-

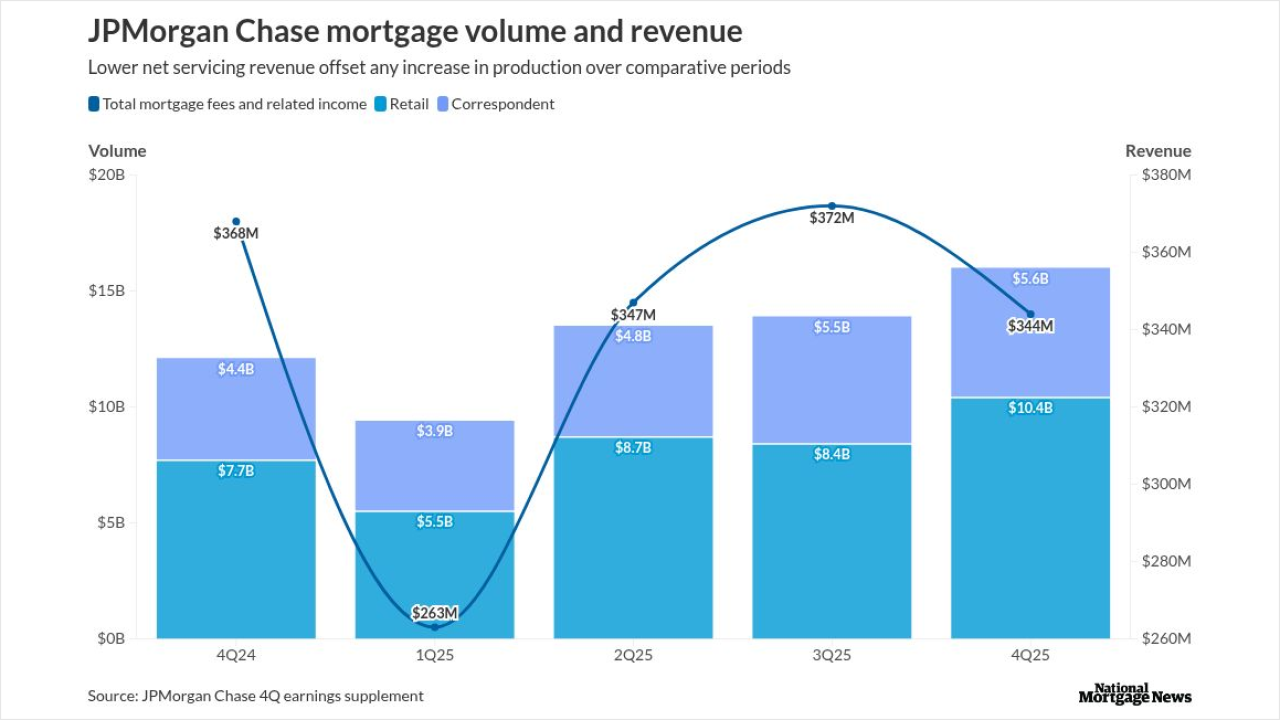

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

"These changes reflect adjustments we're making to ensure our staffing levels, locations and expertise align with current business needs; efficiencies we have gained through technology; and progress against our transformation work," the company said in a statement.

January 13 -

President Trump Tuesday told reporters he would not delay announcing his pick to fill a new vacancy on the Federal Reserve Board despite threats from Republican Senators to block any Fed nomination until a recently-disclosed Justice Department investigation into Fed Chair Jerome Powell is resolved.

January 13 -

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Sales of new homes in the US were little changed in October near the strongest pace since 2023 as builders lured anxious customers with price cuts and incentives.

January 13 -

The Bureau of Labor Statistics reported Tuesday morning that consumer prices rose 0.3% in December, with annual inflation stuck at 2.7%, lending credence to the Federal Reserve's cautious stance toward interest rates heading into 2026.

