-

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Ocwen Financial Corp. is on track to become profitable on a pretax basis by the third quarter without any special items enhancing earnings, according to a preliminary release of its fourth-quarter results.

February 7 -

Ocwen Financial's cost-cutting initiatives are bearing fruit toward returning to profitability, management said, although the company's third-quarter loss was slightly higher than the same period one year ago.

November 5 -

A federal judge granted in part and denied in part Ocwen Financial's motion to dismiss Florida regulators' case against the company, the last remaining of 30 state lawsuits filed in 2017.

October 2 -

A federal judge in Florida dismissed the Consumer Financial Protection Bureau's lawsuit against Ocwen Financial Services, stating the agency improperly asserted an excessive number of claims without specifying the particular count to which they applied.

September 6 -

Black Knight's second-quarter earnings dropped 20% from the previous year as it took a hit from its indirect investment in Dun & Bradstreet, offsetting a 7% increase in revenue.

August 7 -

A Florida-based loan servicing company has agreed to pay $84,000 to cover attorneys fees, penalties and costs associated with improper foreclosures it initiated in Maine, the state said.

August 7 -

Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

August 6 -

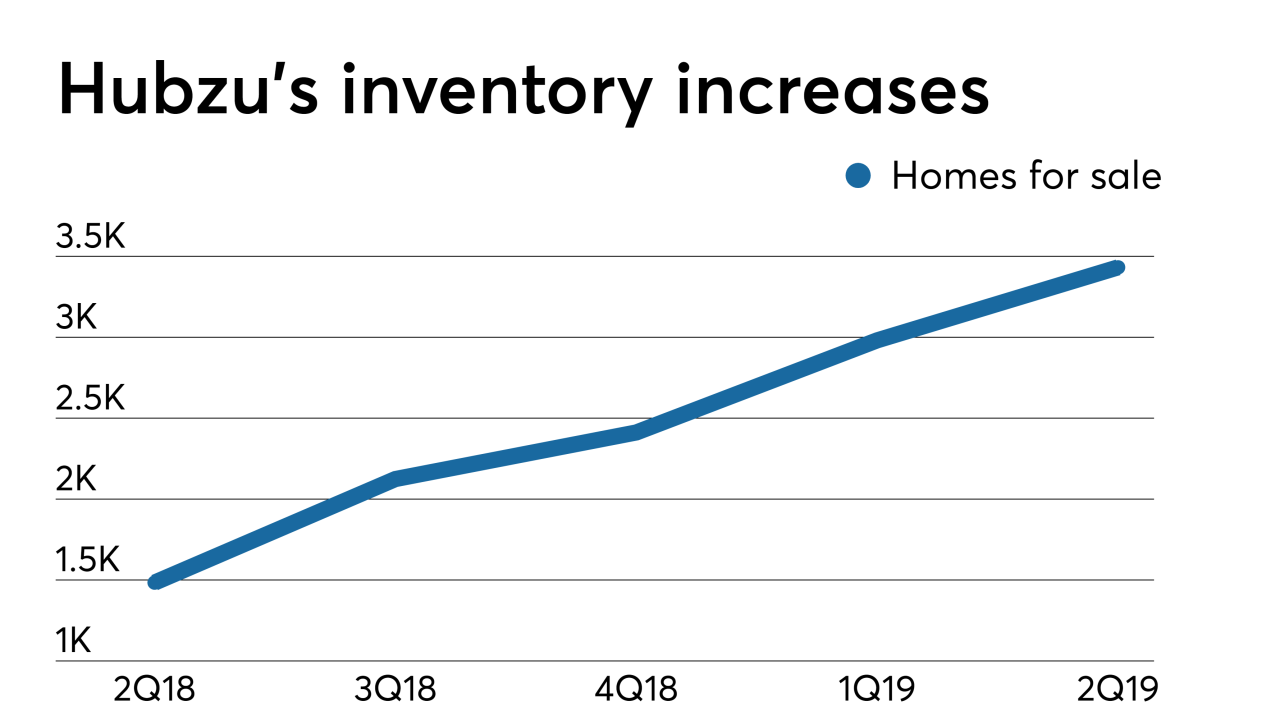

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

Liberty Home Equity, a subsidiary of Ocwen Financial, is offering a new private-market alternative to Federal Housing Administration-insured reverse mortgages.

July 22 -

Ocwen Financial, Fidelity Information Services and Fidelity's corporate parent have agreed to settle a lawsuit over regulatory audit expenses Fidelity submitted to Ocwen for reimbursement.

May 9 -

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Now that Ocwen settled the servicing practices lawsuit brought by the Massachusetts attorney general, just two outstanding complaints remain from the 30 filed nearly two years ago.

April 1 -

Ocwen Financial reduced the size of its net loss by nearly half during 2018 thanks to cost-cutting measures, and economies of scale from its acquisition of PHH Corp.

February 27 -

Altisource Portfolio Solutions recorded multimillion-dollar net losses in the fourth quarter and the full year for 2018, due to the reduction of the Ocwen Financial servicing portfolio and other repositioning activities.

February 26 -

Ocwen Financial Corp. now alleges that Fidelity Information Services misled California officials about its ability to conduct the audit at the heart of litigation.

February 12 -

Ocwen Financial subsidiary PHH Mortgage will pay a total of $750,000 to six military members and increase employee training to settle Department of Justice allegations that it conducted foreclosures that violated the Servicemembers Civil Relief Act.

February 6 -

These days, no wedding is complete without a hashtag combining the happy couple's names. It got us thinking: Why not give mortgage industry M&A deals the same treatment?

December 26 -

A National Fair Housing Alliance-led group plans to amend and refile a recently dismissed complaint against Deutsche Bank, Ocwen Financial Corp. and Altisource Portfolio Solutions alleging racial discrimination in property preservation.

November 21