-

A measure of contract signings for the purchase of previously owned homes unexpectedly increased in November after surging a month earlier, according to data released by the National Association of Realtors.

December 28 -

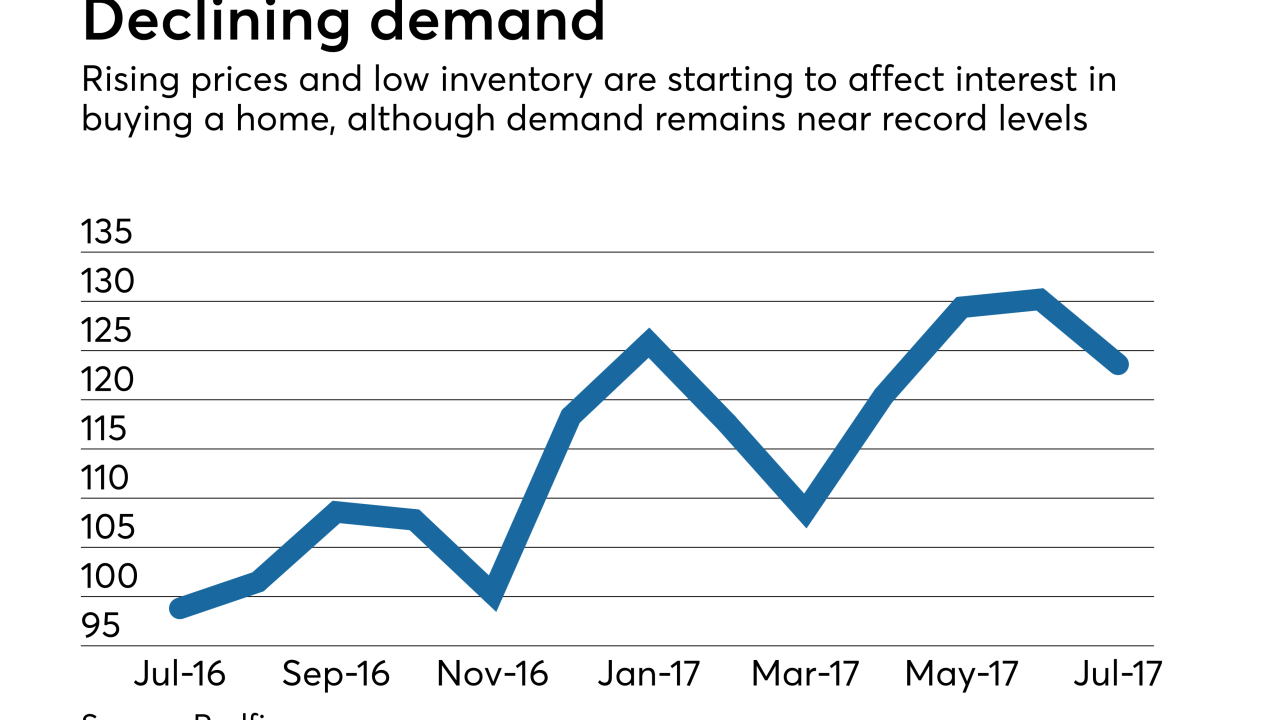

Homebuyer interest dipped slightly in November, but remains well above year-ago levels, according to Redfin.

December 27 -

In a sign that the Bay Area's housing shortage has reached new heights, even having a boatload of cash now may not be enough to land your dream home.

December 21 -

Here's a look at the 11 housing markets where the share of entry-level homes for sale is greater than the share of first time home buyer shoppers.

December 19 -

The maximum loan amount for Federal Housing Administration mortgages will go up in more than 3,000 counties for 2018.

December 7 -

Despite rapid price gains and tight inventory nationally, prices in many of the largest housing markets are still below the peaks reached before the Great Recession.

