-

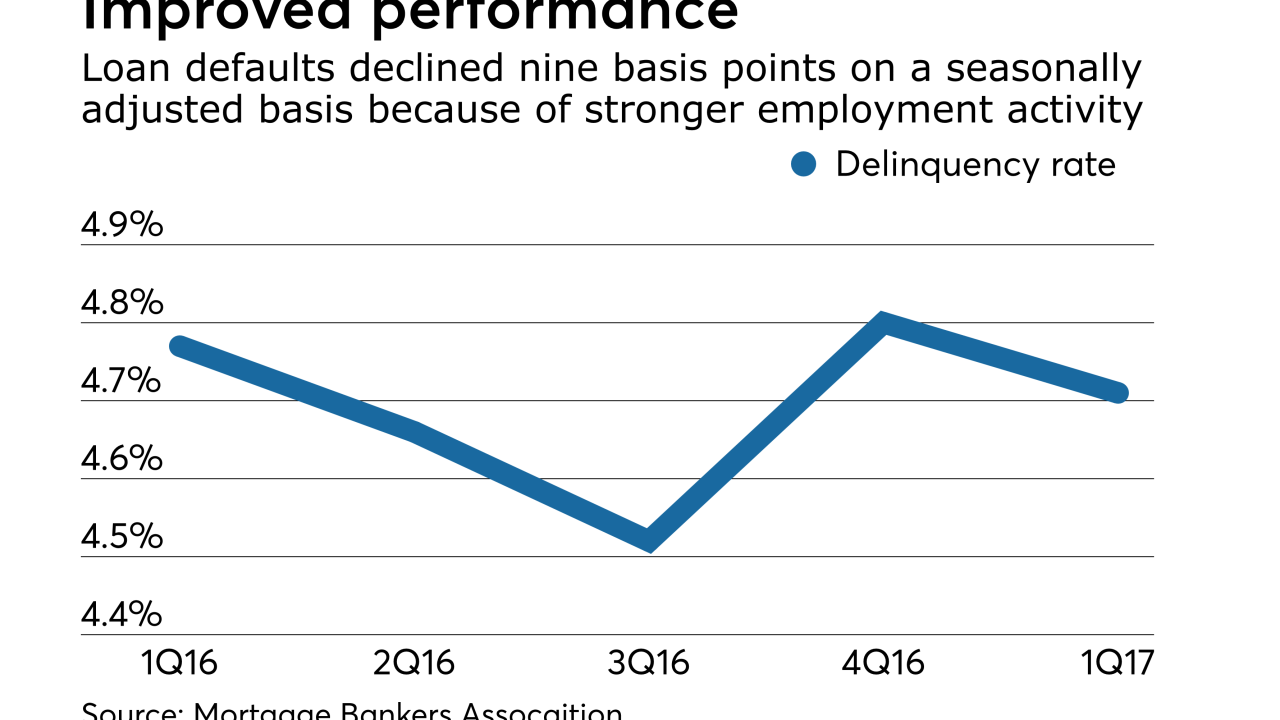

Lower defaults among government-guaranteed mortgage borrowers drove the overall delinquency rate down, the Mortgage Bankers Association said.

