-

David Lowman, executive vice president of the single-family business at Freddie Mac, has informed the company he will be stepping down from his position on or about Nov. 1.

October 8 -

Allowing the mortgage giants to retain profits resolves a short-term capital shortfall, but how much capital they would need after exiting conservatorship is still the bigger question.

October 4 -

Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

October 3 -

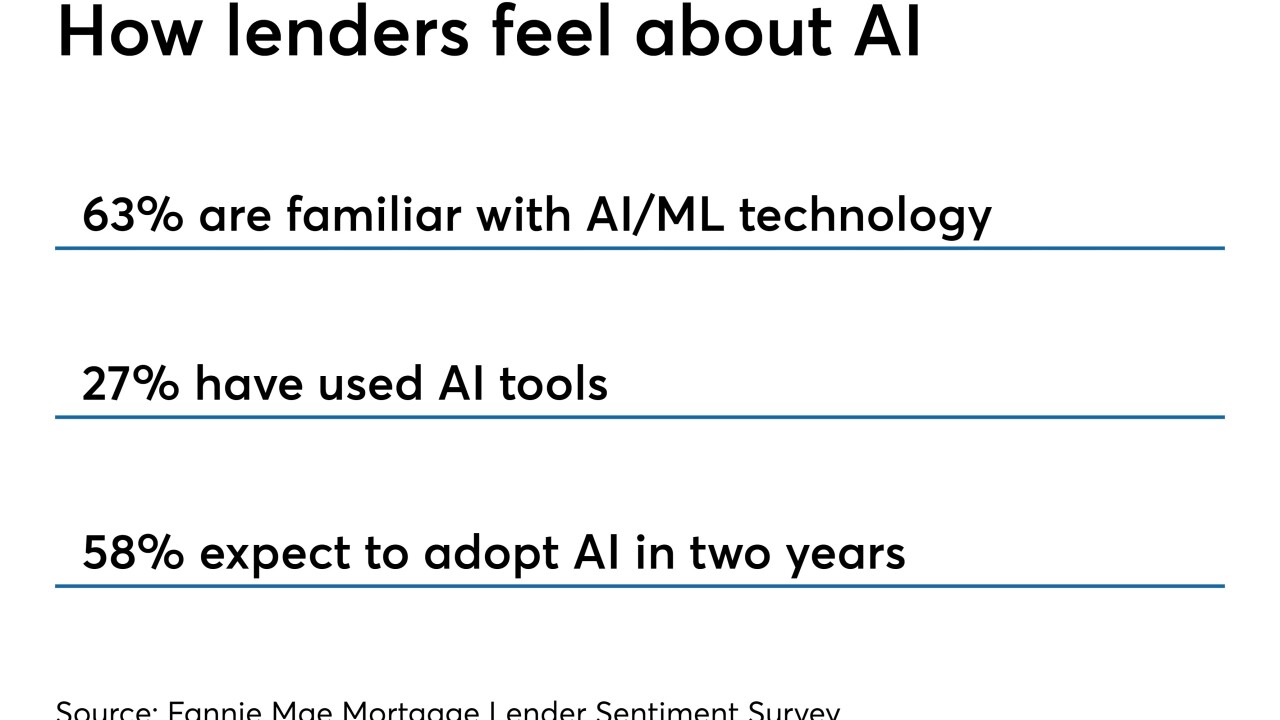

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

The Trump administration's thinking on housing is filled with conflicts and contradictions, a quilt work of at times irrational proposals that seem to be at odds with the real world of mortgage finance.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Guild Mortgage, which originated loans on some of the first manufactured homes eligible for new lower-rate Fannie Mae financing, anticipates demand for this housing type will continue to grow this year.

October 1 -

Freddie Mac is increasing the number of companies offering merged reports from the credit bureaus through integrations with its Loan Product Advisor automated underwriting system.

September 30 -

The move to alter the government's preferred stock purchase agreements is the first major one under FHFA Director Mark Calabria's tenure to wind down the conservatorship of the government-sponsored enterprises.

September 30 -

The shareholders' claims against Fannie Mae and Freddie Mac's regulator mirror arguments in cases challenging the Consumer Financial Protection Bureau.

September 26 -

Freddie Mac's efforts to improve underwriting could include the use of a technology firm's artificial intelligence-driven consumer-risk modeling software that can expand access to credit, according to the Wall Street Journal.

September 26 -

September has been the most volatile month since March when it comes to 30-year conforming mortgage rates, with average weekly movements of 11 basis points up or down, according to Freddie Mac.

September 26 -

While no one is suggesting that the plan will help banks regain the share they've ceded to nonbanks, bankers believe that stabilizing Fannie Mae and Freddie Mac could at least help them keep what they have.

September 24 -

Industry groups are calling on the consumer bureau to eliminate the debt-to-income limit for “qualified mortgages” and provide a short-term extension of special treatment for Fannie- and Freddie-backed loans.

September 24 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

The recapitalization of Fannie Mae and Freddie Mac prior to the 2020 election is unlikely even if the net worth sweep ends, according to a Keefe, Bruyette & Woods report.

September 23 -

The Federal Housing Finance Agency is ending a Freddie Mac pilot that posed a competitive threat to the private market for mortgage servicing rights financing.

September 19 -

Mortgage rates had their largest week-to-week uptick since October 2018 as bond market investors reacted to positive news about the economy, according to Freddie Mac.

September 19 -

The mortgage industry has put more emphasis on organizing data in a digital manner and presenting it in an easily digestible format.

September 18 -

Freddie Mac is partnering with Finicity to give lenders access to a new automated process that advances efforts to consolidate borrower-authorized data validation checks used in the secondary market underwriting process.

September 18 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17