-

The new regulation, codifying requirements already in practice, is meant to help the mortgage giants prepare for the adoption of a uniform security in June.

February 28 -

With few headlines to drive up or down movement in the bond markets, mortgage rates held steady after declining for three consecutive weeks, according to Freddie Mac.

February 28 -

Credit risk transfer does more than just reduce exposure to a downturn in the housing market. It also provides them with information about how others view mortgage credit risk.

February 27 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26 -

Without the ability to issue unsecured debt nearly as cheaply as U.S. Treasury bonds, Freddie Mac could not afford to repurchase defaulted loans from MBS, Freddie CEO Don Layton said.

February 26 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

The Senate Banking Committee's vote on Mark Calabria's nomination to lead the agency comes amid speculation about congressional and administrative GSE reform plans.

February 21 -

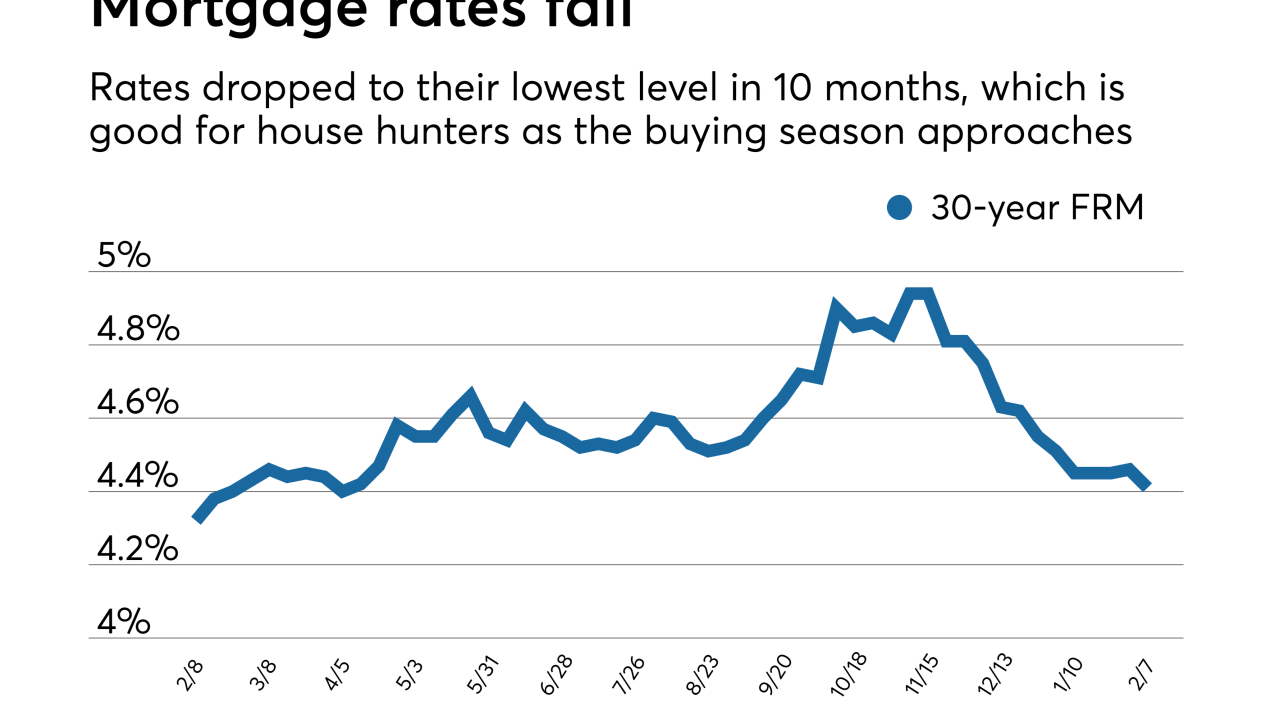

Mortgage rates declined for the third straight week, adding to a brighter outlook for the spring home buying season, according to Freddie Mac.

February 21 -

Refinance volume slipped following growth in mortgage rates, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

The administration’s choice to regulate the government-sponsored enterprises appeared to distance himself from speculation that the White House may try to overhaul housing finance without legislation.

February 14 -

Rep. Blaine Luetkemeyer, R-Mo., told the mortgage giants' chief federal regulator that the Financial Accounting Standards Board’s new model for estimating loan losses could pose risk across the mortgage market.

February 14 -

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

February 14 -

Industry observers will be closely monitoring Mark Calabria's testimony before the Senate Banking Committee on Thursday for hints about how the Trump administration plans to proceed on mortgage finance reform.

February 13 -

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

Older Americans' growing propensity to stay in one place as they age may be keeping nearly 15% more homes off the market than in the past, according to Freddie Mac.

February 6 -

Fourth-quarter increases in Fannie Mae and Freddie Mac mortgage origination volume helped Walker & Dunlop reach a new quarterly high in revenue of $215 million.

February 6 -

After the State of the Union speech Tuesday night, members of the House and Senate banking committees said they were intent on trying to address the biggest unresolved piece of financial services policy: housing finance reform.

February 6 -

Recent developments give the impression that the administration and lawmakers are in direct competition, but the ultimate framework may rely on coordination from both branches of government.

February 5 -

Absent some policy change, nearly a third of the loans backed by Fannie Mae and Freddie Mac could be in violation of the Consumer Financial Protection Bureau's Qualified Mortgage rule in two years.

February 4