-

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

Premiums written increased 45%, while net operating income was up over 65%, the American Land Title Association said.

June 28 -

Corresponding Treasury yields seesawed over the past week, as some experts see “transitory” inflation persisting.

June 24 -

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

For all respondents, cash edged financing by one percentage point, but half of those that bought last year used cash, ServiceLink found.

June 23 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16 -

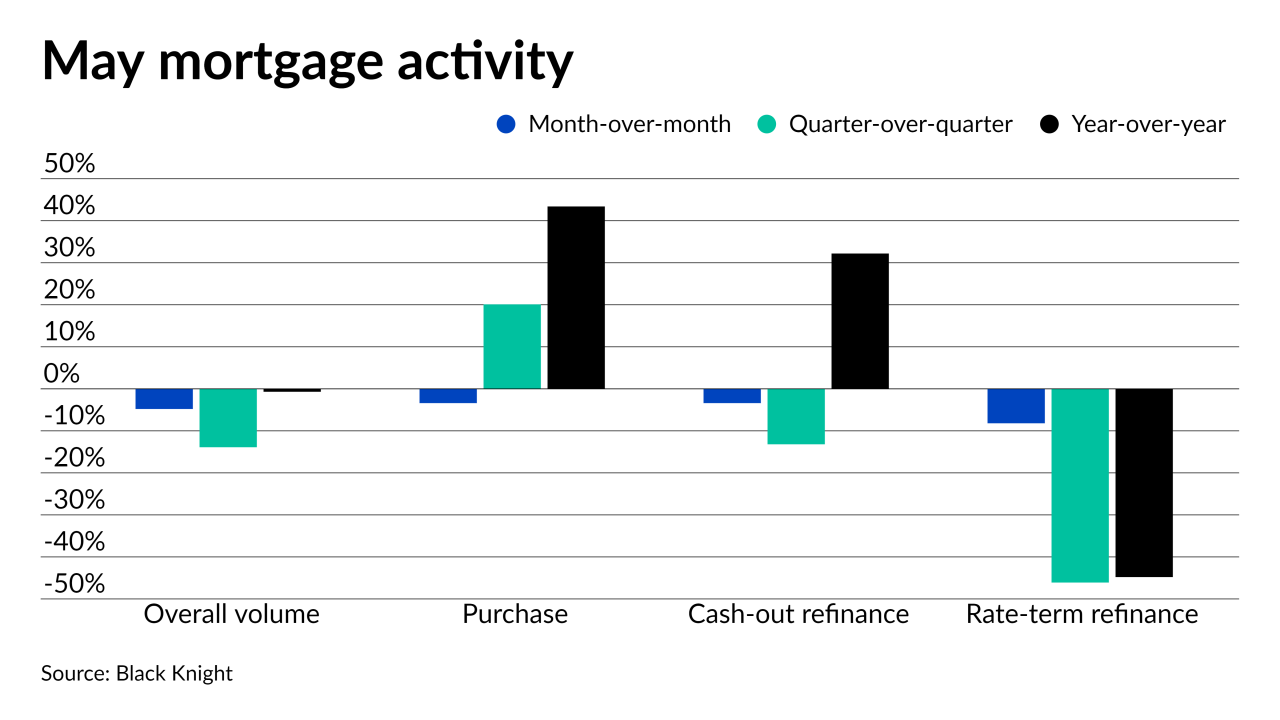

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Even though product availability is now at the same point where it was one year ago, it remains at 2014 levels.

June 10 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

Purchase loans tick upward, even as housing demand pushes prices well above 2020 levels.

