-

The era of plentiful refinance volume is over for the foreseeable future, because mortgage rates remained in a very narrow band for the past decade, said Mortgage Bankers Association Chief Economist Mike Fratantoni.

May 21 -

Housing finance reform cannot be piecemeal, but must be done using a comprehensive approach, an independent mortgage banker says.

May 17 Hallmark Home Mortgage

Hallmark Home Mortgage -

Mortgage rates descended through the onset of spring's home buying season, pushing up the share of refinance loans and volume of new-home purchase applications, according to Ellie Mae and the MBA.

May 16 -

Even if the U.S. economy slows during the rest of 2019, the outlook for the housing and mortgage market remains strong, said economists at Fannie Mae and Freddie Mac.

May 16 -

The trade dispute with China is likely to affect consumers' willingness to buy a home and apply for a new mortgage loan, according to the Mortgage Bankers Association.

May 15 -

While prepayment speeds on agency mortgage-backed securities rose in April, that increase should be short-lived as further significant interest drops are not expected, said a report from Keefe, Bruyette & Woods.

May 13 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Lenders and policymakers could further build on a recent surge in Asian-American homeownership if they took three steps, according to the Asian Real Estate Association of America.

May 9 -

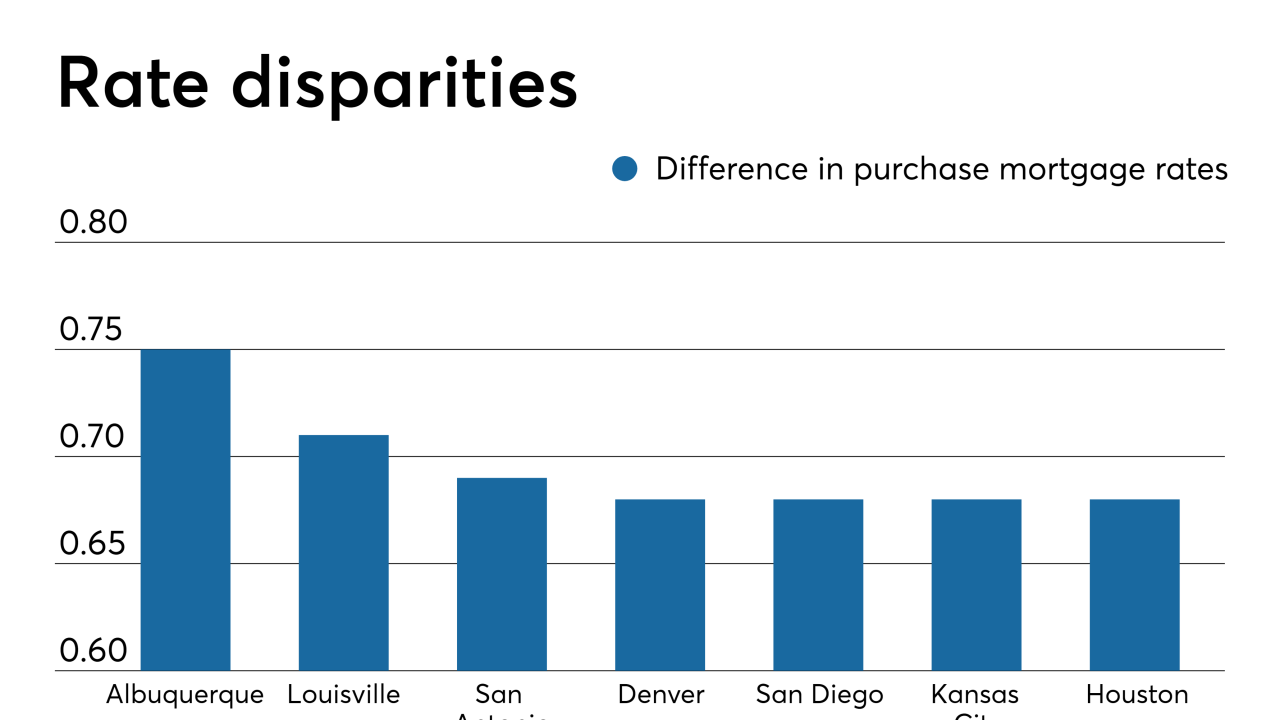

Lenders can help both the consumer save money and their own volumes by offering the most competitive rates or reducing their fees. Here's a look at the 12 housing markets borrowers save the most over the life of their loan by shopping around for a mortgage, according to LendingTree.

May 8 -

An increase in purchase activity drove the week-over-week rise in mortgage application volume as homebuyers entered the market while interest rates fell, according to the Mortgage Bankers Association.

May 8 -

Regions Bank, like many lenders, has seen its refinancing volume shrink dramatically as a percentage of overall originations over the last few years, prompting it to refocus its mortgage bankers on very different purchase originations.

May 7 -

Customer retention for mortgage servicers hit an all-time low at the start of the year, and a sensitive mortgage rate environment is only creating more competition, according to Black Knight.

May 6 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

Having a cash-out refinance program is important to greater share of originators in the West than it is in the United States as a whole, the Top Producers 2019 survey found.

May 1 -

Millennials closed mortgage loans at their fastest pace in four years as lower interest rates pushed up purchasing power and incentivized them to pull the trigger, according to Ellie Mae.

May 1 -

Mortgage applications decreased 4.3% from one week earlier although concerns over the global economy resulted in falling interest rates, according to the Mortgage Bankers Association.

May 1 -

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

April 30 -

Freddie Mac increased its origination forecast for 2019 by nearly 4% from last month as lower interest rates will result in more borrowers refinancing than previously expected.

April 30