-

A lack of new and existing homes for sale led to a drop in purchase and overall mortgage application volume although refinances grew.

July 25 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

When big banks bailed on brokers during the housing crisis, United Wholesale Mortgage doubled down. As third-party originations now make a comeback, the family-owned company is determined to chip away at retail lenders' dominance.

July 13 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11 -

The job market gaining steam year-over-year pushed the purchase and overall mortgage application volume upward despite refinance activity dropping to an 18-year low.

July 11 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10 -

The Consumer Financial Protection Bureau's practice of "regulation by enforcement" and use of nonbinding guidance materials makes its regulatory efforts "unfair and ineffective" to lenders and servicers, the Mortgage Bankers Association said.

July 5 -

Volatility in the financial markets, uncertainty with foreign trade and the housing supply deficit caused mortgage applications to drop for the second straight week.

July 5 -

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

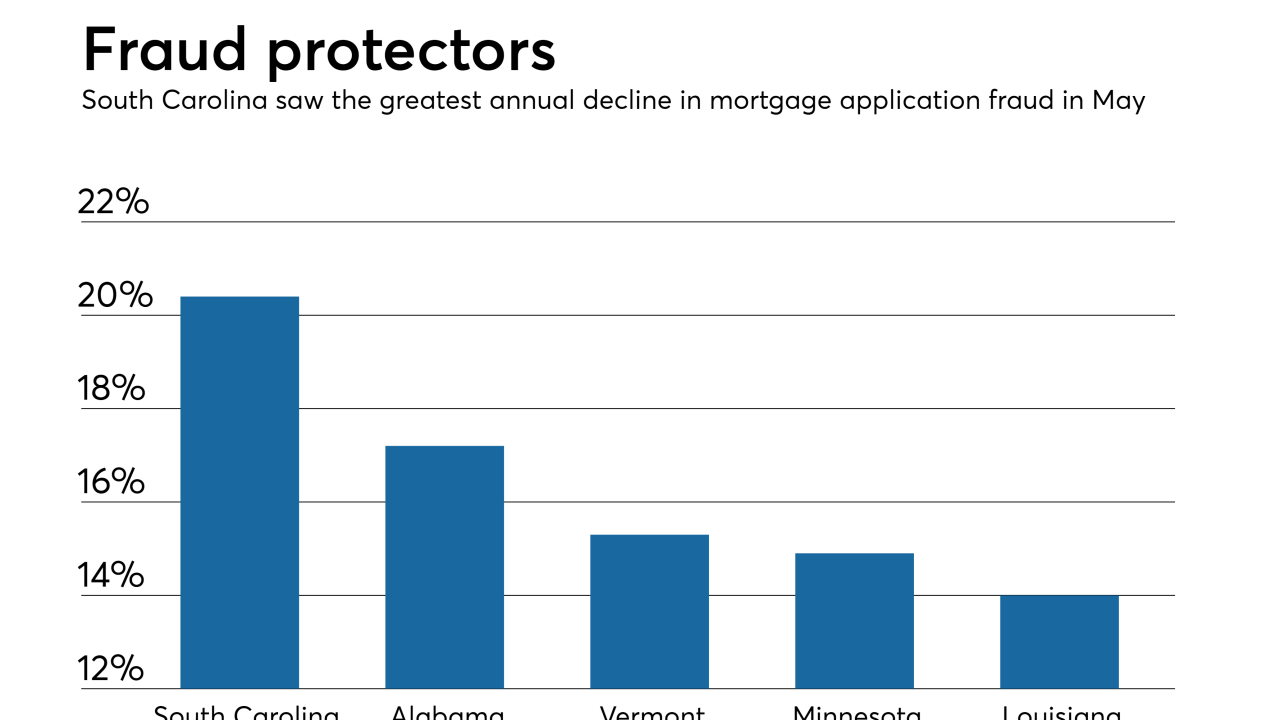

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28