June 9 -

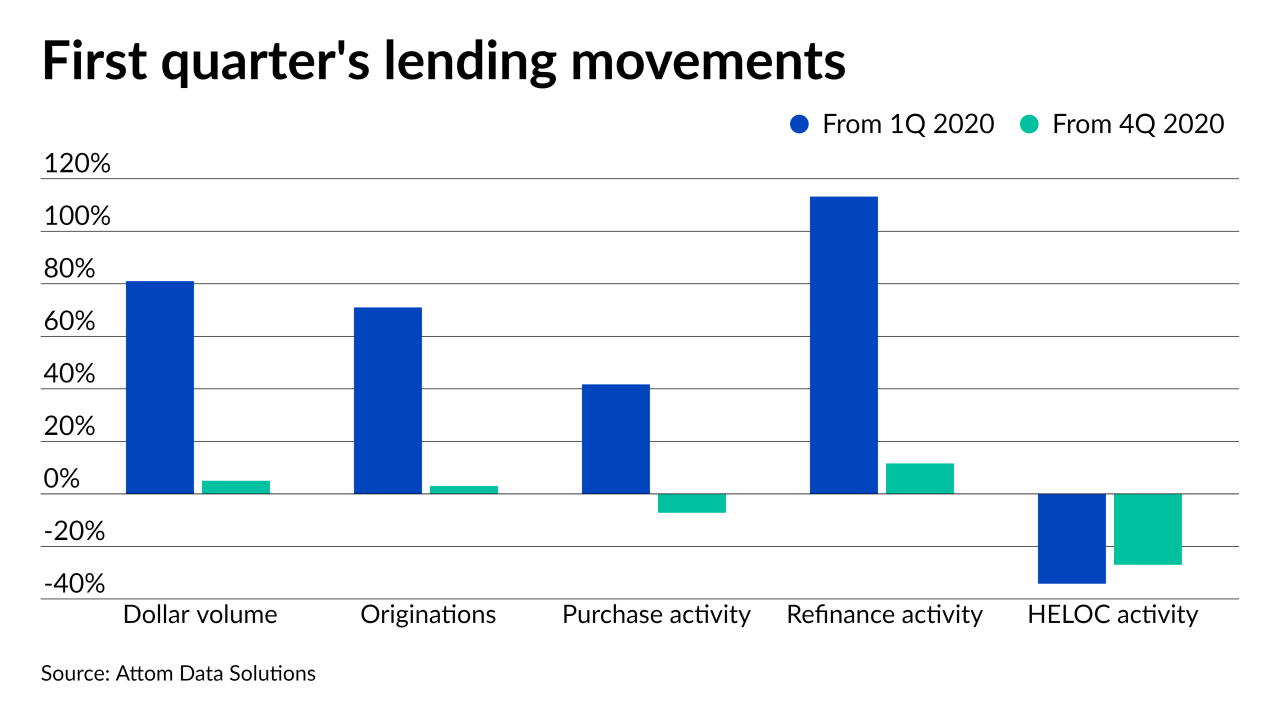

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

The MBA’s Market Composite Index decreased a seasonally adjusted 4% last week, dropping to a point not seen since February 2020.

June 2 -

Borrowers with loans secured by personal rather than real property made up 46% of manufactured housing borrowers in 2019 and of this group, only 5% used the loans to refinance.

June 1 -

The steady pace of refinance activity has also continued, as borrowers seek to take advantage of sub-3% rates.

May 27 -

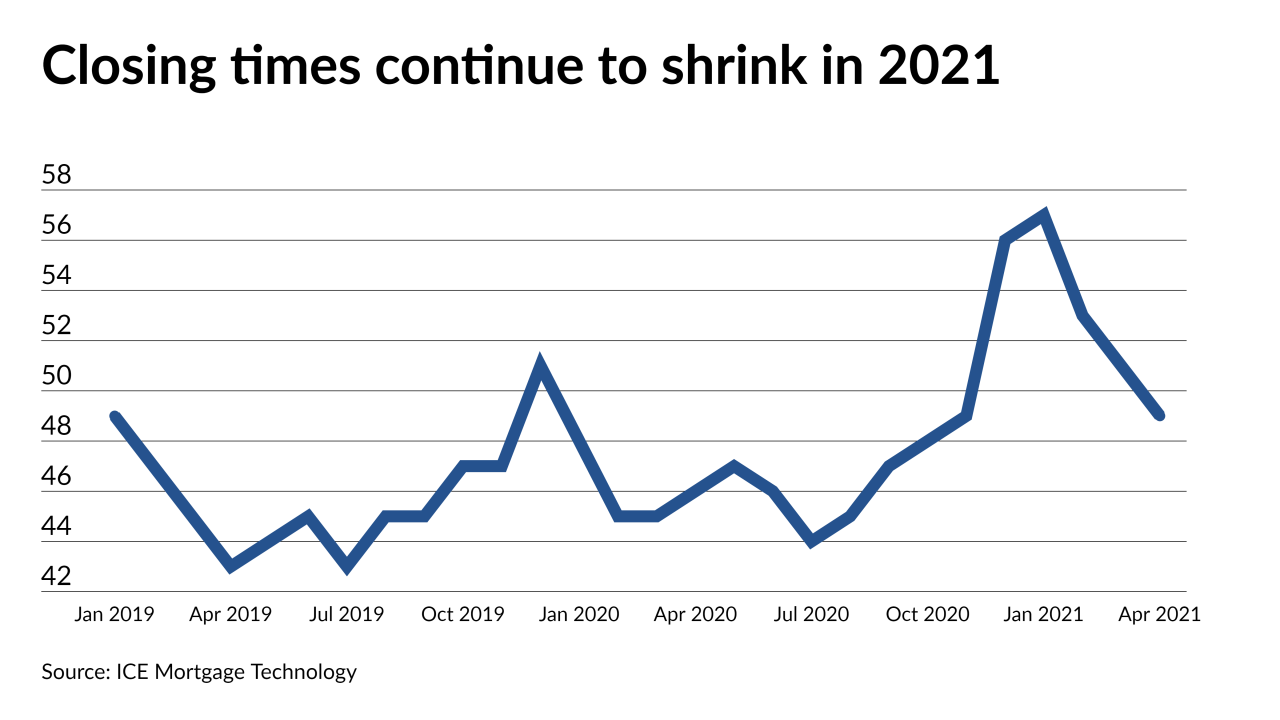

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

Garg discusses how Better plans to maintain growth in a volatile market in an exclusive interview.

May 25 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Mortgage activity fell across the board despite analysis that 14.5 million current qualified borrowers would benefit from a refinance, according to Black Knight.

May 17 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12