May 16 -

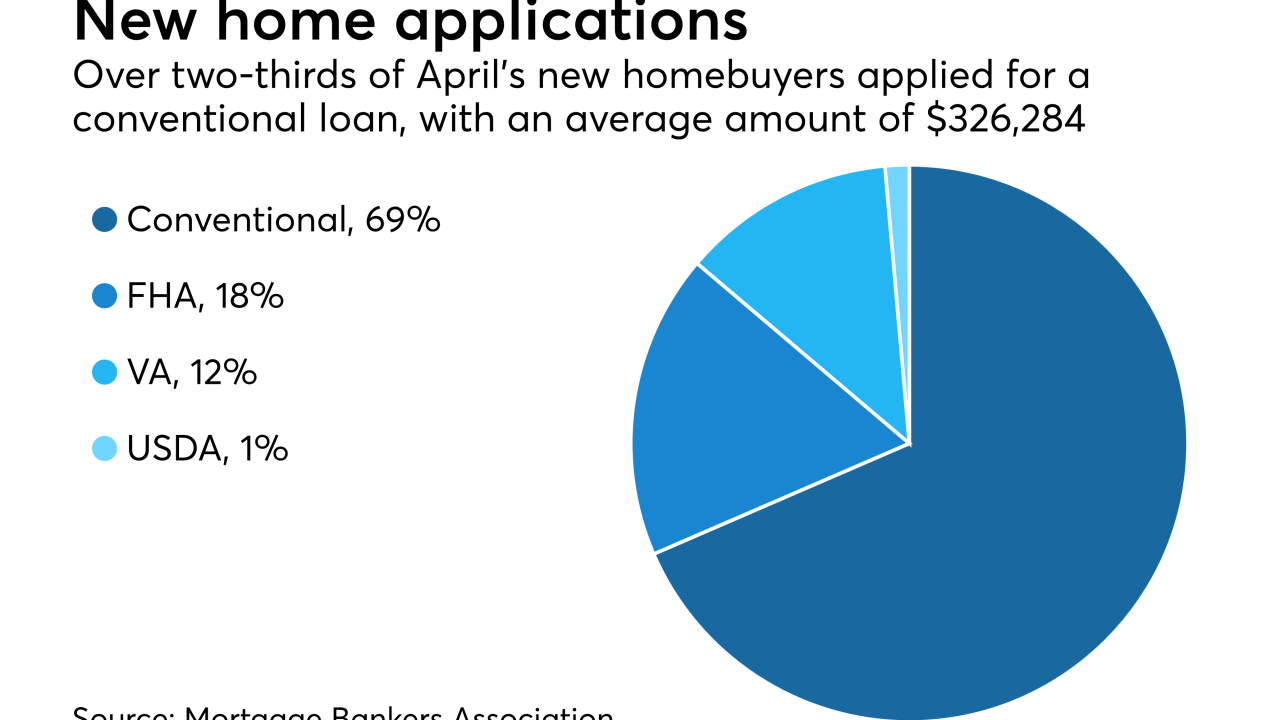

There were fewer new home purchase loan applications in April, as year-over-year activity declined for the first time in 2017.

