-

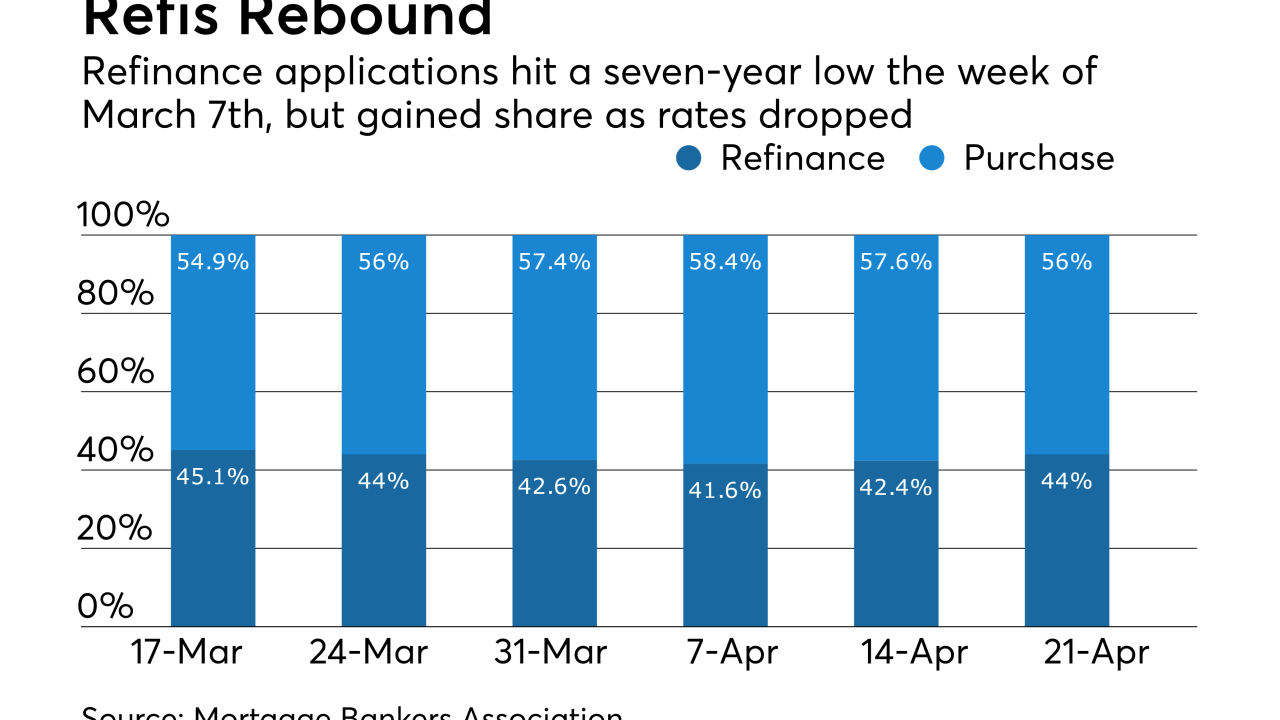

Mortgage application volume increased 2.7% for the week of April 21 as more consumers applied for refinance loans.

April 26 -

Mortgage application volume decreased 1.8% from the previous week driven by lower purchase activity, according to the Mortgage Bankers Association.

April 19 -

Lawmakers from both political parties are increasingly interested in forcing lenders that offer loans to upgrade home heating and cooling systems to issue better disclosures, a prospect that has some in the industry nervous.

April 18 -

New home purchase loan application activity reached its highest point in March as builders looked to fill the growing demand for housing.

April 13 -

Per-loan profits for nonbank lenders increased over 13% in 2016 from the previous year, driven by higher loan balances and increased revenue.

April 13 -

Mortgage applications increased 1.5% from one week earlier even though refinancing activity continues to shrink, according to the Mortgage Bankers Association.

April 12 -

By replicating human tasks, robotic process automation technology is driving scale and efficiency in loan manufacturing.

