a result of economic uncertainty, according to Freddie Mac.

August 17 -

Affordability issues along with a lack of knowledge about home buying are holding millennials back from pursuing homeownership, according to a survey from loanDepot.

August 16 -

Critics of recent False Claims Act enforcement argue the Justice Department is too heavy-handed toward lenders and servicers. But in an industry reputed for shoddy processes during the crisis, perhaps stringent oversight is warranted.

August 11 National Mortgage News

National Mortgage News -

For all the talk that Janet Yellen’s plan to shrink the Federal Reserve’s balance sheet will hurt Treasuries, U.S. mortgage bonds face a bigger test.

August 11 -

Picking a new benchmark for adjustable-rate mortgages is the easy part. Industrywide implementation is where things get tricky.

August 10 -

Mortgage rates dropped to their lowest point in six weeks as bond investors were concerned about inflation and the U.S. economy, according to Freddie Mac.

August 10 -

Dividend payments by Fannie Mae and Freddie Mac are due to come one day after the U.S. is estimated to hit the debt ceiling, raising the stakes in the debate over whether those payments should continue.

August 9 -

The Federal Housing Finance Agency promoted Andre Galeano to oversee its regulation and supervision of the 11 Federal Home Loan banks.

August 9 -

Low-down-payment purchases are on the rise, but not necessarily with the same pre-crisis practices and risk factors.

August 8 -

PHH Corp. will pay the Justice Department $75 million to settle a False Claims Act investigation of its underwriting practices on government-insured mortgages and loans sold to Fannie Mae and Freddie Mac.

August 8 -

The mortgage finance giants Fannie Mae and Freddie Mac could need nearly $100 billion in bailout money in the event of a new economic crisis, according to stress test results released Monday by their regulator.

August 7 -

Credit risk transfers have emerged as more than just a method for mitigating taxpayer exposure. They could be a key component of comprehensive housing finance reform.

August 7 Moody's Analytics

Moody's Analytics -

The government-sponsored enterprise is still looking for the right balance between offering a product that's attractive to investors and a cost-effective way to reduce risk.

August 3 -

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

A bipartisan duo of lawmakers is set Tuesday to introduce a bill designed to increase homeownership opportunities for “credit invisible” consumers.

August 1 -

Freddie Mac is on track to double the number of low down payment mortgages it will buy in 2017, while continuing to see its serious delinquency rate fall to record lows.

August 1