May 15 -

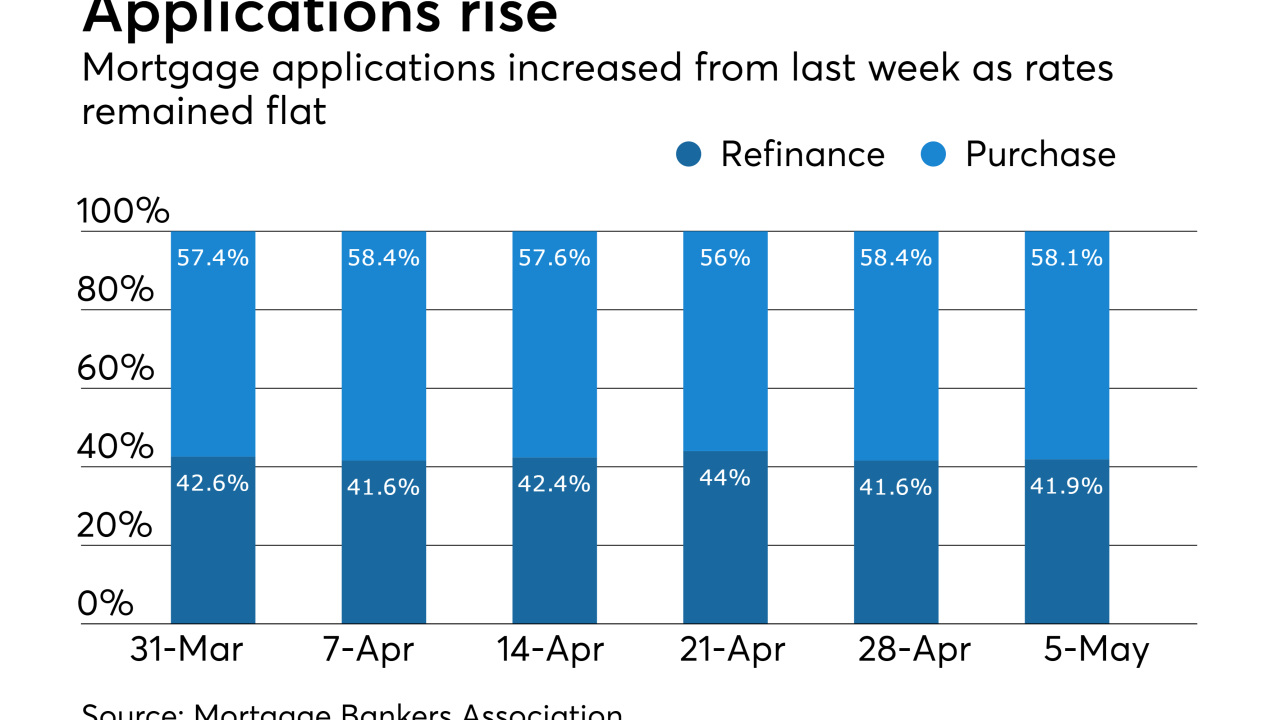

Mortgage applications increased 2.4% from one week earlier as there was little movement in interest rates, according to the Mortgage Bankers Association.

May 10 -

Mortgage credit availability declined in April as lenders cut back on the number of conforming products they offered.

May 4 -

Mortgage rates held steady in anticipation of the Federal Open Market Committee not increasing short-term rates at its meeting Wednesday, according to Freddie Mac.

May 4 -

From housing finance reform to the latest economic projections, here's a look at the biggest stories and best insights from this week's Mortgage Bankers Association National Secondary Market Conference in New York.

May 3 -

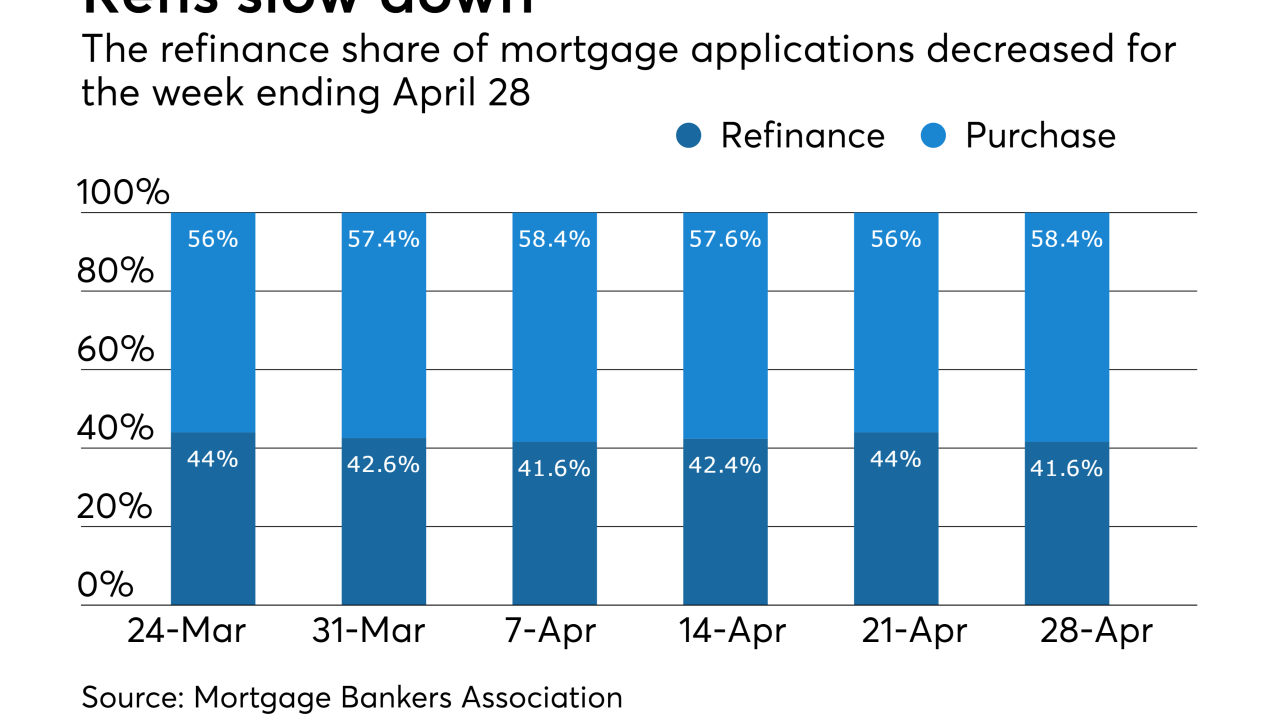

Mortgage application volume decreased 0.1% from one week earlier as refinance activity resumed its decline, according to the Mortgage Bankers Association.