December 6 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

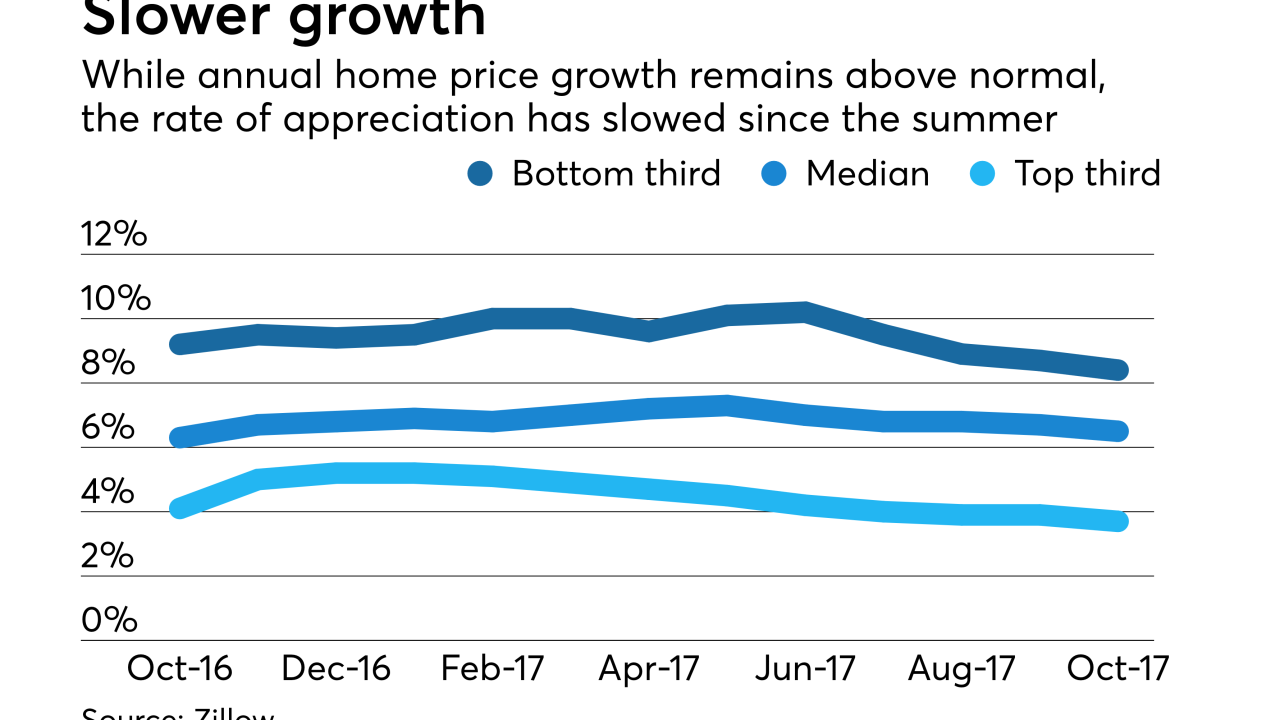

Home price appreciation continues to increase at a much higher than normal pace, although the rate of growth has been slowing since the summer.

November 22 -

The housing market has been underperforming its potential since May, and October's performance gap was the largest it's been since November of last year, according to First American Financial Corp.

November 21 -

The treatment of local property taxes and the mortgage interest deduction in the House Republicans' tax plan would cause homeowners in high-cost states like California to incur much higher tax bills.

November 8

-

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 8 -

Here's a look at 12 cities where the median home sales price is below $215,000, but the combination of housing costs, local wages and other market forces is making home purchasing power disappear in these once-cheapest places to live.

October 5 -

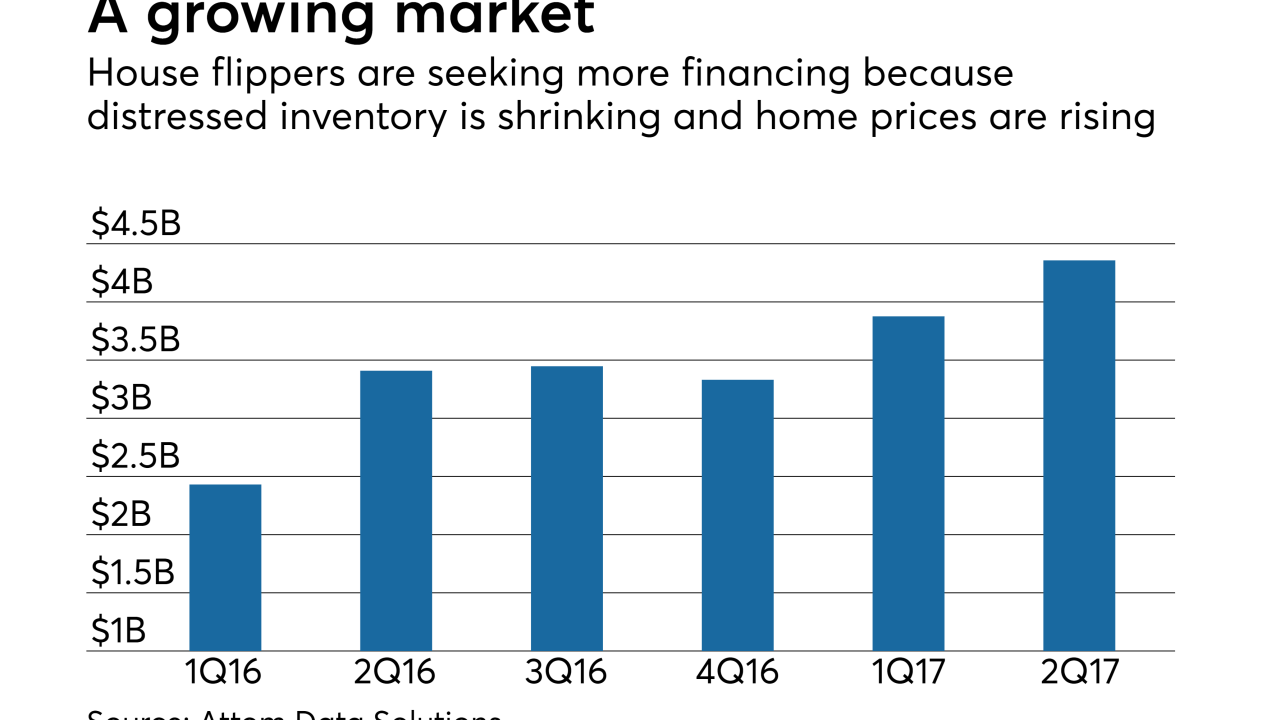

A new wholesale loan channel at CoreVest will work with mortgage brokers who are starting to source loans to house flippers for the first time.

September 28 -

As distressed inventory dries up and home prices soar, more investors are borrowing to buy flip houses. Here's a look at the 12 states with the largest share of financing for flipping houses.

September 20 -

Return on investment from flipping houses has declined nationwide for three straight quarters. Here's a look at five cities that still offer robust returns and five markets worth avoiding.

September 14 -

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

Consumer confidence in the housing market is growing overall, but the gap between those that say it's a good time to buy versus selling a home is widening, according to Fannie Mae.

September 11 -

From Indiana to Ohio, here's a look at the 12 states where the combination of prices and wages offer home buyers the best bang for the buck.

September 8 -

Rising prices are starting to keep potential purchasers from looking for homes and making an offer although interest remains near record levels, according to the Redfin Housing Demand Index.

September 5 -

It might make better financial sense to rent compared to buying a house in Washington's Whatcom County if you plan on living here fewer than seven years, according to a new report.

September 5