April 11 -

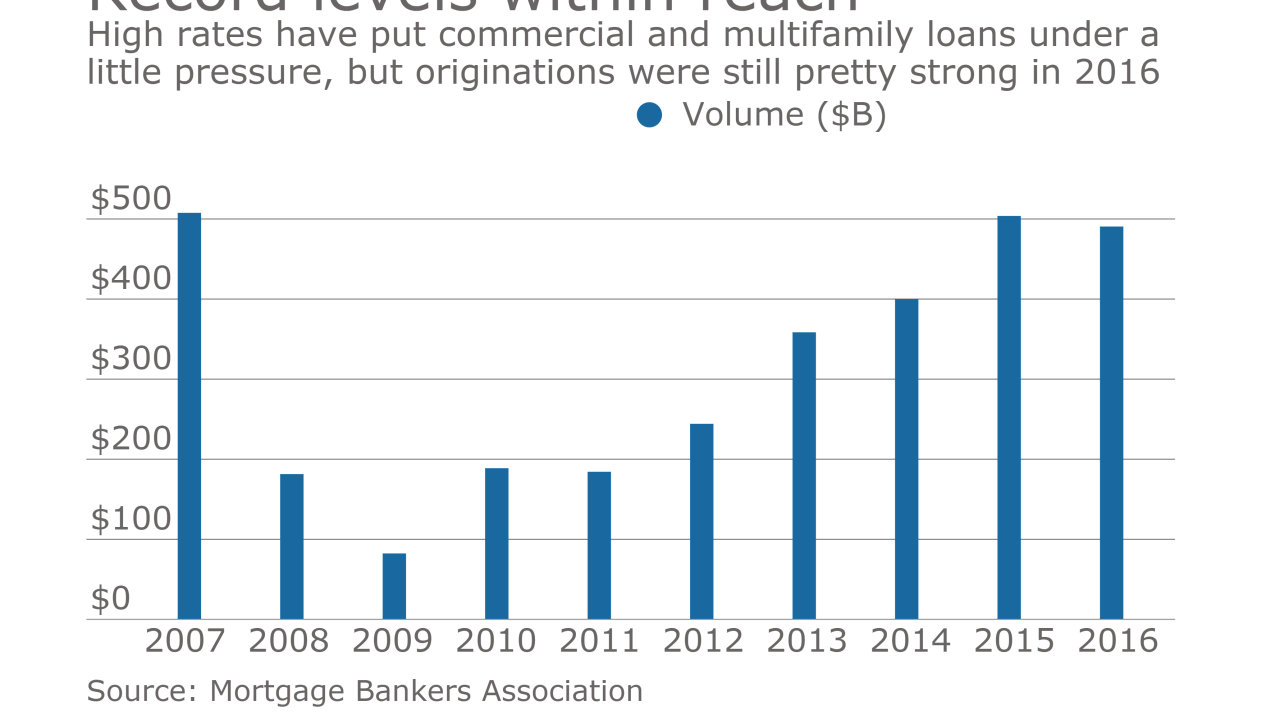

Commercial and multifamily mortgage bankers originated $490.6 billion closed loans in 2016, making it the third strongest year on record despite the pressure higher rates have put on volume.

April 6 -

Increased access to jumbo loan products brought mortgage credit availability to its highest level since the bust.

April 6 -

Mortgage applications decreased 1.6% from one week earlier as refinancing activity continues to shrink, according to the Mortgage Bankers Association.

April 5 -

Loan defects are inching upward in a market where higher rates could lead to more fraud risk.

March 31 -

Refinance applications reached their lowest share in more than seven years even as mortgage rates fell last week, according to the Mortgage Bankers Association.

March 29 -

The industry expects to lean on technological efficiencies this year as higher rates and dwindling refinances test their businesses.

March 28 -

In a bitterly partisan Congress, two senators are making a rare push across party lines to solve a persistent riddle with huge implications for the U.S. housing market: What to do with Fannie Mae and Freddie Mac?

March 28 -

Most tax lien and civil judgment data will be taken out of credit bureau files on July 1, possibly inflating scores and raising concerns about liability for mortgages that sour.

March 27 -

Despite the additional risks, originating mortgages for landlords of single-family rentals could help lenders fill the gap of waning refinance volume.

March 24 -

Here's an early look at what technology developers will be doing to dazzle and impress lenders and servicers during the Mortgage Bankers Association's technology conference in Chicago.

March 24 -

Mortgage lenders have already begun to feel the burn of higher interest rates.

March 21