May 3 -

Fannie Mae and Freddie Mac will continue to pursue opportunities for the government-sponsored enterprises to provide liquidity to the single-family rental market, despite opposition from mortgage and real estate industry groups.

May 2 -

Mortgage Bankers Association President David Stevens is confident that housing finance reform will move forward under the Trump administration, but criticized calls to simply let the government-sponsored enterprises recapitalize and be returned to shareholders without additional reforms.

May 1 -

The Trump administration's initial tax plan may be short on details, but a bipartisan bill offers some very specific relief for the commercial real estate industry.

April 27 -

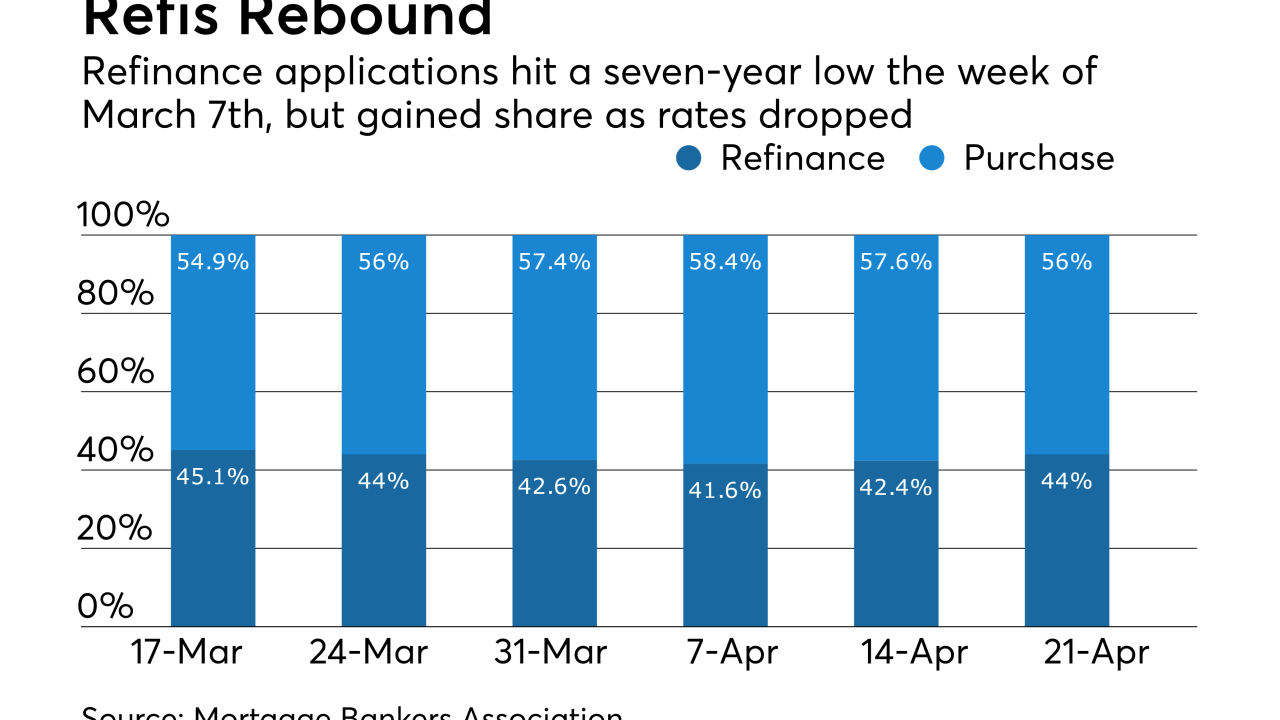

Mortgage application volume increased 2.7% for the week of April 21 as more consumers applied for refinance loans.

