-

An increase in purchase activity drove the week-over-week rise in mortgage application volume as homebuyers entered the market while interest rates fell, according to the Mortgage Bankers Association.

May 8 -

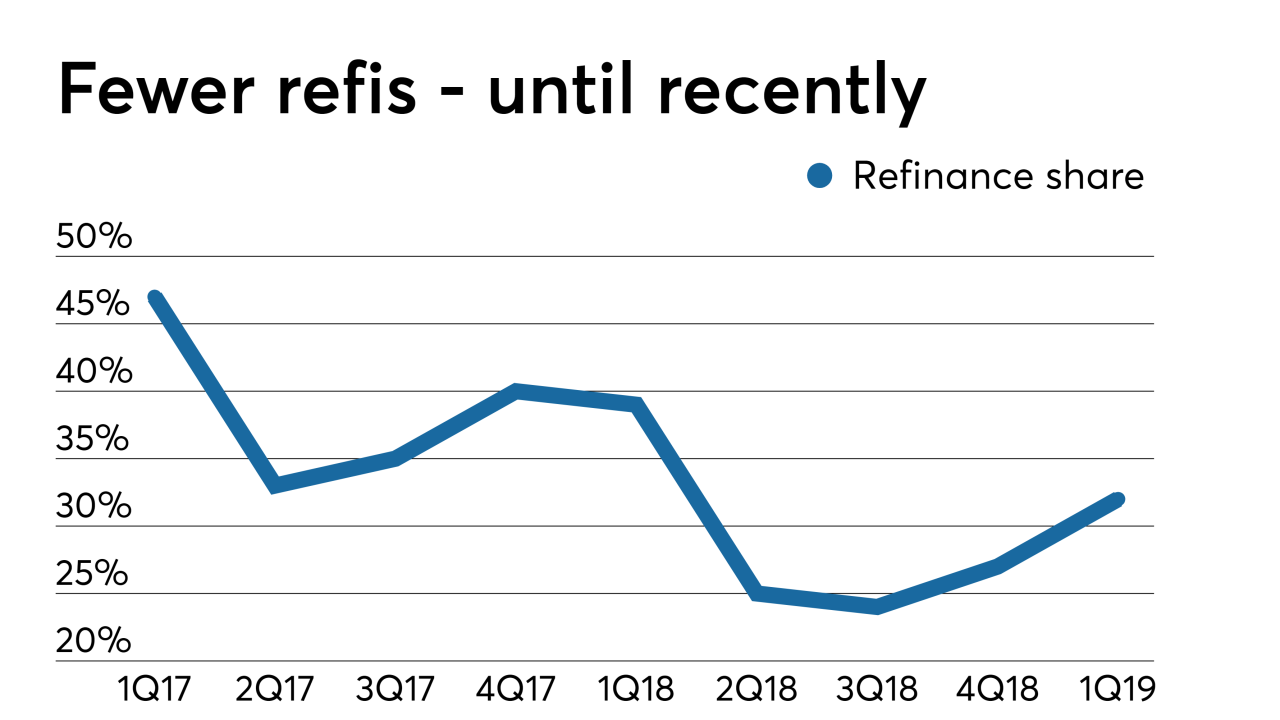

Regions Bank, like many lenders, has seen its refinancing volume shrink dramatically as a percentage of overall originations over the last few years, prompting it to refocus its mortgage bankers on very different purchase originations.

May 7 -

Customer retention for mortgage servicers hit an all-time low at the start of the year, and a sensitive mortgage rate environment is only creating more competition, according to Black Knight.

May 6 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

Having a cash-out refinance program is important to greater share of originators in the West than it is in the United States as a whole, the Top Producers 2019 survey found.

May 1 -

Millennials closed mortgage loans at their fastest pace in four years as lower interest rates pushed up purchasing power and incentivized them to pull the trigger, according to Ellie Mae.

May 1 -

Mortgage applications decreased 4.3% from one week earlier although concerns over the global economy resulted in falling interest rates, according to the Mortgage Bankers Association.

May 1 -

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

April 30 -

Freddie Mac increased its origination forecast for 2019 by nearly 4% from last month as lower interest rates will result in more borrowers refinancing than previously expected.

