-

The FHFA can go beyond a recent Trump administration report to level the playing field between the private sector and Fannie Mae and Freddie Mac.

September 17 American Enterprise Institute Housing Center

American Enterprise Institute Housing Center -

With the qualified mortgage patch expiring and a recession likely, wealth inequities that have hurt black and millennial homeownership could worsen, according to the National Association of Real Estate Brokers.

September 16 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

Whether Congress and/or the mortgage industry is able to untangle two opposing threads in the Trump administration's plans is anyone's guess.

September 12 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Deutsche Bank is cooperating with the Justice Department's antitrust investigation into whether several of the largest global banks conspired to rig trading in unsecured bonds issued by Fannie Mae and Freddie Mac.

September 12 -

An indictment unsealed in a Brooklyn federal court alleged four New Yorkers and one Floridian misled mortgage companies, the government-sponsored enterprises and a government agency regarding short-sale property prices.

September 12 -

Mortgage rates rose seven basis points compared with the prior week, but remained below 3.6% over four consecutive weeks for the first time since the fourth quarter of 2016, according to Freddie Mac.

September 12 -

The regulator for Fannie Mae and Freddie Mac suggested that a finalized capital framework for the two mortgage giants could be published by the end of the year.

September 11 -

Senate Banking Committee members feel urgency to pass a bill dealing with Fannie Mae and Freddie Mac, but the same obstacles that have stalled congressional action for years remain.

September 10 -

While many lenders lately managed their business expecting reduced volume, now they get to capitalize on extremely low mortgage rates. But today's benevolent conditions will not always be with the industry.

September 9 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The Treasury secretary said he hopes lawmakers will back reforms of Fannie Mae and Freddie Mac within three to six months.

September 9 -

Fannie Mae and Freddie Mac investors won a victory in their long battle to reap benefits from their stakes in the mortgage giants with a court ruling letting them pursue claims that the U.S. sweep of the companies’ earnings is illegal.

September 9 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

The Treasury Department made clear in a much-anticipated report that it prefers Congress take up reform of the government-sponsored enterprises, but it also recommended steps that federal agencies could take without legislation.

September 5 -

The Mortgage Industry Standards Maintenance Organization has released a dataset designed to prepare lenders for a new mortgage application and automated underwriting system upgrades at Fannie Mae and Freddie Mac.

September 5 -

Mortgage rates fell to lows not seen October 2016, affected by concerns over manufacturing and the ongoing trade war with China, according to Freddie Mac.

September 5 -

New Home Mortgage Disclosure Act data shows debt-to-income ratios have risen but also have been frequently cited among reasons for denials, suggesting lenders are becoming more cautious about this underwriting metric.

September 3 -

Damage from Hurricane Dorian's storm surge has the potential to affect 668,052 homes, according to CoreLogic's latest analysis. Reports estimate a worst-case total of $144.6 billion in reconstruction cost value.

August 30 -

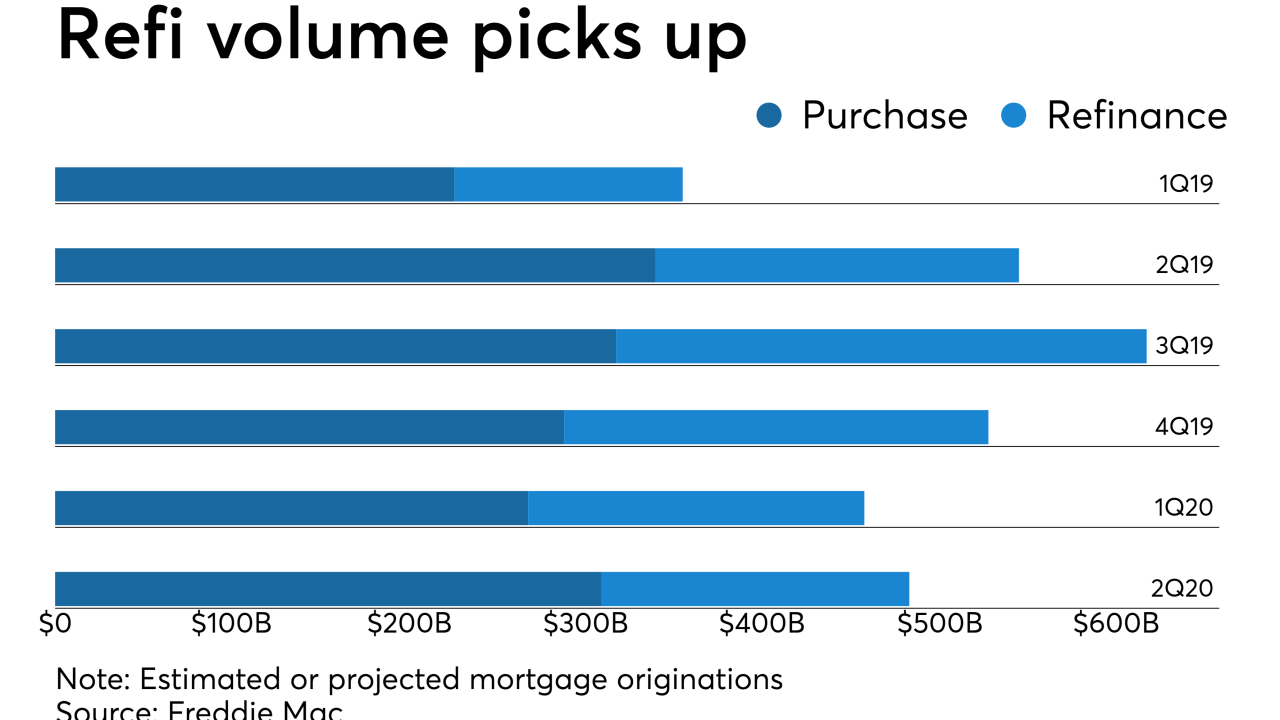

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29