-

California could soon help first-time home buyers with their down payments and mortgage costs under a proposed $1-billion program to make homeownership more financially feasible for low- and middle-income residents.

May 13 -

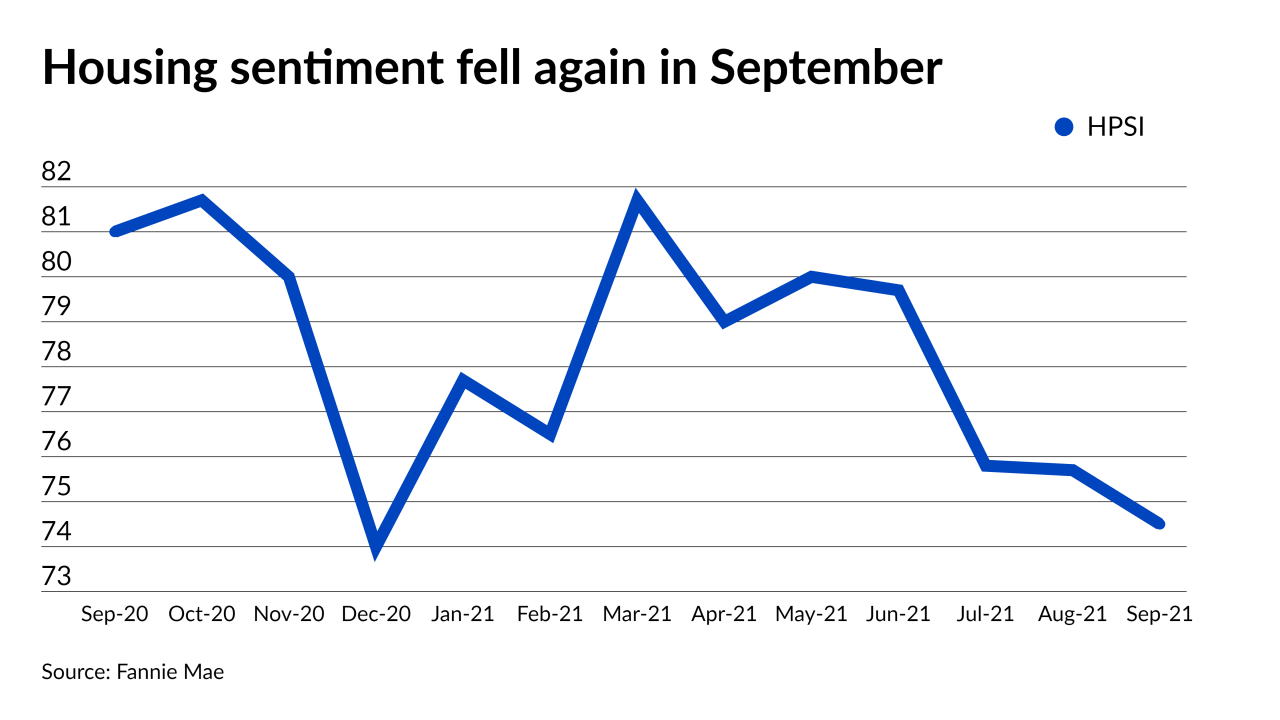

A larger share felt it was a bad time for both buying and selling, but a growing number expect price growth to slow.

May 9 -

The median rent in the tri-county area jumped 57% from March 2021 to March 2022, according to the latest data from realtor.com.

April 29 -

While housing costs continued to set records, several signs of moderation have begun to appear in the last several weeks, according to Redfin.

April 26 -

Recent affordability and interest rate trends led to “clear evidence” of discouragement among potential consumers in the purchase market in the first three months of 2022, according to the National Association of Home Builders.

April 25 -

-

-

Suburban pushback against a proposal that would have loosened regulations of new units in New York State led to its removal from the state budget.

April 11 -

A majority of housing experts also believe first-time homeownership should hit 2019 levels again within four years; however, a substantial number don’t expect it this decade.

March 28 -

While the median income rose 1% over the last year, the median price of a home rose a staggering 25%, according to the the Federal Reserve Bank of Atlanta.

March 27 -

A quarter-percent increase would eliminate more than a million buyers for median-priced homes according to the National Association of Home Builders.

March 8 -

CalHFA’s executive director Tiena Johnson Hall discusses her agenda for encouraging affordable housing development in the inventory-strapped state.

November 19 -

Only eight states experienced annual appreciation viewed as sustainable, according to Fitch Ratings.

November 17 -

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

The sharp increases of the pandemic era have added nearly a year to the amount of time the average consumer needs to save for a 20% down payment, according to Tomo.

September 28 -

However, with mortgage rates down and household income increasing, consumers have 129% more buying power today than they did 16 years ago, according to First American.

August 30 -

The gulf between buyer demand and the amount of listings for sale drove housing values to a six-decade peak, according to CoreLogic.

August 3 -

Renters will need to reserve an additional $369 per month to keep up with rising listing prices over the next year, according to Zillow.

July 8 -

A Virginia-based builder announced a line of manufactured housing that features clean energy technology, reduced waste and “plug-and-play” assembly.

July 6 -

Financial inclusion is the civil rights issue of our generation — and getting more Americans, especially younger and minority families, into decent, affordable housing is a critical step on the ladder to financial capability, writes a board member of the National Credit Union Administration.

June 29