-

Mortgage applications rose for the second straight week as key interest rates fell back toward 5%, according to the Mortgage Bankers Association.

December 5 -

The nation's largest mortgage lending company for U.S. military veterans did less business in Hawaii during its recent fiscal year compared with the prior year.

November 30 -

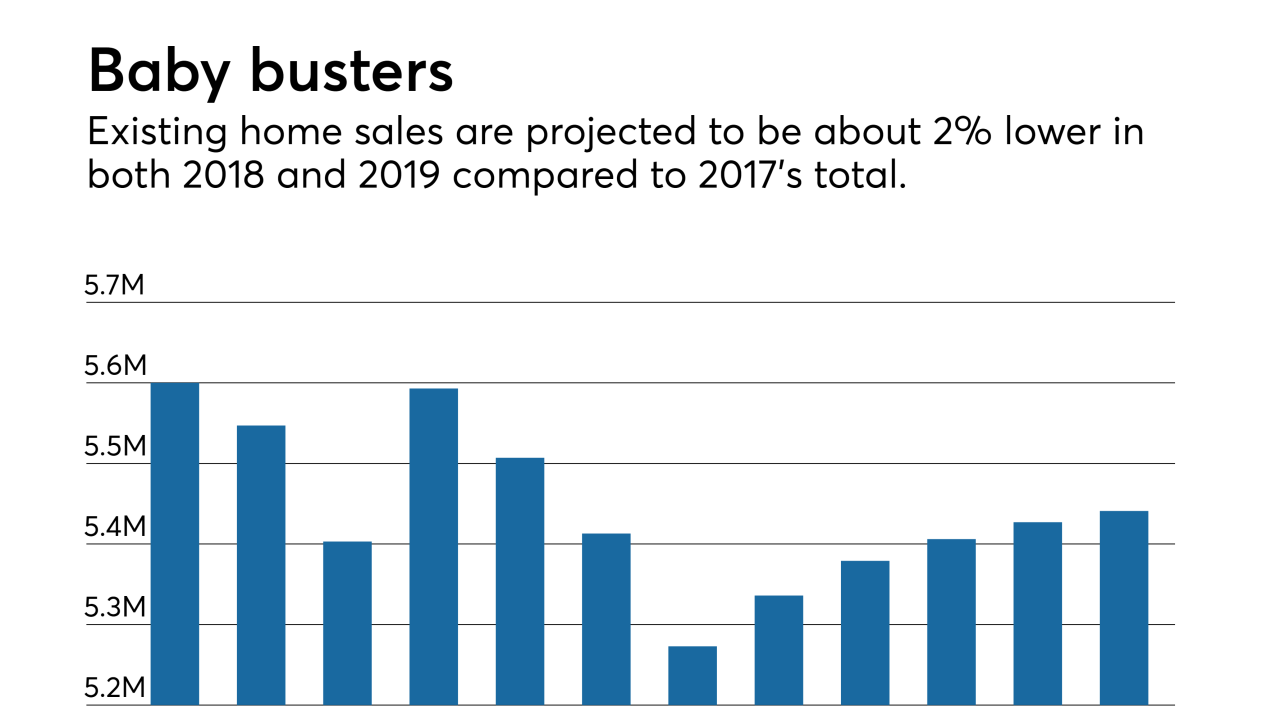

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

The rush in holiday shopping also boosted the housing market as mortgage applications increased 5.5% from one week earlier, according to the Mortgage Bankers Association.

November 28 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

Mortgage application activity decreased 0.1% from one week earlier as refinance volume tanked, although interest rates fell, according to the Mortgage Bankers Association.

