-

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

If CMBS litigation picks up in earnest in the aftermath of the pandemic, lessons gleaned from over a decade of RMBS litigation could pay dividends, Bilzen Sumberg lawyers Philip Stein and Kenneth Duvall say.

December 8 Bilzin Sumberg

Bilzin Sumberg -

The single-family, duplex and multi-unit condo properties have an average age of 60 years, more than double the age of other rated SFR securitizations.

December 7 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

Adolfo Marzol came to the agency after a stint at HUD and a 30-year career in the mortgage industry. He will depart on Dec. 18.

December 4 -

Fannie hasn't completed any credit risk transfers to private investors since the second quarter. Some experts worry the decision — likely spurred by the company’s concerns about a recent capital regulation — could put the mortgage giant on unsteady footing.

December 3 -

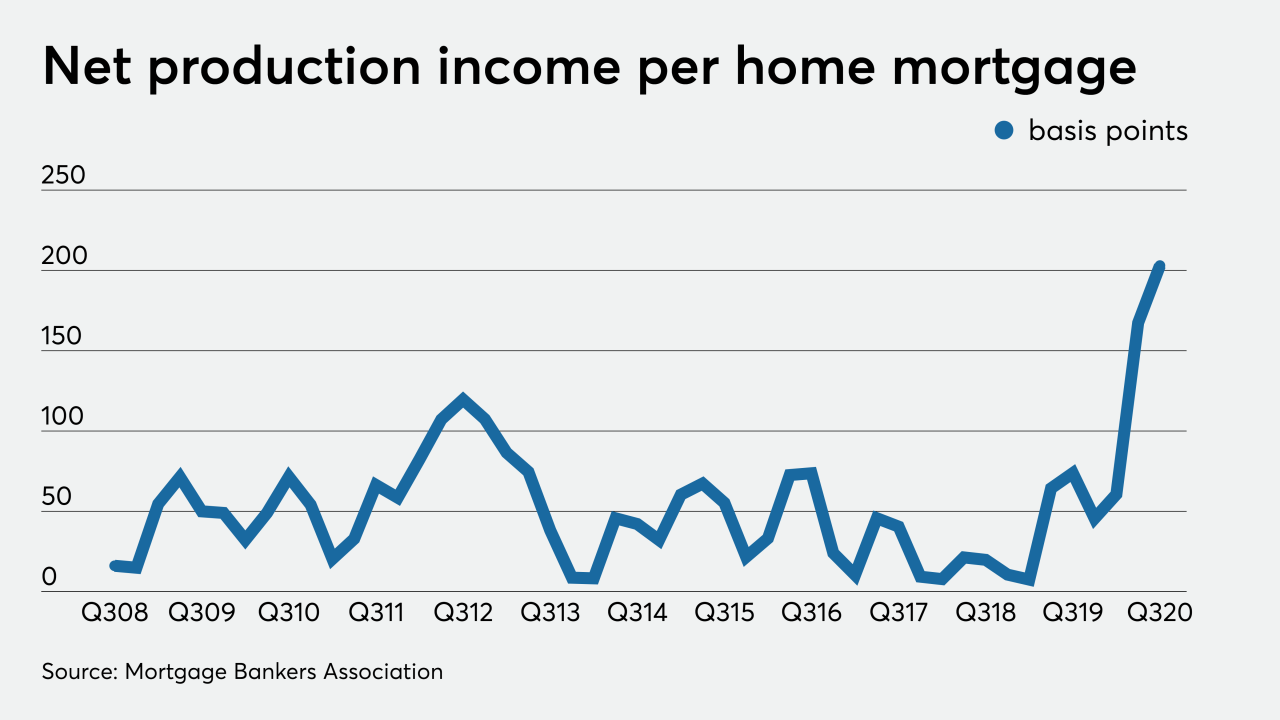

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3 -

The results are in the middle of the range provided before the company went public in October.

December 3 -

The transaction involving 345 high-balance mortgages is just the third sponsored by Morgan Stanley's mortgage acquisition and trading arm since the financial crisis more than a decade ago.

December 3 -

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2