January 13 -

Financial markets took a tumble Monday morning after Federal Reserve Chair Jerome Powell announced that he was the subject of a Justice Department inquiry concerning the central bank's headquarters renovation. Lawmakers and former Fed officials decried the move as political intimidation.

January 13 -

-

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants.

January 12 -

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

January 12 -

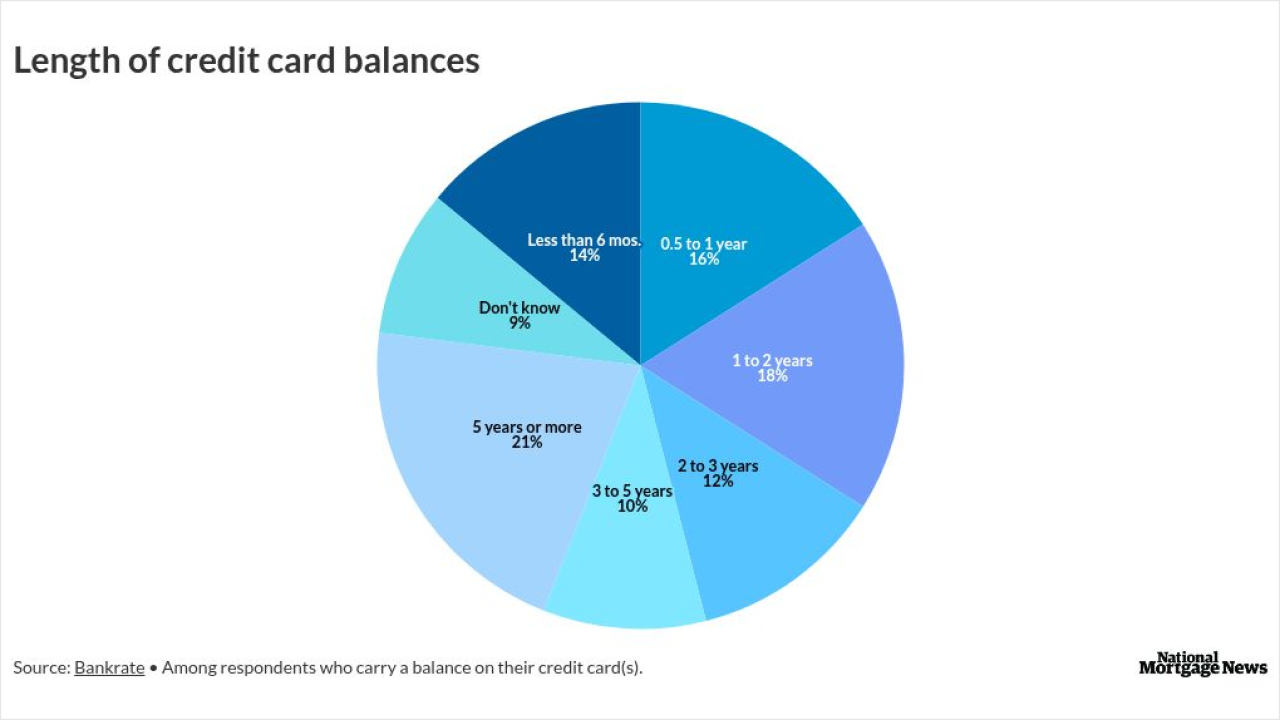

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

But a senior administration official said the DOJ, not Pulte, is behind the subpoena that relates to Powell's congressional testimony about Fed building renovations.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

Home prices are now something Americans can wager on. Polymarket partnered with Parcl to offer prediction markets tied to housing price indices.

January 9 -

The Senate allowed the nomination of a permanent director of the Consumer Financial Protection Bureau to lapse, giving acting Director Russell Vought more time to lead the agency on a temporary basis.

January 9 -

The deal which brings hundreds of thousands of agents under one roof also combines retail lender Guaranteed Rate's separate joint ventures with each brokerage.

January 9 -

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9