November 21 -

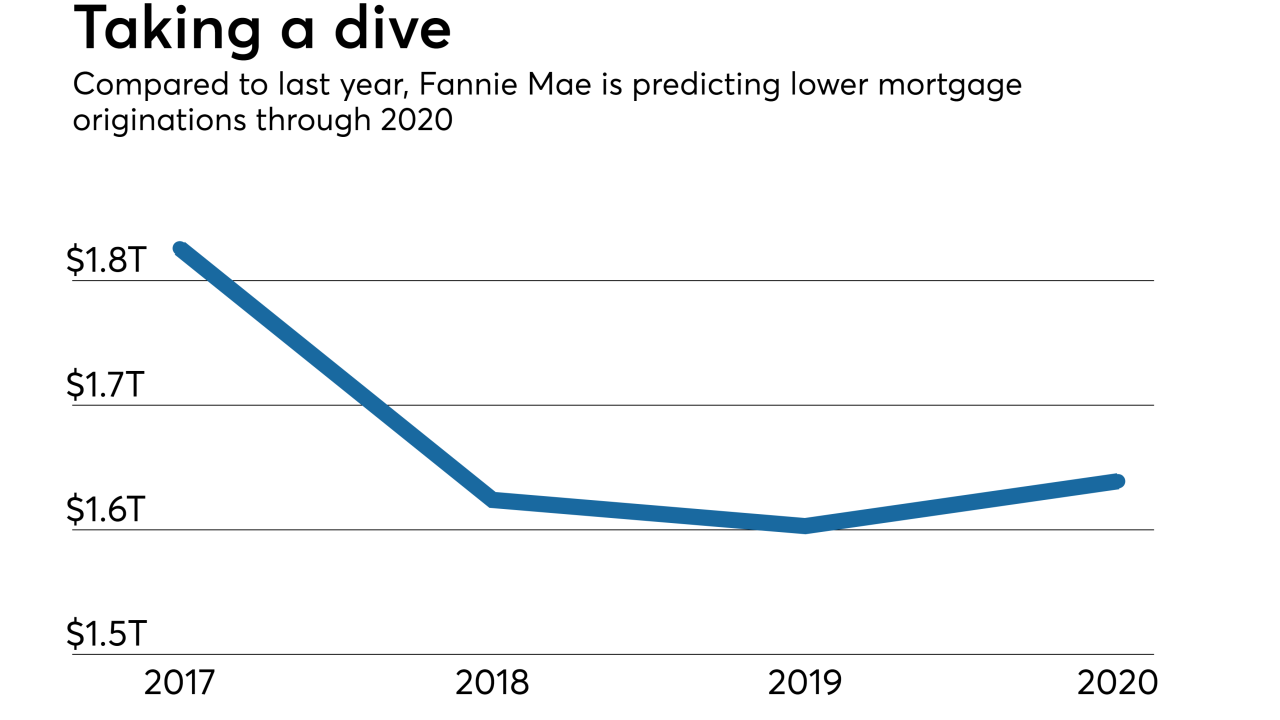

Fannie Mae's economic growth forecast for 2018 inched up slightly, but a strong labor market won't mean the same positive results for housing.

November 20 -

Mortgage fintech LoanSnap launched VA Smart Loans, which will provide personalized options to current and former service members applying for a Veterans Affairs-guaranteed mortgage.

November 15 -

Borrowers will get more leeway to finance energy- and water-efficient improvements under a new program coming from Freddie Mac.

November 14 -

As interest rates rise, mortgage originators need to teach millennial homebuyers about the product options outside of conventional loans, Ellie Mae said.

November 14 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

American Financial Resources, a Parsippany, N.J.-based mortgage lender, will pay any required agent fees for U.S. Department of Veterans Affairs loans for its brokers and correspondents on all AFR-related VA loan submissions starting Veterans Day.

November 12 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

The Federal Housing Administration's life-of-loan premium discourages borrowers from refinancing into another FHA mortgage, damaging the stability of the insurance fund.

November 8 Potomac Partners

Potomac Partners -

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

As the Federal Housing Administration prepares to release its annual actuarial report this month, the industry is questioning how the reverse mortgage program fits into the agency's future.

November 2 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

While all portions of mortgage credit underwriting standards have slipped since the early post-crisis period, it is the deteriorating conditions that most increases vulnerability for future loan quality, a Moody's report said.

October 29 -

All four national title insurance underwriters saw an increase in third-quarter net earnings compared with one year prior even as new orders declined because mortgage origination volume fell this year.

October 25