-

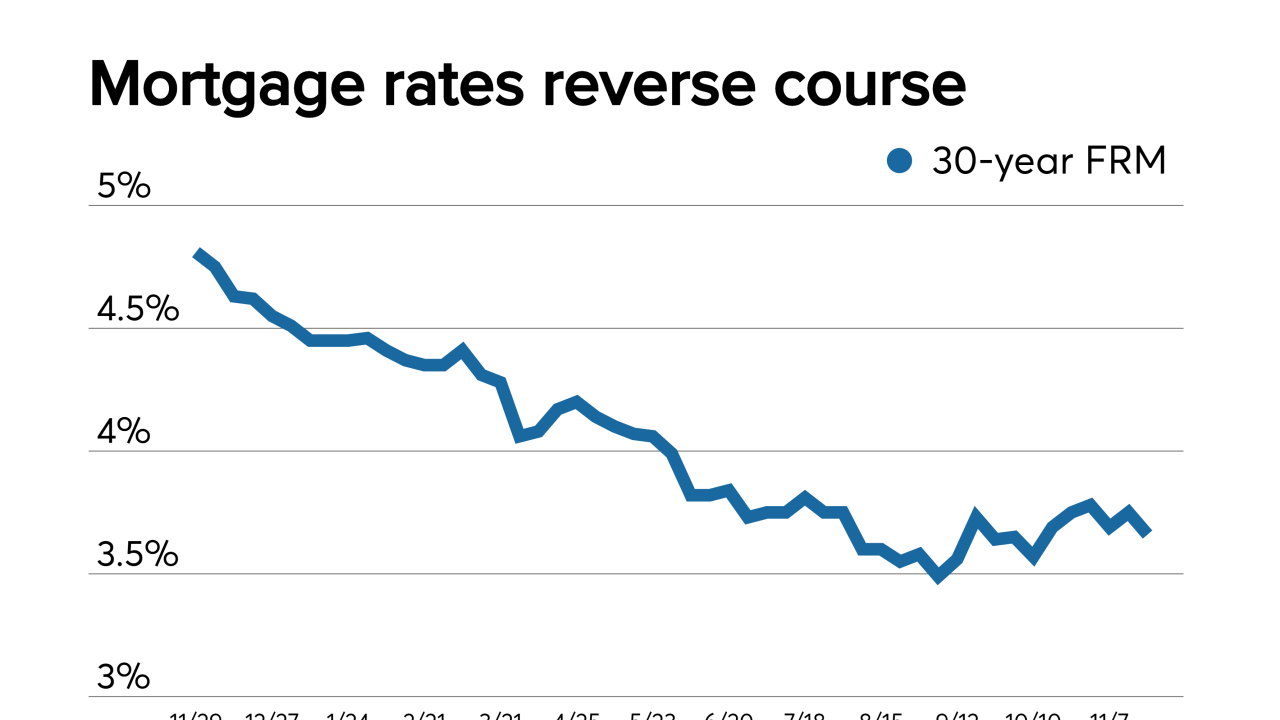

If the first weekly Freddie Mac report of the year is any indication, there could be far less volatility for fixed mortgage rates in 2020 than there was in 2019.

January 2 -

Polls showing an upswing for President Trump's re-election chances against top potential Democratic candidates favor housing finance and mortgage giants Fannie Mae and Freddie Mac, according to Height Capital Markets.

January 2 -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies' regulator executes plans for their release into the private sector.

December 27 -

Mortgage rates ended the week little changed from the previous seven-day period and near historic lows for the year, according to Freddie Mac.

December 26 -

Freddie Mac reduced its origination forecast for 2020 to under $2 trillion, now projecting $184 billion less in refinance volume compared with its November outlook.

December 24 -

The deadline for China Oceanwide to complete its acquisition of Genworth Financial was extended for a 13th time, following completion of the sale of Genworth MI Canada to Brookfield Business Partners.

December 23 -

Mortgage rates ended the week unchanged from the previous seven-day period, according to Freddie Mac, although not without some gyrations from the results of the elections in the United Kingdom and U.S-China trade talks.

December 19 -

A dozen of the nation's largest underwriters were accused of colluding with traders to artificially set prices on the secondary market for Fannie Mae and Freddie Mac securities.

December 17 -

The Federal Housing Finance Agency has proposed a plan that would exempt the Federal Home Loan Banks from conducting stress tests.

December 16 -

Freddie Mac launched a groundbreaking multifamily structured pass-through deal that includes a class of floating rate bonds indexed to the Secured Overnight Financing Rate for the first time ever.

December 13 -

Mortgage rates rose slightly with a stronger-than-expected jobs report starting the week and the Federal Open Market Committee decision to hold the line on short-term rates ending it, according to Freddie Mac.

December 12 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

Mortgage rates remained unchanged this week, after moving back and forth during the period on economic and trade news, according to Freddie Mac.

December 5 -

The outperformance of mortgage-backed securities versus U.S. Treasuries has extended for a third straight month into November, buoyed in part by a decline in volatility.

December 2 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

Mortgage rates resumed their upward movement this week, but it's not putting a damper on real estate sales activity, noted Freddie Mac.

November 27 -

For the private-label mortgage-backed securities market to grow, regulators need to focus on collateral management in addition to changes to data disclosure rules.

November 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Mortgage rates fell this week, reversing a gradual upward trend, to reach their lowest level in six weeks, according to Freddie Mac.

November 21