-

While boosting origination volume for lenders and providing financial benefits for borrowers, the refinance boom could have adverse effects down the road, according to TransUnion.

February 12 -

Forget about Edina, Arden Hills and other coveted communities. A flight to affordability is upending the housing market in the Twin Cities.

February 12 -

From the heartland to the desert, here's a look at 10 housing markets where buyers are looking to move — and the high-cost markets they're leaving, according to Redfin.

February 11 -

Officials in Lakeland, Fla., are hoping they've found a strategy to lure private developers to build affordable single-family homes and apartments in the city.

February 11 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

A city agency that in recent years lost its luster as a place where low-income New Orleanians could go for low-interest mortgages is set to re-emerge as a key player in plans to develop more affordable housing in the city.

February 10 -

Galvanized by the Moms 4 Housing standoff that drew national attention to the region's affordability crisis, Oakland officials may soon overhaul the way homes are bought and sold and other Bay Area cities are considering similar measures.

February 10 -

With steady home price appreciation and falling interest rates, by some measures the shares of distressed mortgages existing in the market shrunk to record lows, according to Black Knight.

February 3 -

For people in their 20s and 30s, New Hampshire's home prices are rising as fast as their concerns over affording a place to live.

February 3 -

Homeownership is one of the fastest ways for people to build wealth and giving down payment assistance provides creditworthy borrowers an opportunity to buy a house they otherwise wouldn't have, according to the CBC Mortgage Agency.

January 31 -

Between 2014 and the third quarter of 2019, the median price of a single-family home in the Boise area increased 75%, to $303,100 from $172,900, according to the National Association of Realtors.

January 28 -

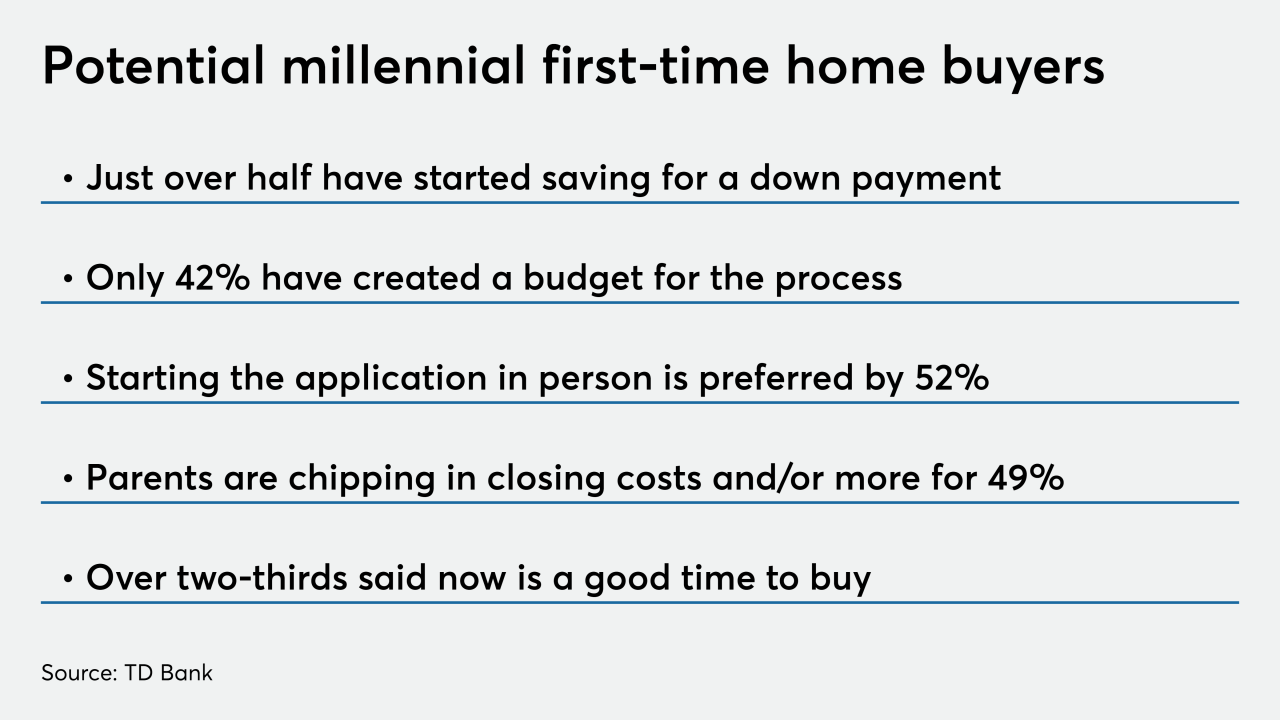

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

Sales of new homes cooled for a third month in December, signaling a potential pullback after purchases climbed to some of the best levels in more than a decade amid lower borrowing costs and a solid labor market.

January 27 -

Bidding wars for Bay Area homes have scraped new lows, as buyer fatigue with high prices and stressful deals saturates most of the region.

January 23 -

The inventory of homes for sale is at a seven-year low and that is likely to continue to shrink in the coming months, a Zillow report said.

January 21 -

The rate of home sales reached a 33-month peak in December, swinging the pendulum of supply and demand, and pushing value appreciation to a 19-month high, according to Redfin.

January 17 -

With home price appreciation decelerating, the top end of the marketplace appears to be taking the biggest hit, according to Zillow.

January 15 -

More than half of Columbus homebuyers are millennials, according to a new study from the mortgage lead generation company LendingTree.

January 14 -

When it comes to purchasing a home vs. renting on the affordability continuum, the reasonably priced properties skew towards less populated areas, according to Attom Data Solutions

January 14 -

While buying a home in most markets results in lower monthly housing payments, in the nation's most populated counties renting is the more affordable option, Attom Data Solutions said.

January 10