April 30 -

A renovated office complex in Florida and a recently built Great Wolf Lodge resort in Orange County make up two of the largest loans in Wells Fargo's latest conduit.

April 25 -

Purchase mortgage applications, which until now were unaffected by the recent rise in interest rates, fell by 4% on a seasonally adjusted basis from last week, according to the Mortgage Bankers Association.

April 24 -

Economic growth will slow in 2019, but conditions will help home sales hold steady, with mortgage volume now being projected to rise over 2018, according to Fannie Mae.

April 18 -

Mortgage rates continued to decline through the spring home buying season, driving up the share of refinance loans and overall closing rates, according to Ellie Mae.

April 17 -

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Mortgage application volume fell 5.6% from one week earlier as rising interest rates put an end to the recent surge in refinancings, according to the Mortgage Bankers Association.

April 10 -

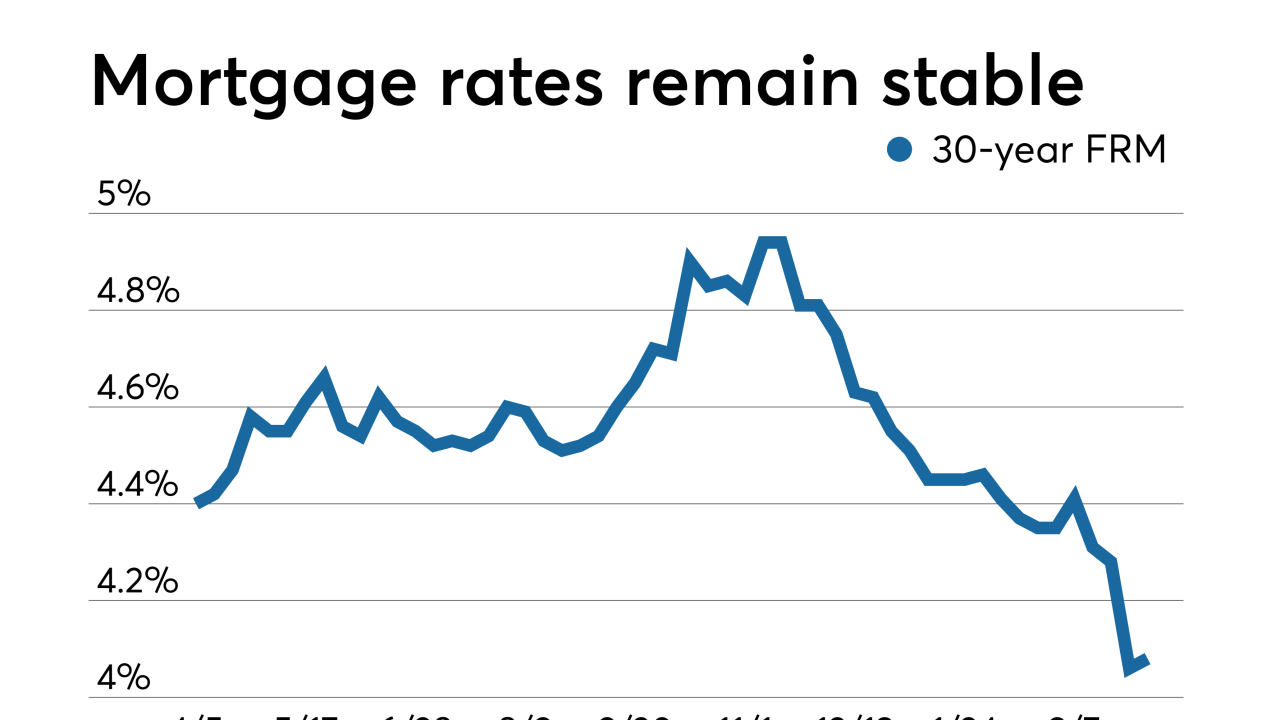

Mortgage rates held steady after several weeks of declines, during which there was the largest weekly drop in more than 10 years, according to Freddie Mac.

April 4 -

From where to find borrowers that competitors overlook, to how to adjust strategies when interest rates change course, top producers are adapting when market conditions change.

April 3 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Mortgage refinance applications reached their highest level in three years as interest rates plunged last week in the aftermath of the Federal Open Market Committee's March meeting.

April 3