April 26 -

Mortgage application volume decreased 1.8% from the previous week driven by lower purchase activity, according to the Mortgage Bankers Association.

April 19 -

Lawmakers from both political parties are increasingly interested in forcing lenders that offer loans to upgrade home heating and cooling systems to issue better disclosures, a prospect that has some in the industry nervous.

April 18 -

New home purchase loan application activity reached its highest point in March as builders looked to fill the growing demand for housing.

April 13 -

Per-loan profits for nonbank lenders increased over 13% in 2016 from the previous year, driven by higher loan balances and increased revenue.

April 13 -

Mortgage applications increased 1.5% from one week earlier even though refinancing activity continues to shrink, according to the Mortgage Bankers Association.

April 12 -

By replicating human tasks, robotic process automation technology is driving scale and efficiency in loan manufacturing.

April 11 -

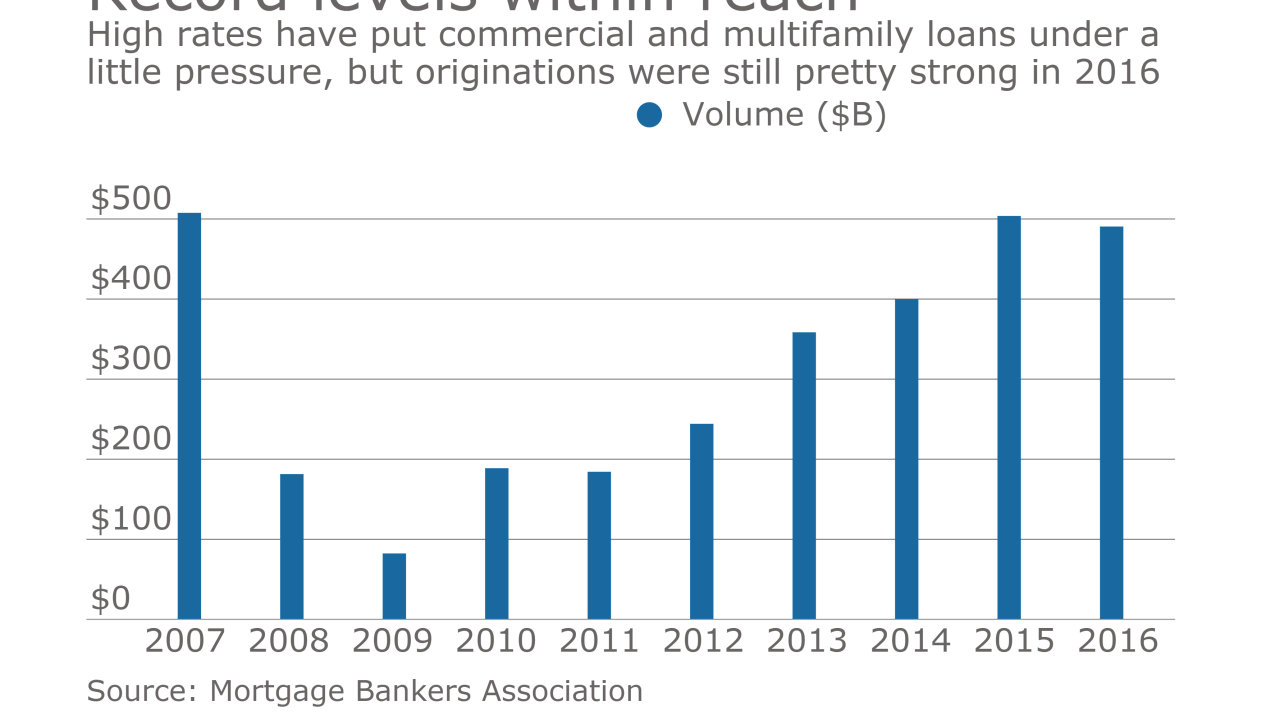

Commercial and multifamily mortgage bankers originated $490.6 billion closed loans in 2016, making it the third strongest year on record despite the pressure higher rates have put on volume.

April 6 -

Increased access to jumbo loan products brought mortgage credit availability to its highest level since the bust.

April 6 -

Mortgage applications decreased 1.6% from one week earlier as refinancing activity continues to shrink, according to the Mortgage Bankers Association.

April 5