-

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

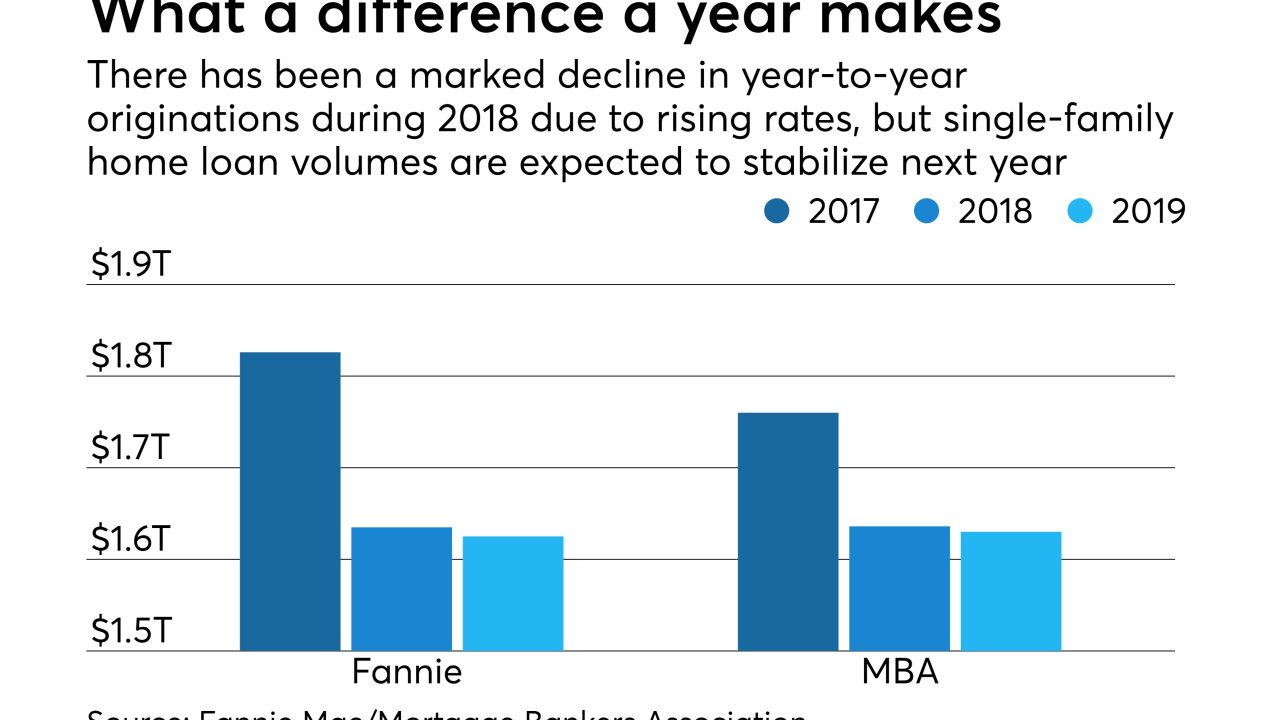

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Builder Lennar Corp.'s purchase of CalAtlantic's financial services operations boosted its mortgage segment's earnings in the third quarter as the acquisition offset declines in per-loan profits and refinancing.

October 3 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

September 26 -

Increased competition among non-qualified mortgage lenders leading to lower starting interest rates for borrowers should result in fewer of these loans prepaying within one year of origination, said Standard & Poor's.

September 24 -

A stronger economy, easing house price appreciation and slightly improving inventory conditions aren't enough to push up home sales this year, according to Freddie Mac.

September 24 -

As mortgage rates remained mostly tepid throughout the summer, closed refinances had their first month of growth in August, according to Ellie Mae.

September 19 -

Mortgage applications were up 1.6% from one week earlier, marking only the second increase of the past two months despite key interest rates rising, according to the Mortgage Bankers Association.

September 19 -

To help close deals, there are steps online lenders can take to establish a quick and personal connection with real estate agents.

September 18 -

Loan officers whose habits are attuned to the refi market need to improve their relationship game to make it in this business, NBKC Bank's Dan Stevens told attendees at Digital Mortgage 2018.

September 17 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5