Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Interest rates jumped from a new record low, while Fannie Mae and Freddie Mac were widely panned for imposing a refinance fee.

August 14 -

A former home mortgage consultant with the company alleges she was subjected to a lower compensation structure, awards and benefits compared to her male counterparts.

August 12 -

Deferrals on residential mortgages and home-equity loans have been a common theme at JPMorgan Chase, Bank of America, Wells Fargo and Citigroup since the start of the coronavirus pandemic.

August 5 -

With year-to-date issuance at $51.7 billion, investor demand appears to remain strong despite economic headwinds of the pandemic.

August 5 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

Democrats Elizabeth Warren of Massachusetts and Brian Schatz of Hawaii have sent a letter to CEO Charlie Scharf demanding a response to news reports that the bank has been placing borrowers into forbearance plans without their consent.

July 30 -

The national conversation around systemic racism has compelled large banks to withdraw support from the “disparate impact” proposal. But community banks maintain that the proposed reforms would reduce frivolous claims.

July 20 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

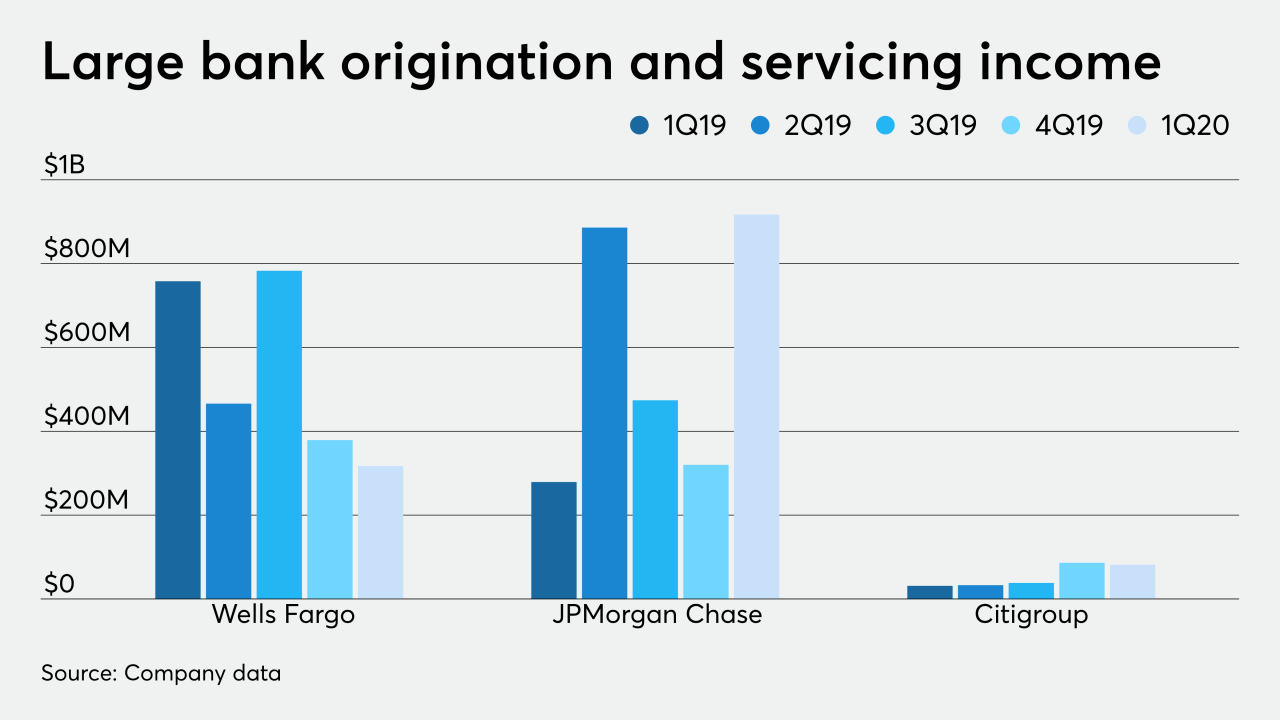

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

The amount far surpassed that of any other servicer required to purchase Ginnie Mae-backed loans that were 90 days past due.

July 13 -

However, those who aren't current bank customers need to have $1 million in a qualifying account.

July 10 -

Fercho will join Wells Fargo in August and report to Mike Weinbach, the bank's CEO of consumer lending.

July 9 -

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

June 11 -

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

May 29 -

Banking regulators restored the scandal-plagued bank's score three years after assigning it the lowest possible rating under the Community Reinvestment Act.

May 4 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

While much is unknown about how badly the coronavirus pandemic has damaged Southern Nevada's economy, one economist doesn't foresee a major housing market crisis here.

April 21 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

April 2 -

JPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with 200 state-chartered banks and credit unions, have agreed to let borrowers skip payments for 90 days if their finances have been upended by the pandemic.

March 25