-

Both refinancings and purchases will be stronger than what Fannie Mae had previously forecast.

August 17 -

Its stock price, which slid since day two of trading, opened 10% on the earnings news.

August 14 -

The FHFA director’s move this week to impose an “adverse market fee” of 0.5% on most refinanced mortgages will shift billions out of the hands of American consumers and into the hands of Fannie Mae and Freddie Mac — and their private shareholders.

August 14 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

Refinance volume led the spike in mortgage applications for the week ending Aug. 7 as interest rates continued tumbling.

August 12 -

The company's Dun & Bradstreet investment reduced its results by $31 million.

August 10 -

Gross supply as of the end of June has already reached $1.2 trillion, a torrid pace considering the last decade has averaged $1.3 trillion per annum.

August 7 -

Conditions have improved for the first time since November.

August 6 -

Insurance claims and claims expenses were 503% above 1Q and 1,075% over 2Q19.

August 6 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

Record-low interest rates allowed homebuyers to purchase $32,000 more house for the same monthly payment compared to last July, boosting affordability to the highest level since 2016.

August 3 -

The combined impact of coronavirus forbearance periods ending while low rates persist means large workloads for title insurers, appraisers and others.

July 31 -

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30 -

The government-sponsored enterprise reported net earnings of $2.55 billion, up from $461 million in the first quarter.

July 30 -

The annual survey and ranking of mortgage servicers found that while trust is increasing, borrowers were frustrated with some digital interactions and long wait times with call centers.

July 30 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

Mortgage applications decreased 0.8% from one week earlier as the latest spread of COVID-19 weighed on the minds of consumers looking to buy or refinance, according to the Mortgage Bankers Association.

July 29 -

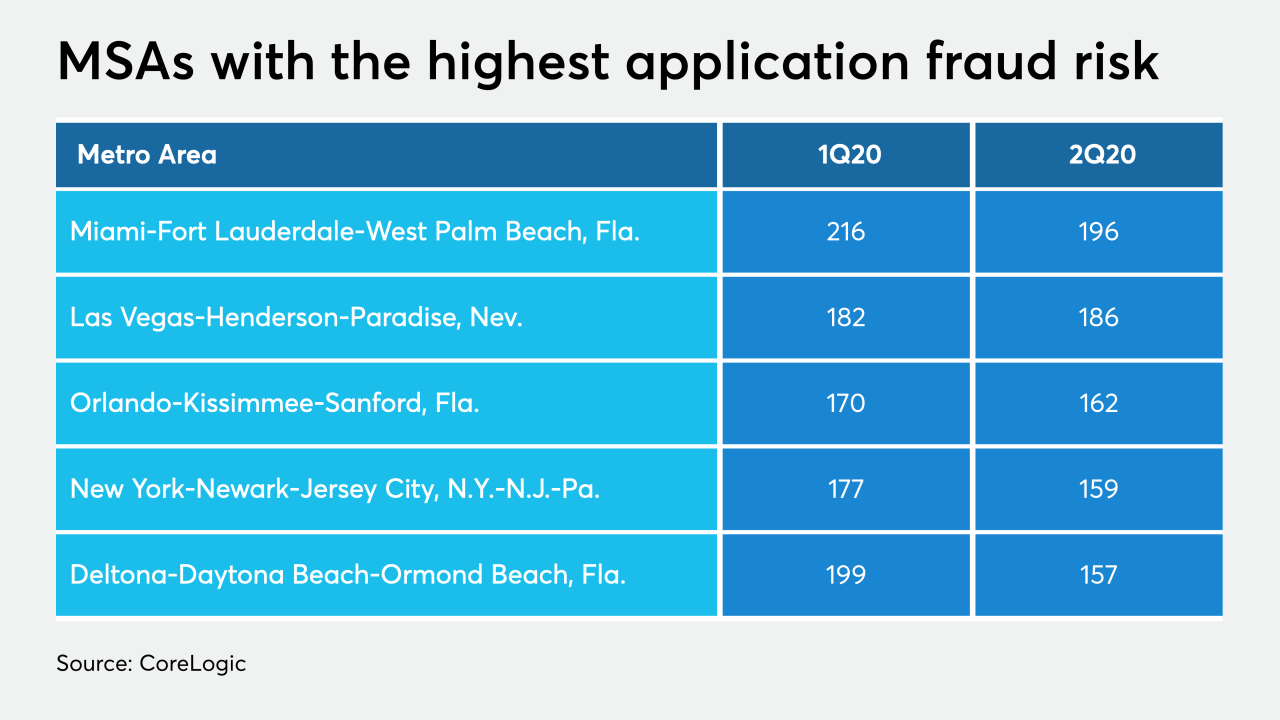

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24